General Electric (GE) is not one of the companies that is associated with a serious embrace of the energy transition, and for good reason. While GE is one of the world’s largest makers of wind turbines, its much larger GE Power division invested deeply in building, installing and maintaining coal, gas and nuclear power plants, an investment which deepened after its acquisition of Alstom in 2015.

The result was what the Institute for Energy Economics and Financial Analysis (IEEFA) has described as “a case study in how rapidly and unexpectedly the global energy transition away from fossil fuels travels up the economic chain and destroys value in the power generation sector” – or in other words, a disaster.

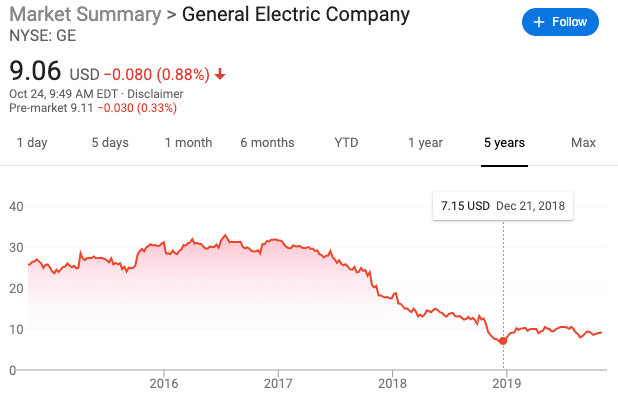

From spring 2017 through the fall of 2018, GE’s stock collapsed, leading to a 74% decline in market capitalization, and a loss of $193 billion to investors. Among the investors that has felt the pain is one of the world’s largest asset managers, BlackRock, which is also one of GE’s biggest shareholders.

But now, GE and BlackRock are making another bet. While smaller in scope compared to its investments in conventional generation, a cool quarter of a billion dollars is a sizable chunk of money for the segment it is investing in.

Yesterday Distributed Solar Development (DSD), a joint venture of GE & BlackRock, announced that it has closed a $250 million fund financed by Morgan Stanley, Silicon Valley Bank and Fifth Third Bank to fund a portfolio of commercial and industrial (C&I) solar projects through 2020.

And while we say GE and BlackRock, the latter put the larger stake in, with 80% of the investment when DSD launched in July of this year.

The C&I market

This is not the first investment that GE and its partners have made into this space. GE Solar, which has been around since 2012, has developed more than 125 projects. But this investment is a significant signal from one of the world’s largest power companies in a sector which has seen its own share of troubles.

The International Energy Agency (IEA) has predicted that the C&I segment will be the largest growth segment for solar globally over the next five years. However, according to Wood Mackenzie and Solar Energy Industries Association, the U.S. “non-residential” sector – where it lumps C&I and community solar – was down in 2018 versus 2017, and fell further in the first half of 2019.

Wood Mackenzie attributes this in part due to the slow roll-out of the SMART program in Massachusetts and interconnection delays in multiple leading markets, and expects renewed growth in this sector in coming years due to more aggressive state renewable energy mandates.

But market barriers remain, and developers often complain of a lack of standardization for C&I deals, with every one a “snowflake”. Additionally, there can be a difference in interests between building owners and tenants, which has been cited as one reason for the slow progress of Los Angeles’ feed-in tariff.

It remains to be seen if BlackRock and GE’s bet on C&I solar will pay off; but for a company that has lost so much betting against the energy transition, it is definitely time to up the stakes.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Nice article Christian. One point of clarification….DSD is what used to be known as GE Solar. Same people…new branding.