With solar now mainstream and a contributor to the global energy mix, it’s even more important to increase solar deployment in order to meet energy needs and climate goals. The International Energy Agency for the first time takes a look at the global solar supply chain in the recently released IEA Special Report on Solar PV Global Supply Chains.

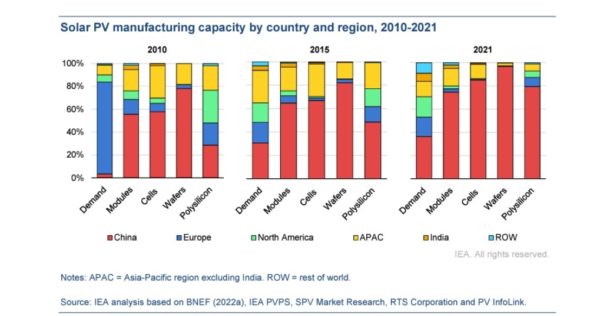

The report highlights the role that China plays in the global solar supply chain and how it came to be such a dominant force. For example, China has invested over $50 billion in new solar supply capacity, which is ten times more than Europe, and created more than 300,000 manufacturing jobs across the solar supply chain since 2011. China is home to the top ten suppliers of solar manufacturing equipment, and its share across the entire supply chain exceeds 80%, which is more than double China’s share of global PV demand.

How did China get to be such a dominant force in the solar supply chain? Government policies have focused on solar as a strategic sector, and the result of strong policies and investment is shown in the value of solar exports, which amounted to over $30 billion last year. China’s share is only increasing, according to the report, which estimates that it’s set to rise to over 95% in coming years.

One of the downsides in using solar products manufactured in China has been the amount of carbon used to produce products for use in generating clean energy. A lot of electricity is used in the production of solar products, and 60% of that is generated by coal. However, the report notes that solar manufacturing represented only 0.15% of energy-related global CO2 emissions in 2021. Transporting PV products accounts for only 3% of total PV emissions.

Another downside is the reliance on one single country for almost the entire solar supply chain. Today, China’s Xinjiang province accounts for 40% global polysilicon manufacturing; one out of every seven panels produced worldwide is manufactured by a single facility. The report indicates that this level of concentration represents a considerable vulnerability.

To meet IEA’s Roadmap to Net Zero Emissions by 2050, global production capacity for polysilicon, ingots, wafers, cells and modules would need to more than double by 2030 from today’s levels. Diversification of the supply chain will reduce vulnerabilities, as well as offering economic and environmental opportunities, the report contends. It points to supply chain disruptions caused by the COVID-19 pandemic and Russian’s invasion of Ukraine, and recommends that countries increase resilience by making the investments needed to boost domestic manufacturing. The IEA report estimates that new solar manufacturing facilities along the supply chain could attract $120 billion investment by 2030.

Where and how to invest

Annual investment levels need to double throughout the supply chain, and the report points to critical sectors as being polysilicon, ingots and wafers. The benefit, in addition to decreasing vulnerability, is jobs and reduced carbon by reducing transportation. The report estimates that the solar industry could create 1 300 manufacturing jobs for each gigawatt of production capacity. Domestic manufacturing can reduce carbon emissions if the local electricity mix is less carbon-intensive than in the exporting country. It also saves on transportation costs when goods are produced closer to where they’re used.

Key to spurring a domestic supply chain is to keep costs low, starting with the cost of electricity. Electricity accounts for over 40% of production costs for polysilicon and nearly 20% for ingots and wafers. In Chinese provinces where polysilicon is produced, the average electricity price of around $75 MWh, or almost 30% below the global industrial price average.

Policies

The IEA report highlights key policy action areas to ensure solar PV security of supply by diversifying manufacturing and raw material supplies. The following are recommendations for diversifying manufacturing and raw material supplies:

- Move solar PV supply chain diversification up the policy agenda as an integral part of advancing clean energy transitions.

- Consider crafting an industrial policy while maintaining a commitment to principles of open and transparent markets and avoiding barriers to trade.

- Consider integrating solar PV manufacturing facilities in industrial clusters, near traditional energy-intensive plants or other larger renewable electricity consumers (green hydrogen or green steel consortia) to help aggregate demand.

- Diversify raw material and PV import routes to reduce supply chain vulnerabilities.

Download the full report here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

We’ve handed China our technological achievements and intellectual property–developed at high risk and costs to investors–through low wage outsourced labor nations under the guise of globalization.

Clinton’s campaign kicked it off in SillyCon Valley’s semiconductor businesses in the early 90s.

After he was elected, they were rewarded with more H1-b and L1-a visas than Congress aporoved to insource cheap labor from eastern Europe and Asian Pacific countries, garnering greedy profits at the expense of American’s jobs.

We’re now paying the price! Not only in solar, but in weaponization of other technologies and increasing loss of global economic power to China…where the sun now shines brightly on our #-1 threat.

Long padt time to turn it around with rejeuvinated U.S. manufacturing means ya’ think? Right? Forest Gump.