A homeowner or a business that installs solar power in the United States currently is eligible for an Internal Revenue Service (IRS) tax credit, which offsets 26% of the cost of a solar power project.

There are two versions of this credit: the Residential Energy Efficient Property Credit for private persons, and the Investment Tax Credit for business.

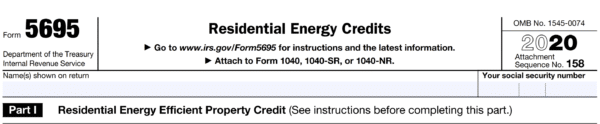

Residential solar purchasers should follow IRS guidance here, and fill out IRS Form 5695 when submitting annual taxes. Commercial entities will follow this guidance and complete IRS Form 3468.

Now, pv magazine USA is not a tax advisor, so seek professional advice before filling out these forms. The tax implications of solar construction should be part of a well-vetted solar contractor’s field of expertise, but here, too, solar contractors aren’t tax specialists, either.

With those caveats in mind, here are a few of the important aspects of the current version of the federal tax credit.

First, in order to take advantage of a federal tax credit, there must be a federal tax liability to apply the credit against.

There are many reasons that taxes might not be owed in any one year. Perhaps there were a lot of write-offs (more kids), or maybe you are retired and living on nontaxable income. If you don’t have a tax liability, then you can probably stop reading this article right here.

Residential solar power projects cost roughly $3.00 per watt, with a national average size of around 7,000 watts. That gives us an average project price of $21,000. The 26% tax credit in this scenario would provide a $5,460 credit to apply against what’s owed to Uncle Sam.

Image: Sullivan Solar

As you can see, it is very important to look closely at your tax liability to understand how this credit may fit into your finances.

Second, you’ll only get cash back if the taxes you already paid for the year are greater than what you owe.

For example, let’s say you paid $5,460 in federal income taxes over the course of the year. As noted above, a $21,000 solar power project would offer that exact value of tax credit. After verifying that your solar tax credit is worth $5,460 via the tax forms above, you’ll get back exactly that amount after filing your taxes.

However, if you happen to have paid $2,730 this year in federal income tax, and another $2,730 next year – you’ll get $2,730 back each year. The 2020 IRS form above allows taxpayers to carry unused portions of the tax credit into their 2021 return.

Third, the tax credit will fall from 26% to 22% in 2023. After 2023, the residential tax credit ends. For business customers, it continues indefinitely at 10%.

Battery systems

Next, battery systems charged by the solar power system are included in this solar tax credit. Whether batteries make pure financial sense is a different calculation entirely.

One final thought: solar tax credits are not set in stone. Incentives scheduled to vanish at the end of 2023 may soon renew. There’s even a chance that the incentives could increase.

In March, three senators introduced a bill that would temporarily allow businesses to get the tax credit back as cash, regardless of whether they owe the IRS. In May, a second piece of legislation was submitted which would make the cash payback permanent, not only for businesses but also for individuals.

The Biden Jobs Plan would increase the tax credit to 30%, both expanding the credit to those with little or no tax liability, and extending the credit for 10 more years.

If and when the laws do change, pv magazine USA will cover the news, and this author will update our Solar 101 series.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The extension of the 26% Federal Tax Credit truly made a huge difference and it gives home owners the opportunity to save an additional 4% compared to the 22% it was going to be.

Especially in California, now is easily the best time to install solar panels + battery storage such as the Tesla Powerwall. The heat is coming so there is most likely to be power outages in which the value of these units become higher. Also expect the supply to decrease while the demand increases.

I love how the article also talks about the two different types which are the Residential Energy Efficient Property Credit for homes, and the Investment Tax Credit for businesses.

Also, the U.S. federal tax credit gives individuals 30% off a home electric vehicle charging station plus installation costs (up to $1,000).