It’s odd to be writing about an active feed-in tariff (FiT) in 2019. The policy which accelerated Germany into a 7 GW+ market annually and kick-started the global solar market had its heyday nearly a decade ago, with feed-in tariffs being introduced across Europe and Asia. This led to spectacular market growth but also dramatic crashes when the ambition of the market created exceeded these policies’ political support.

What is even more strange is to be writing about a FiT in the United States. Despite the Public Utilities Regulatory Policies act of 1978 (PURPA) serving as a model for Germany’s FiT, the U.S. market has instead been driven by the Investment Tax Credit (ITC), net metering and renewable energy mandates. The few feed-in tariffs in the United States have typically been small, regional affairs.

Among these, Los Angeles has had the largest FiT program, which was started under Mayor Eric Garcetti (D) in 2013 and which earlier this week was approved by the board of the Los Angeles Department of Water and Power (LADWP) for expansion from 150 MW to 450 MW.

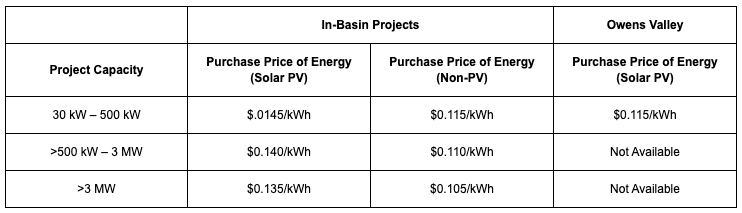

Like other feed-in tariffs, LA’s FiT pays a fixed price under long-term contracts to owners of PV systems, one which is typically set at a price to incentivize building such systems. For Los Angeles these prices are generous; under the latest pricing adjustment the program will pay between 13.5 and 14.5 cents per kilowatt-hour for projects in the Los Angeles basin.

These changes now go do the City Council for final approval, and this expansion appears to be building on the momentum of a revamp of the program in 2017.

Mid-sized DG

Unlike net metering, which is typically focused on residential systems, FiTs often have their greatest impact on the market for systems larger than those on residential rooftops but smaller than the large solar farms in deserts, fields and forests.

This sector, often described as the commercial and industrial market, has struggled in recent years in the United States. Wood Mackenzie reported recently that this sector had the lowest volume of installations in Q2 2019 since the third quarter of 2016, with only 426 MWdc installed, including community solar.

Los Angeles’ FiT has supported projects from 30 kW to 3 MW in capacity, but under the changes approved this week, projects up to 10 MW will be eligible. This means that if developers want to build solar on large warehouses or industrial buildings, they won’t be limited by how big they can go.

And while the price for these projects under LA’s FiT is much higher than that of larger-scale solar or wholesale market prices, these mid-sized installations also offer unique benefits. Many of these projects are located in strategic locations to meet electricity demand locally, thus reducing the need for transmission and distribution infrastructure. This means that while the price is high, so are the potential benefits and savings for utility customers.

LADWP referenced the potential savings from deferred transmission investments in its news release, and this may explain why the program is limited to projects in the Los Angeles basin, with only a small volume set aside for communities in the Owens Valley.

Solar + storage future

It’s no accident that the feed-in tariff is being revamped at this time, as it follows on the launch of the City of Los Angeles’ 2019 Sustainable pLAn, which seeks to reach 100% renewable energy by 2045.

Even with imports and exports from rest of California, it is going to take more than solar to get to the higher levels envisioned in this plan. LADWP says that in 2020 it plans to introduce an expansion of the program to support local solar + storage projects. These can help meet the city’s evening peak demand, and LADWP has mentioned that these projects can also provide voltage control support for the grid.

However, there is still a long way to go. Despite Mayor Garcetti’s controversial order to to set a schedule for decommissioning local gas plants, LADWP has a lower portion of rooftop solar per customer when compared with the state’s three big investor-owned utilities, and it’s going to take a lot of power – both during the day and at night – to meet the city’s needs with clean energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.