First Solar had a good day today. This morning the company announced the opening of the second-largest PV module factory in the Western Hemisphere, three months ahead of schedule. As clarified in tonight’s results call, when fully ramped the mammoth facility in Lake Township has the ability to pump out 1.3 GW of PV modules annually, up from the 1.2 GW that First Solar had earlier estimated.

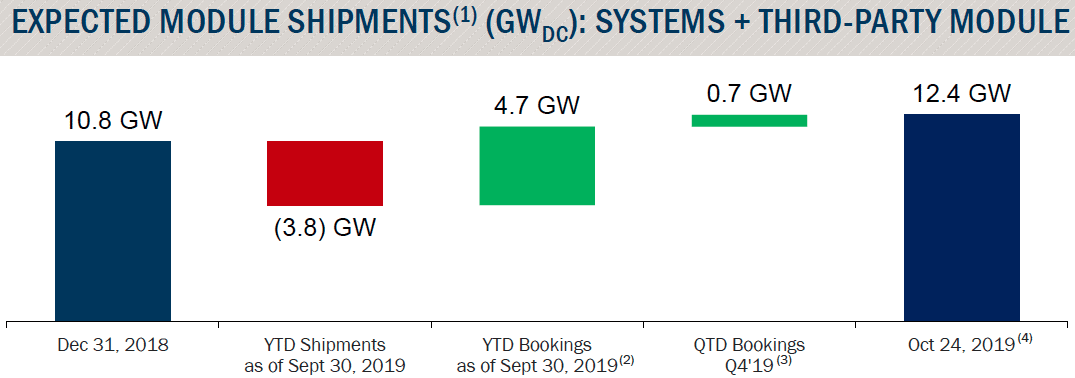

This afternoon the company revealed third quarter results which show it running at full capacity, growing its backlog to 12.4 GW, and producing a nice profit. The company reported a 7.6% operating margin on revenues of $547 million, with $30.6 million in net income.

These module bookings make it so that First Solar is sold out through the second quarter of 2021, nearly two years from now. It’s a nice position to be in.

The company did burn through $500 million in cash during the quarter due to a variety of factors, including the ramp of its factories. But First Solar still has cash, restricted cash and marketable securities of $1.6 billion. Again, not bad.

First Solar also marked some costs relating to the shedding of its engineering, procurement and construction division, which it says is because it no longer needs the specialization required to install the smaller Series 4 modules, now that it has mostly moved to the larger Series 6. 100 employees who served in that division will be laid off.

First Solar is also improving its large-format Series 6. It’s unclear how much of the increase in the nameplate capacity of the Lake Township factory (dubbed “Perrysburg 2” in the call) is due to higher efficiencies, but First Solar has started production of its first bin of 440 watt modules, making the Series 6 one of the most powerful modules available on the market.

First Solar is running at 100% capacity utilization, and expects to ship between 5.4 and 5.6 GW of modules by the end of the year. With new factories in Vietnam as well as Ohio, the company is on track to remain a heavyweight in the module industry, as the only thin-film maker to come close to the scale of the Chinese crystalline silicon module giants.

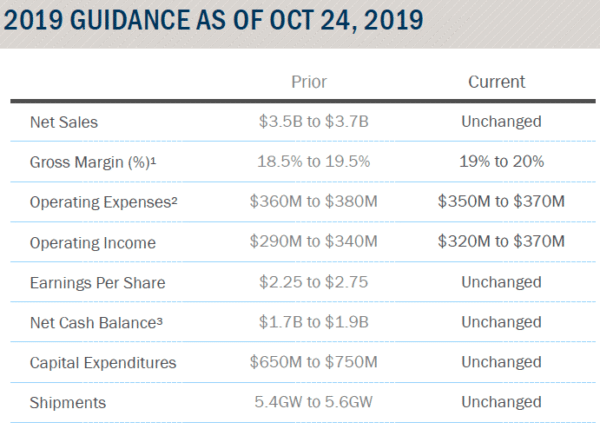

For the full year 2019, First Solar’s guidance is pretty much unchanged, except that it plans to be slightly more profitable.

For the full year 2019, First Solar’s guidance is pretty much unchanged, except that it plans to be slightly more profitable.

The company is also marking its 20th anniversary, and has shipped 25 GW of modules over that period of time. CEO Mark Widmar describes the company as operating “from a position of strength”, and many of his statements could be applied to the solar industry writ large.

“What was once a producer of a niche technology has evolved into a global company,” stated Widmar.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.