Southern California has embraced solar perhaps more than anywhere else this side of Germany. The results have been dramatic; while California got around 14% from its power from solar in 2018, according to utility renewable portfolio standard filings the portion is even higher in Southern California,

All of this solar is exacerbating the duck curve, leading to lower mid-day power prices and steep ramps in the evening. And now the answer to this and other system needs met met by large volumes of solar is arriving: batteries. And lots of them.

Yesterday Macquarie announced that it has closed on debt financing for 97 MWh of batteries as the third phase of a 63 MW/340 megawatt-hour (MWh) battery project for Southern California Edison. Notably, this project is not a few large batteries, such as utility PG&E is deploying in Northern California, but behind-the-meter systems for “grid-constrained pockets” of its service area in the urban sprawl in the western end of the Los Angeles basin.

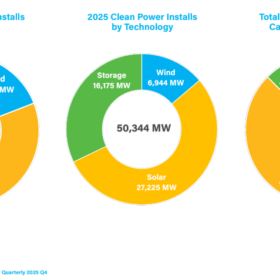

And yet this is not the only battery system which is coming for the seemingly endless land of freeways and sun known to those outside the region simply as “LA”. According to reliable sources, the Los Angeles Department of Water and Power (LADWP) is planning to deploy 1.8 GW of batteries as part of the plan to replace the local capacity that will be lost when three large gas plants are shut down, as part of Mayor Eric Garcetti’s plan to rapidly decarbonize the City of Los Angeles.

LADWP officials declined to confirm plans for these batteries.

Battery prices just keep coming down

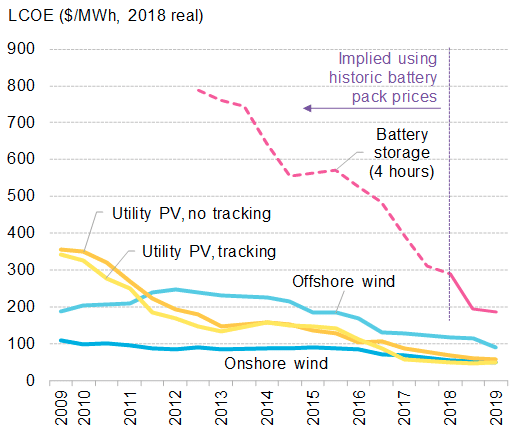

All of this falls on the heels of new research by Bloomberg New Energy Finance (BNEF) which shows that the cost of lithium-ion batteries is continuing to fall, with prices declining 35% over the past year to $185 per megawatt-hour. This is part of a larger decline, with the cost for lithium-ion storage falling 76% since 2012.

Some of this can be attributed to developments in the supply chain. While there have been concerns about the prices of key materials, particularly cobalt, a spike in cobalt prices in late 2017 and early 2018 has subsided, with prices back below $20 per pound around the beginning of 2019.

Some of this can be attributed to developments in the supply chain. While there have been concerns about the prices of key materials, particularly cobalt, a spike in cobalt prices in late 2017 and early 2018 has subsided, with prices back below $20 per pound around the beginning of 2019.

And while South American lithium producers have been slow to scale to meet the rising demand, at the BNEF Summit in New York this week, Aleksey Yefremov of Instinet noted that Chinese and Australian lithium producers had quickly moved in to fill the gap.

However, the raw supply of chemicals is only one of several factors, and Elena Giannakopoulou, the head of energy economics at BNEF describes “staggering improvements” in the cost declines of batteries, wind, and solar, citing “technology innovation, economies of scale, stiff price competition and manufacturing experience.”

Much of this is happening in China, which not only controls the supply of key process materials but represents the majority of the world’s battery manufacturing capacity – a trend which is likely to only increase in coming years, given the massive capacities of battery factories that the nation is planning.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.