In Iowa, through the end of 2022 the Solar Energy Industries Association (SEIA) reports 658 MW of installed solar capacity to date. This is enough clean energy to power over 80,000 homes.

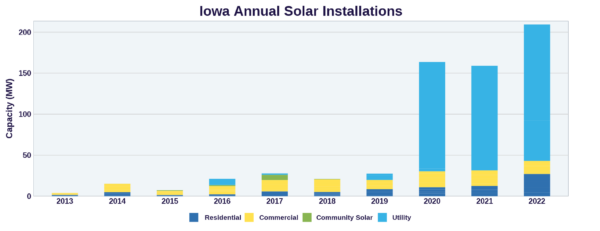

The Hawkeye State was largely a commercial, industrial, and residential solar market until 2020, when utility-scale development took off. Most of the solar capacity in the state was installed across three recent landmark utility-scale years of 2020 through 2022.

While only about 1% of the state’s electricity comes from solar, nearly 60% of Iowa’s energy mix is sourced from wind power, according to the Iowa Environmental Council (IEC).

SEIA forecasts Iowa to add another 1.5 GW of solar over the next five years, ranking it 33rd among U.S. states in terms of capacity. Meanwhile, the IEC projects the total cumulative wind capacity in Iowa will reach 14 GW by 2024.

Incentives

While Iowa doesn’t have a state-mandated net metering law, some utilities have offered it. Net metering involves the crediting of a customer bill for sending excess solar production to the electric grid.

MidAmerican Energy, a Berkshire Hathaway Energy utility, and Interstate Power & Light, an Alliant Energy utility company, do not participate in net metering, but do offer a bill credit based on 15-minute energy inflow and outflow intervals.

Iowa also offers solar easement and access rights laws that help ensure a consumer installation won’t be covered by shade. Some municipalities in Iowa also have provisions to prevent homeowners associations from blocking a solar installation, according to EnergySage.

Like most states in the U.S., solar is property tax exempt in Iowa. While Zillow modeled that purchased solar arrays can raise a home’s value by 4%, that additional assessed value won’t be assessed for property taxes. Iowa also has a sales tax exemption for electric generating equipment, so solar array purchasers will be exempt from the 6% state sales tax.

Like all states in the U.S., Iowa solar installations are eligible for the solar Investment Tax Credit, a direct-paid credit that covers 30% of installed system costs.

Iowa used to have a state tax credit for solar, though it has been phased out. The credit was 15% from 2016 to 2019, phasing down to 0% for systems installed after June 2022. The credit was capped at $5,000 per installation.

The state’s tax credit program has led to $15 million in credits paid over the last ten years, and private investment averaging $5 million per year in the state. About 4,600 Iowa homeowners have received credits.

In March 2022, Iowa Senator Dan Zumbach (R-Des Moines) submitted legislation that could dictate to landowners that they are forbidden from leasing their land for commercial solar use, even if their soil meets a minimum ‘corn suitability rating.’

Notable installation

The Hawkeye Solar Project received approval for electric generating certificates from the Iowa Utilities Board in October 2022. The 200 MW utility solar project is expected to produce enough power for 50,000 homes. Ranger Power is the developer of the 1,500-acre solar project. Construction of the project generated an estimated 200 jobs. The carbon offset is equivalent projected to reach the equivalent of taking nearly 100,000 cars off the road.

Upon approval, Hawkeye’s developer pegged commencing construction for the fourth quarter of 2022 or the first quarter of 2023, with a projected commercial operation date in the fourth quarter of 2024. Located near Grand Mound, Iowa, the project represents a $250 million capital investment into the local community and is expected to generate over $12 million in new tax revenues to the county. Tax funds are expected to be allocated as 40% towards Clinton County infrastructure and public services, 50% to school districts, and 10% to local townships and agricultural extensions.

As part of the land leasing agreement, the owner-operator of the project is required to return the land to its pre-existing condition following decommissioning of the project. There will be a decommissioning bond, or money set aside, to ensure that funds are available to take care of restoration obligations.

Up next

Last time, pv magazine reviewed the solar incentives of Minnesota. Next time, we will look at the state of solar in Missouri. Read the full series here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Some additional details, state Senator Dan Zumbach (R-Ryan) serves a NE Iowa district 48, but maintains an office in Des Moines.

The Iowa Public Utilities Commission approves only Investor-owned Utility rate plans, including required net-metering for the two investor owned Utilities: Alliant, and MidAmerican. Most of the Iowa land area is served by 145 Co-Op and Municipal utilities that have rates determined by their own Board of Directors and do not have to offer a net-metering plan. see https://www.sierraclub.org/sites/www.sierraclub.org/files/sce/iowa-chapter/energy-globalwarming/ElectricUtilityStructure.pdf