In recognition of the increasing responsibility placed on the world’s largest financial institutions as important actors against climate change, Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance and Sierra Club came together to create a report outlining how these economic leaders have used their resources to fund fossil fuels since the signing of the Paris Climate Agreement in 2016.

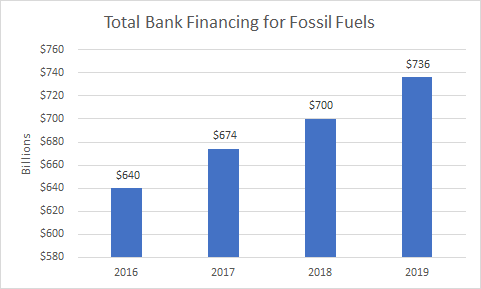

Banking on Climate Change adds up financing from 35 private-sector banks to the fossil fuel industry, finding that in the four years since the agreement, these banks have funneled $2.7 trillion into fossil fuels. In direct opposition to the agreement, annual fossil financing has increased each year since the signing, reaching $736 billion in 2019.

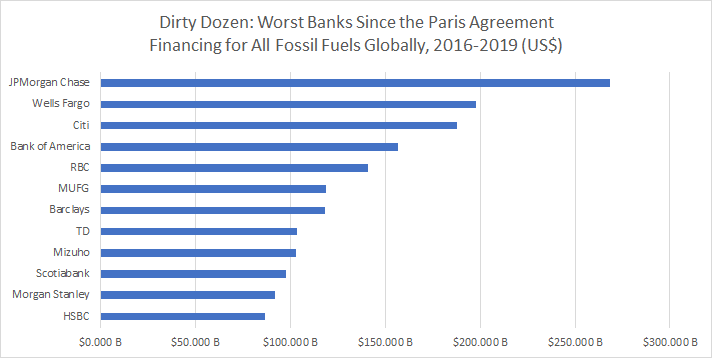

Of the top-five fossil bankers over that time, four are American (JPMorgan Chase, Wells Fargo, Citi, and Bank of America), with Royal Bank of Canada (RBC) coming in fifth. Outside of North America, Mitsubishi UFJ Financial Group was the largest fossil supporter in Japan, while Barclays took that crown in Europe, and Bank of China came in front in China.

The report breaks down each of the 35 banks on a 200-point scale. the scale took into account bank policies restricting financing for fossil fuel expansion, as well as commitments to phase-out or exclude financing for fossil fuel companies. Under this criteria, the strongest bank for fossil finance reduction was France’s Crédit Agricole, which scored 69.5 out of a possible 200 points. ‘Strongest’ is a relative term in this case, as Crédit Agricole has still contributed $44 billion in fossil financing since 2016.

The weakest bank is…

As for the weakest, that honor was given to JPMorgan Chase, the bank which has provided 36% more fossil fuel financing than any other since the signing of the Paris Climate Agreement, also holding the top spot in yearly fossil fuel financing every year since 2016. JPMorgan Chase is the world’s top financier of fossil fuel expansion, Arctic oil and gas procurement, offshore oil and gas and fracking.

What the report shows is that not only has the Paris Agreement failed to slow down fossil fuel financing, in many cases funding has actually accelerated. Funding from the banks studied to 2,100 fossil fuel companies has grown each year. Progress was made briefly, as financing to 100 of the biggest purveyors of coal, oil, and gas fell by 20% between 2016 and 2018, however that progress was short-lived and overshadowed, as last year financing bounced back 40%.

The one bright spot to be had for climate activists is the decline in financing towards coal mining and power. Finance to the top-30 coal mining companies declined by 6% between 2016 and 2019, while finance to the top-30 coal power companies shrank by 13%. Coal is where Crédit Agricole was able to supplant the bank’s high policy score.

In June 2019, Crédit Agricole made a commitment to stop working with companies developing or planning to develop any new coal infrastructure, whether that be in mining, services or power. Later on, the bank kicked coal further, pledging to phase out all coal from its portfolios by 2030 in the EU and all Organization for Economic Cooperation and Development member countries, and by 2040 in the rest of world.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.