On December 1, the International Energy Agency (IEA) suggested the United States will install 178 GW more renewable energy from 2022 through the end of 2026. Just a few weeks earlier, S&P Global Market Intelligence published a projection that the United States could install 71 GW of wind and solar power in 2022 alone.

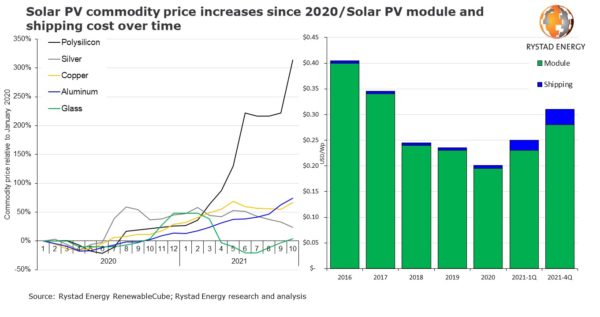

On a third path, Rystad Energy believes it is possible that 50% of global utility scale solar capacity might be cancelled or postponed.

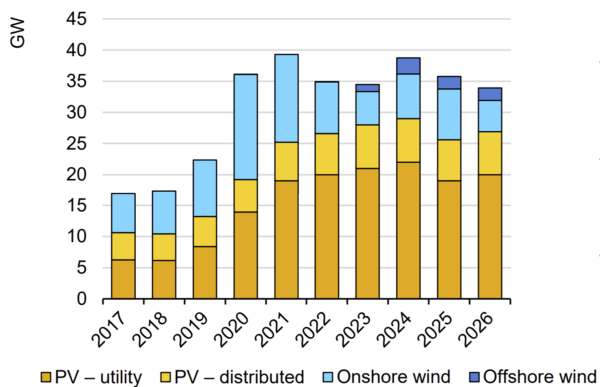

According to the IEA’s Renewables 2021 analysis, 2021 will be a record peak deployment year for the US, adding over 39 GW of new wind and solar capacity. Following this record year, however, the IEA predicts a downward trajectory for deployment.

From 2022 through 2026, the IEA sees 26.6, 28, 29, 25.6 and 26.9 GW of solar power being deployed, respectively. In total, the IEA estimates that 270 GW of solar capacity would be installed by the end of 2026 – nearly three times the 100 GW currently deployed as of January of this year.

IEA also included an “accelerated” deployment projection for the next five years, which would add 53.7 GW of capacity to their estimate. This addition would raise deployment projections from 178 GW to 231 GW of utility and distributed solar, plus on and off shore wind. These numbers may appear optimistic, but the group has gained infamy in the energy community after 20+ years of releasing laughably underestimated solar capacity growth estimates.

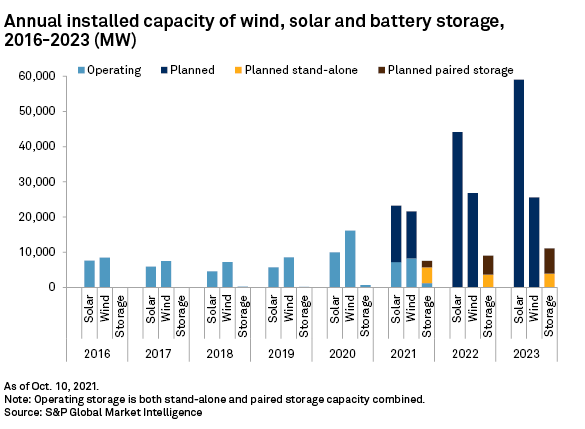

On an upward path, S&P sees potential for 44 GW of solar and 27 GW of new wind in 2022. The first year of the S&P’s projected capacity increase is equivalent to nearly 40% of the 5-year IEA growth estimates.

In 2023, the S&P anticipates that solar will increase by nearly 33%, while wind capacity deployments will stay flat, or slightly decline. Combined, S&P believes we will see 156 GW of combined wind and solar additions in 2022 and 2023 – that’s 87% of the IEA’s five year projection, in only two years.

Since the release of S&P’s report, the U.S. House of Representatives has passed the Build Back Better/Reconciliation package. S&P has noted that if the package gets through the Senate with the main solar incentives in place, some of the 2022 solar volume might fall into 2023 or 2024.

Sitting amongst all of these cheery projections is one analyst suggesting that supply challenges could have a massive, negative impact on 2022 growth.

The group says that polysilicon pricing has increased by more than 300%, and shipping costs for a container have grown by over 500%. These increases have added 6-8¢/kWh to the cost of solar panels, and 2.5¢/watt to shipping.

Roughly, 75% of the United State’s 2022 capacity projections are expected to come from utility scale projects.

Watching over all of this noise, Bloomberg New Energy Finance’s Jenny Chase is pushing her own team to increase their solar power projections, noting “there is always at least a bit more solar than you think there is“ – while concurrently calling out the IEA (cowards!) for their shortchanged numbers.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.