Community solar is popular. For residents and businesses, it’s accessible, equitable, and flexible. For developers, it’s a scalable way to deploy large distributed solar projects. For policymakers, it’s democratizing and revenue-generating. It’s no wonder most new community solar programs are immediately over capacity once they launch. The Inflation Reduction Act (IRA) should change that.

Most community solar programs are capped, meaning a limited number of megawatts are available. Regulators work to design these programs with a Goldilocks mindset, with just enough incentives to attract developers into an unknown market while trying to limit the monetary expense to maximize the number of projects built. In the early stages of a program, incentives are generous to compensate for the risk. The generosity pays off: Illinois attracted ten times the available capacity, and New Jersey’s program launch had 862 MW applications for just 78 MW of public programs.

Developers rely on incentives like renewable energy credits, generous bill credits, and/or rebates to make projects pencil. As programs mature, these incentives are revised to stretch a program budget further, but markets are still capped when the money runs out. In some cases, the caps are legislative—only a limited number of MW can participate each year. In other cases, like New York, the caps occur when a critical incentive runs out. But in any case, limited community solar markets frustrate nearly everyone: Developers and asset owners can be hesitant to invest in land campaigns with certainty that their project will be selected, residents and businesses have limited options for projects, and policymakers can’t achieve lofty goals for energy access.

Opportunity for change

In the fall of 2021, shortly after the passage of the IRA, I moderated a panel of community solar experts at RE+. We were trying to answer the question, “Are Uncapped Community Solar Markets Possible?” Every person on stage was painfully aware of the gold rush effect that has become the hallmark of community solar markets. The developers agreed they might be willing to exchange less generous incentives for more capacity. The certainty and scale that larger, uncapped markets could offer are attractive compared to a lottery for a few lucrative projects.

My panelists were not arguing that community solar could or should exist without incentives and market signals, just that programs can better allocate funds to prioritize more projects.

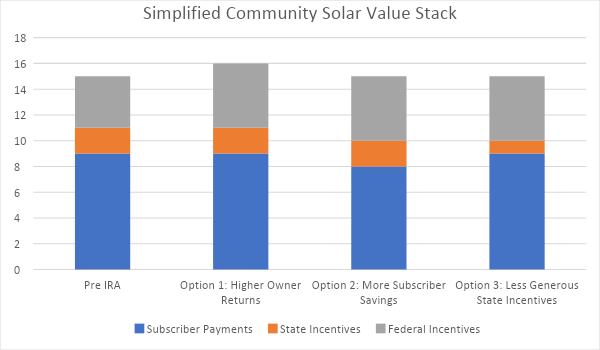

Imagine an oversimplified version of a community solar project. There are three revenue streams from a project: subscriber payments, state/utility incentives like RECS, rebates, or fixed credit values, and federal tax incentives. The IRA supercharges the Federal Tax piece for strategically positioned projects with additional community benefits. If we imagine that a developer will receive a higher tax credit under the IRA, there are three outcomes from this bump (let’s assume the project needs to make $0.14/kWh to be viable):

1. She could keep everything the same, generating a higher return on the project.

2. She could pass on additional savings to the subscriber, keeping her returns equal to a pre-IRA project.

3. The state could haircut its portion of the capital stack; the developer could keep the discount to the subscriber the same and achieve a similar IRR to a pre-IRA project.

Options one and two have clear advantages over today’s community solar market. If a developer keeps more returns, she may likely take more investment risk and enter markets earlier. Still, it could throw fire on an already hot market. In option two, residents and businesses see more meaningful savings and could be more eager to sign up, reducing the cost of acquiring subscribers. Still, the total number of projects is capped at today’s market size. Neither of these scenarios leads to more projects.

Option three could be the key to significantly expanding community solar markets: the developer keeps her return margin, the subscriber still sees savings, and the state/utility has more money. They spend the same amount on a program that serves more residents and businesses while subscribers still see meaningful savings on their utilities. More project availability also creates more certainty in the market for developers, thus making them more likely to invest in a specific market.

Complex equation for equity

The IRA has the potential to bring in more money for each project, leading to more community solar development opportunities. Still, community solar is more complex than three data points leading to a return on investment. If states are to revisit their incentive structures, it’s important to remember that the higher ITC values available under the IRA aren’t free.

Maxing out the ITC may require siting systems in energy communities, which could increase costs or decrease production. Additionally, projects with higher ITC are expected to service more low-to-moderate-income families and organizations. Without advances in utility bill crediting, outreach to LMI households can be more hands-on, driving up project costs.

The IRA was structured with the notion that more impactful projects are harder to implement and to reward them. Any change in state incentives will likely not be a 1-to-1 ratio between state and federal dollars. Regulators must work with the developer community to determine the actual cost of the calculation, and developers should be honest to create the most sustainable markets possible.

Additionally, some states may want to incentivize more savings for households and businesses over additional project deployment. In this case, it’s still imperative that developers, asset owners, and regulators work together to define savings targets and ensure that projects have enough funding to sustain the market.

More projects is the answer

Some have advocated for a smaller state or utility budget to support community solar programs. This is a mistake. Community solar provides measurable, tangible benefits to the grid and ratepayers. While some may argue about the exact value of these benefits, distributed solar, and community solar specifically, is an integral part of the grid: It democratizes access to clean energy, supports resiliency, and helps to achieve energy equity. While state and utility programs should evolve under the IRA, the goal should be to benefit more participants, fulfilling the promise of shared solar.

Image: Pivot Energy

Kacie Peters is director of industry relationships at Pivot Energy. She has pioneered new markets and sales strategies for organizations including SunEdison, Alta Energy, and board positions on COSSA and ISEA. Currently, Kacie serves as the Director of Industry Relationships for Pivot Energy where she develops marketing strategies for project M&A, codevelopment, and SunCentral, Pivot’s proprietary community solar servicing tool.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.