2018 has been a dramatic year in the U.S. power sector. Chiefly, the slow death coal has sped up somewhat. The U.S. Department of Energy’s Energy Information Administration (EIA) has forecast that 14 GWac of coal-fired power plants will have gone offline over the course of the year, as the second-highest year for retirements to date, and as coal consumption hits its lowest level in four decades.

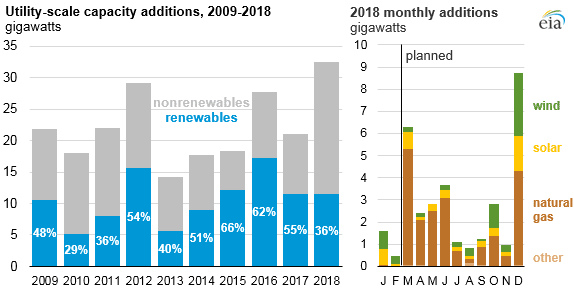

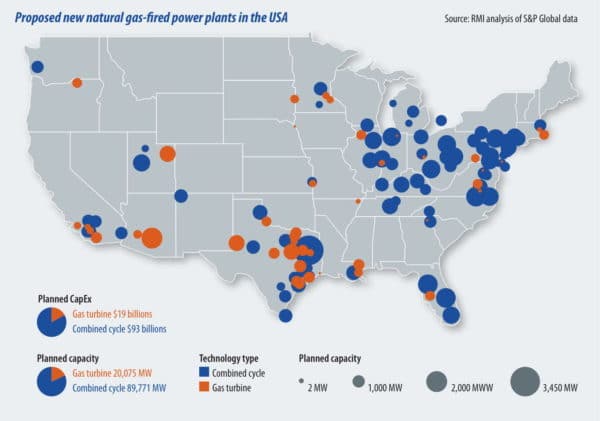

But as this is happening, the United States is also in the middle of a “rush to gas”, which led EIA to predict in May that 21 GWac of gas plants would come online this year, as the first year since 2013 that a higher capacity of fossil fuel plants would come online than renewables.

Graphic: EIA

However, as is often the case EIA was only counting utility-scale solar in this analysis, not distributed generation. Additionally, while pv magazine and other organizations rely heavily on EIA as the prime data source for what is already online, its forecasts of the future power mix have been so immune to influence by reality as to leave many speculating about undue influence from the conventional power industry.

So was EIA right? Will more gas be put online this year than combined wind and solar?

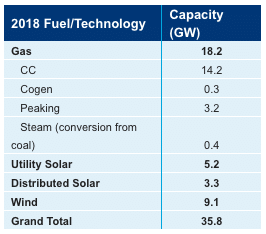

Graphic: Wood Mackenzie

The truth is that with two and a half weeks left in 2018, we’re still not exactly sure. However two major power market analysts – Wood Mackenzie and IHS Markit – are both stating that more gas will come online than renewables – but the numbers are much tighter than EIA’s earlier forecast

Wood Mackenzie is predicting that 18.2 GWac of gas plants will go online, versus 8.5 GW of solar (both utility and distributed) and 9.1 GW of wind – in other words, only 600 MW more of gas capacity.

IHS Markit did not provide exact numbers for gas, but gave almost identical numbers for solar and wind, and indicated that the gas capacity would be slightly greater than these two combined this year.

Geography matters

However, these resources are not coming online in the same places. “Almost all new gas plants are being built east of the Rocky Mountains,” Wood Mackenzie Research Director for Americas Power & Renewables Wade Schauer told pv magazine.

Schauer’s analysis of new gas builds matches those of an earlier Rocky Mountain Institute (RMI) report which found that by far the largest area of planned future gas plants is is the 13-state PJM Interconnection grid which stretches from the East Coast to Chicago.

Schauer says that wind development remains concentrated in the middle of the country, while solar development is taking off “ in almost every major interconnection queue”.

He says that this lack of overlap is not an accident. “Wherever wind and solar are being built, they are displacing the need for gas to some extent,” explains Schauer.

“New gas-fired plant development has really withered in the entire Western Interconnect and also in the Southwest Power Pool and ERCOT. We’re seeing many utilities upping their plans for renewables and energy storage while reducing their plans for new gas-fired capacity.”

Correlation and causation

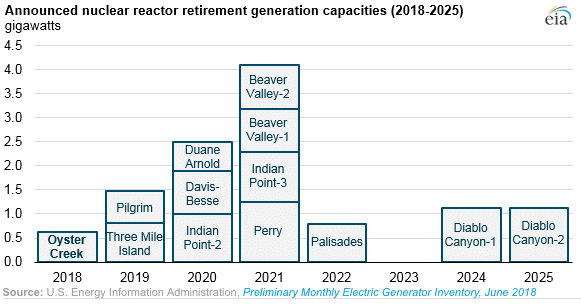

Coal retirements are the obvious factor behind the growth in gas, but IHS Markit also stresses existing and coming nuclear retirements as a factor. While only one 625 MWac nuclear power plant went offline in 2018, two more are planned in 2019, three in 2020 and four in 2021.

Wood Mackenzie’s Schauer argues that retirements are not the only factor. “In some cases new gas is being built to replace retiring coal facilities, but in others it is simply the assumed economics of new plants based upon fuel supply or advanced technology that is driving their development,” states Schauer.

2019 and beyond

Analysts are still adjusting their forecasts for 2019, but Wood Mackenzie expects modest growth in the nation’s solar market, as well as for new build of gas plants to fall back to only 11 GWac – making 2018 an outlier against the larger trend of renewable energy outpacing other forms of generation, including natural gas.

Thomas Maslin, an Associate Director at IHS Markit, notes that the 2018 build for gas could be due to other factors. “There is no ITC and PTC for gas, so the timing was perfect for gas,” notes Maslin.

He also says that he expects wind installations to pick up sharply in the next few years due to the scheduled expiration of the Production Tax Credit (PTC) for wind. “We have a lot of wind being built in the next couple of years, in correlation with the PTC timing,” Maslin told pv magazine. “We will have a higher percentage of wind being built this year or next year through 2020.”

As for solar, both IHS Markit and Wood Mackenzie are expecting an up-tick in activity over the next few years as projects rush to qualify for the ITC before it expires, with Wood Mackenzie expecting that activity will peak in 2021. But based on what pv magazine is seeing in the market, in interconnection queues, and with state-level renewable energy targets, we suspect that these forecasts are overly conservative.

pv magazine USA will be delivering more analysis on that final point in the coming weeks.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

FYI: I just received a FOA from the DOE about solar powered desalination and within the FOA, it was revealed that over 40% (forty) of all the fresh water consumed in the US is used for cooling of electrical generating facilities.

Gas plants are only being build because of Fracking. That bring short term energy of gas and oil but there wells fade fast. Gas is a very poor long term investment.