As the competition to buy-up large-scale solar assets further intensifies, savvy investors are increasingly turning to smaller-scale, distributed solar. In the past week alone we’ve seen CleanCapital and CarVal buy up a portfolio of commercial and industrial solar developed by KDC Solar, and BlackRock joining forces with GE to launch a behind-the-meter joint development venture.

This morning yieldco TerraForm Power furthered its investment in this space by signing a deal to acquire a portfolio of 320 MW of distributed solar and fuel cells from Canada’s AltaGas for $720 million. Cost per watt here needs to be taken with multiple grains of salt as the portfolio mixes 291 MW of C&I solar plants and roughly 21 MW of residential rooftop solar, further thrown off by around 10 MW of fuel cells, but overall this comes out to $2.25 per watt.

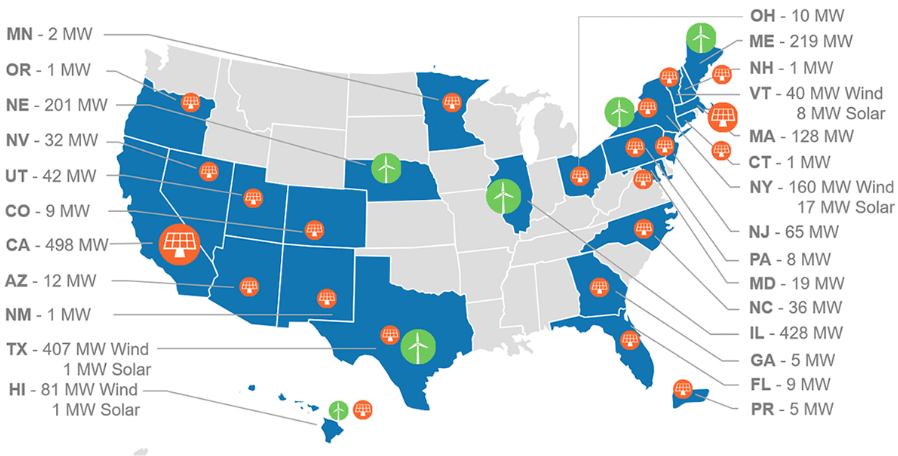

These assets are spread across 20 states and the District of Columbia, and the transaction is expected to close in the third quarter of 2019.

TerraForm is putting down a $72 million deposit on the assets, and will initially fund the acquisition with a $475 million bridge facility. As the current portfolio is not encumbered by any debt, from here TerraForm plans to borrow another $475 million in long-term funding against these assets, and also use $245 million in proceeds from the sale of minority interests in North American wind plants.

This move from wind into DG solar will also bring TerraForm’s distributed generation portfolio to around 750 MW, a significant portion of the 3.7 GW of assets that it owns, most of which is in the United States.

Graphic: TerraForm Power

There is a bit of an irony here that TerraForm is so heavily invested in distributed generation. Three years ago when TerraForm was owned by SunEdison, investors who wanted to prevent the mixing of DG and utility-scale assets in TerraForm dynamited the developer’s acquisition of Vivint Solar. This sparked the collapse of SunEdison, which at the time was the nation’s largest wind and solar developer, and threw Vivint Solar for a loop that took several years to recover from.

The why

In a press release announcing the acquisition, TerraForm shed some light on the logic behind the acquisition, noting that it provides additional opportunities to sell assets to the off-takers of the projects.

TerraForm Power’s business plan is to extract incremental value from the portfolio by cross-selling additional products such as storage and back-up generation to its commercial and industrial customers and reducing operating and maintenance costs by leveraging the scale of what will be a combined ~750 megawatts distributed generation portfolio.

These relatively young assets, with an average age of 3.5 years, also give TerraForm a longer runway of contracted payments. The company notes that the average power purchase agreement (PPA) term for these newly acquired assets is 17 years, which brings its average contract duration to 14 years. And while the company didn’t say how old the wind plants are that it is selling off, but merely that it was time to “recycle” the company’s capital.

“This demonstrates our strategy of recycling capital from stabilized assets with limited opportunities for further value creation into newly acquired assets that meet our return targets and have commercial and operational upside that we can extract through our integrated operating platform,” notes TerraForm CEO John Stinebaugh.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.