Rooftop solar on Houses of Worship offers a unique opportunity for the expansion of solar into communities across the U.S. This helps promote local awareness and acceptance of solar, offsets electricity bills to allow for expansion of community services, and allows these facilities to act as resiliency hubs during outages, amongst other benefits. Recent research from the Lawrence Berkeley National Laboratory analyzes trends related to rooftop solar PV on houses of worship to understand this small but outsized portion of the non-residential solar PV market.

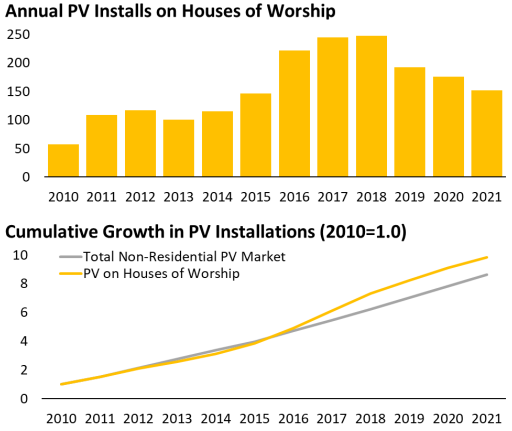

Currently there are 2,509 rooftop PV systems on houses of worship (HoW), representing about 1.9% of all HoW properties. The growth of solar on HoWs has largely followed the non-residential market with a peak from 2016 to 2018. The HoW market share of all non-residential PV systems is about 2% while only making 0.6% of all non-residential buildings.

Roughly half of all PV systems on houses of worship are in California, compared to only one-third of all non-residential systems that are in California. In terms of demographics, solar penetration in HoWs largely reflects the larger market and trends towards wealthier communities. Washington D.C. is an exception to this with the highest relative penetration with 18% of their HoWs having solar with over 70% of those serving local non-white and Hispanic communities.

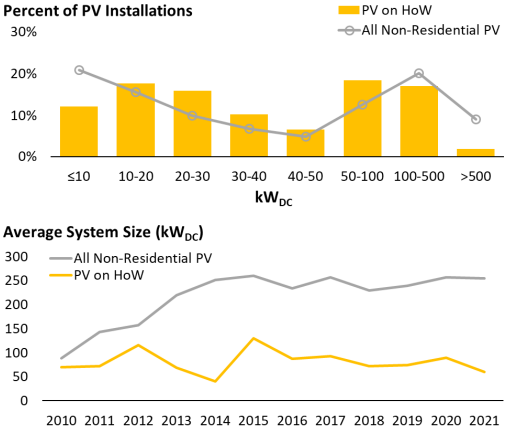

PV systems on HoWs average 80 kW of power capacity, but can vary widely in size. In comparison to the broader non-residential market, there is a smaller share of systems above 500 kW in HoWs, suggesting possible rooftop or financial constraints, according to Berkeley Lab.

Prices for PV systems on HoWs are in-line with similarly sized systems in the non-residential market. The cost for pairing storage with solar was lower on HoWs than across the broader non-residential PV market. Virtually all paired solar plus storage on HoW projects are in California, driven in part by state incentives and outages caused by wildfires, according to Berkeley Lab.

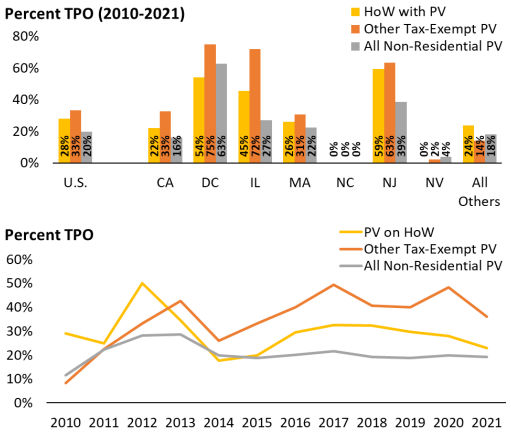

Third-party ownership, through solar leases and power purchase agreements, was much higher than the non-residential market, at 28% of all PV systems for HoWs. The share of third-party HoW PV ownership was even higher in states like Illinois, New Jersey, and Washington D.C. that have additional incentives. In the past, third-party ownership allowed tax-exempt entities the ability to monetize federal tax credits like the Investment Tax Credit and the Production Tax Credit. The Inflation Reduction Act is eliminating that need through the “direct pay” option which would allow them to directly monetize the benefits.

While the market has slowed down, with only 150 new PV systems being installed on houses of worship in 2021, there are new efforts to further adoption in this unique market. The U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) is targeting equitable access to solar in the third round of the Solar Energy Innovation Network (SEIN) with analytical, financial and facilitation help. Part of this work is supporting non-profits like Green the Church, RE-Volv and Interfaith Power & Light to help underserved communities overcome existing barriers to equitable adoption of solar through houses of worship.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.