In states with a weak renewables standard, or none at all, a key battle over an electric utility’s solar deployment plan is fought in a regulatory proceeding triggered by the utility’s filing of an integrated resource plan (IRP)—at least in the 33 states that require utility IRPs.

In theory, to develop an IRP, a utility uses an optimization model that spits out the least-cost mix of future generation resources to meet projected demand, plus a reserve margin. As prices for solar, wind, and storage fall, you would expect to see these plans reflecting an increasing percentage of renewable generation. Yet a utility controls the inputs to the model, and selects which scenarios to consider, so it can skew the model results in ways that disadvantage solar, wind and storage.

Few state regulatory agencies have the budget, expertise, or data to run their own model. But in North Carolina at least, two clean energy groups have hired consulting firms to run models, and have presented the results to North Carolina regulators through a regulatory proceeding.

Both groups found that the least-cost resource mix for North Carolina would involve much more solar than the utilities’ plans projected, with savings coming largely from coal unit retirements and from building only those natural gas units already under construction.

Both groups flagged a key concern with the utilities’ modeling: the two Duke Energy utilities did not let their model “turn off” coal plants, whereas the clean energy groups let their respective models decide whether retiring some coal units would lead to lower utility bills—and found that it would. (North Carolina is served by three utilities: two subsidiaries of Duke Energy, plus a subsidiary of Dominion Energy.)

The North Carolina Sustainable Energy Association (NCSEA) reported that reaching solar generation of 18% by 2033 would help reduce customer bills, compared to just 8% total renewable generation by 2033 as proposed by the two Duke Energy utilities (as shown in a Duke filing, Figure 12-F).

Similarly, modeling results submitted by the Natural Resources Defense Council (NRDC) showed that adding 8 GW of solar in North Carolina by 2025 (compared to 3 GW in Duke Energy’s plans), plus 1.3 GW of storage by 2030, would yield the lowest customer bills. That “low bill” scenario also involved retiring 4 GW of North Carolina coal generation by next year.

Both groups hired consulting firms to run the models. NCSEA hired Synapse Energy Economics to run the EnCompass model, licensed by Anchor Power Solutions, while NRDC hired ICF Consulting to run that firm’s IPM model.

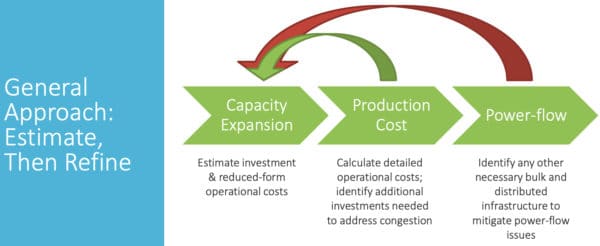

Synapse ran the EnCompass model in both the capacity expansion and production cost modeling modes, said Ms. Jones of NCSEA, while ICF’s IPM model is a capacity expansion model. (For comparison, the Duke and Dominion utilities used capacity expansion and production cost models for their IRPs; Dominion also made limited use of a power flow model.) The different types of modeling can achieve progressively more refined results, as shown here:

Image: National Renewable Energy Laboratory

Both models, EnCompass and IPM, come complete with data on existing electric generating units. Both Synapse and ICF used cost projections for solar and wind power from the National Renewable Energy Laboratory’s Advanced Technology Baseline report. For storage, Synapse used cost projections from Lazard’s Levelized Cost of Storage report, while ICF used NRDC’s mid-case cost trajectory synthesizing four data sources.

NCSEA’s and NRDC’s regulatory filings presented different interpretations of Duke Energy’s IRP treatment of existing coal units. The Synapse report submitted as part of NCSEA’s filing indicated that Duke had “must-run designations for coal units.” A report by Applied Economics Clinic (AEC) jointly filed by NRDC, the Sierra Club and the Southern Alliance for Clean Energy stated that Duke did not forecast the fixed costs of existing units; AEC noted that “future fixed O&M costs are avoidable if the plant retires.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Nice, hopefully this can get more coal generation kicked out and more solar added!

It would be great to be able to do this with more and more utilities.

I still have concerns on how you “plan” with a resource that is not dispatchable or available when your system peak demand occurs at 8AM or 5PM. Without significant storage capacity providing availability during those hours, how can solar or wind replace gas/coal/nuclear or hydro units?

I have never seen a system where the daily peak was 8 AM. As for 5 PM, solar plus storage can do this. Plants have been built in Hawaii and are being built in Florida specifically to provide evening power.

Good question!

You can use probabilistic models to estimate wind & solar annual time series for planning purposes, with various dispatchable resources for backup (hydro, storage, demand response, biomass, or fossil plants). Geographic dispersion and coordinating with neighboring system operations also helps smooth overall output.

Several years ago, solar thermal with storage looked like a promising method of using solar energy after the sun went down, but falling costs of PV and batteries with high round-trip efficiencies have made solar thermal storage look much less promising. That kind of thermal storage could still add flexibility to “baseload” thermal plants such as geothermal (or nuclear in theory), but that application wasn’t widespread the last time I checked.

Winter peak occurs at 8 AM and summer peak occurs at 5 PM in most mid atlantic / southeastern states. Yes, batteries will offer the ability to offset power produced during non-peak timeframes, but in order to “replace” units that are available 24/7, what size battery do you need to meet these peak timeframes when solar is unavailable and wind is undispatchable? What are the losses incurred with the charge/generate cycle? Spinning reserve requirement by FERC is calculated on the largest unit that might be lost. Do we need to start using total solar capacity as the largest unit? What is the expected life of batteries? Solar will only generate 40% and it is not economic to build even a 50% matching battery to move the KWH’s the 4-5 hrs to get into the peak. And the land necessary to cover with solar panels to get the necessary capacity to match existing supplies.