by Mike Mendelsohn, Executive Director, Solar Finance Council*

Securitization of U.S. solar cash flows is hitting its stride in 2018. In just the last several weeks, SunPower and Sunrun have issued (or about to issue) roughly $818 million in debt through the asset backed securitization (ABS) market, sums unheard of just a few short years ago.

Securitization of U.S. solar cash flows is hitting its stride in 2018. In just the last several weeks, SunPower and Sunrun have issued (or about to issue) roughly $818 million in debt through the asset backed securitization (ABS) market, sums unheard of just a few short years ago.

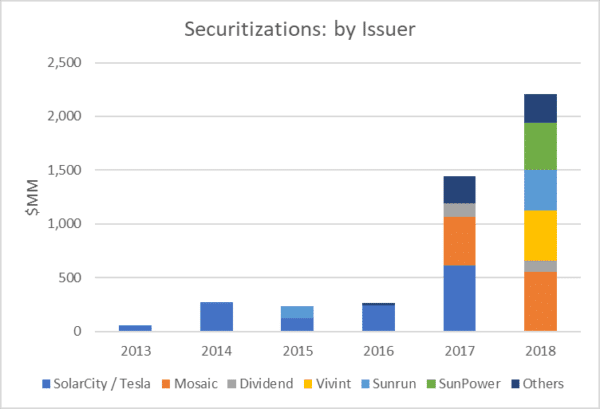

The solar ABS market was borne in 2013 when SolarCity, now formally part of Tesla, issued $54.4 million in long-term notes. That single-tranche issuance was rated BBB+ by Standard & Poor’s and was the only solar ABS that year. The volume of securitizations has grown significantly since then — the current tally for 2018 is $2.2 billion representing 7 ABS issuances, all by different entities. All solar ABS have been issued as Rule 144A bond offerings, their availability limited to Qualified Institutional Buyers, or QIBs.

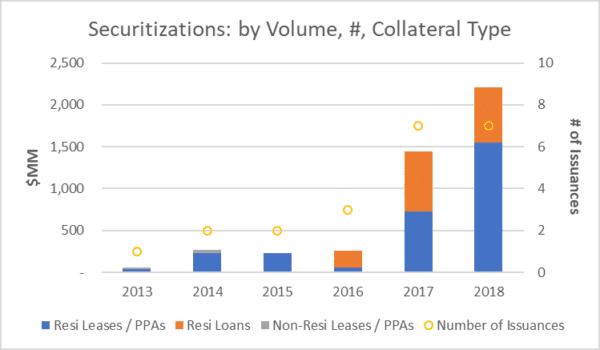

Securitization of residential portfolios, either leases or PPAs (grouped together in this analysis) or loans, comprise the large majority of ABS to date. Loan products, which have made inroads into financing the residential sector, saw significant securitization activity – particularly in 2017. Loan securitizations have totaled $1.58 billion to date, compared to $2.84B for resi leases and PPAs combined. Loans are generally recognized as a more securitizable product relative to PPA and lease contracts: their direct cash flows are not complicated by tax equity (TE) and the need for either back leverage or complex intercreditor agreements between TE and the bondholders. That’s due to the fact that, in loan transactions, the power offtaker is also the system owner, and is responsible for use of the investment tax credit (ITC). MACRS depreciation benefits are lost when a household is the system owner – those are only available to businesses or third-party owners of residential systems.

Securitization of residential portfolios, either leases or PPAs (grouped together in this analysis) or loans, comprise the large majority of ABS to date. Loan products, which have made inroads into financing the residential sector, saw significant securitization activity – particularly in 2017. Loan securitizations have totaled $1.58 billion to date, compared to $2.84B for resi leases and PPAs combined. Loans are generally recognized as a more securitizable product relative to PPA and lease contracts: their direct cash flows are not complicated by tax equity (TE) and the need for either back leverage or complex intercreditor agreements between TE and the bondholders. That’s due to the fact that, in loan transactions, the power offtaker is also the system owner, and is responsible for use of the investment tax credit (ITC). MACRS depreciation benefits are lost when a household is the system owner – those are only available to businesses or third-party owners of residential systems.

Commercial systems represent only a modest sliver of ABS portfolios to date and not since 2014, although there are reportedly several commercial-only portfolios in the works. The cash flows of community and utility-scale solar systems have not been securitized to date.

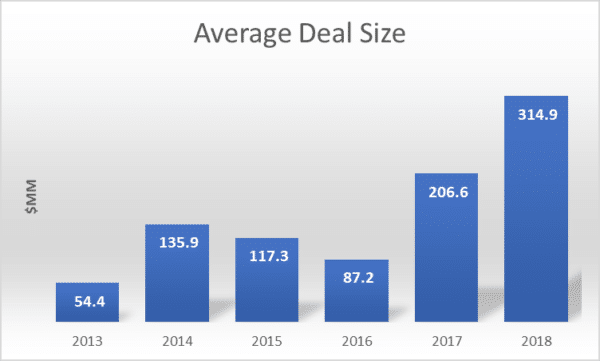

Several signs of maturation for the asset class can be observed in its short history. First, average deal sizes have risen substantially, if not consistently, since the first deal in 2013. In 2018, Mosaic, Vivint, Sunrun, and SunPower have all issued (or are in process) ABS deals of $300 million or larger. Overall, average issuance size has grown to $315 million in 2018, substantial for a relatively new asset class, indicating the growth of the solar market broadly and ability of top players to pool sizable portfolios that make capital raising through the 144A markets attractive.

Several signs of maturation for the asset class can be observed in its short history. First, average deal sizes have risen substantially, if not consistently, since the first deal in 2013. In 2018, Mosaic, Vivint, Sunrun, and SunPower have all issued (or are in process) ABS deals of $300 million or larger. Overall, average issuance size has grown to $315 million in 2018, substantial for a relatively new asset class, indicating the growth of the solar market broadly and ability of top players to pool sizable portfolios that make capital raising through the 144A markets attractive.

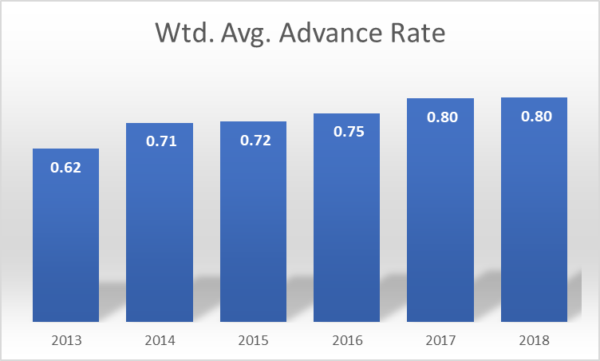

Perhaps more relevant are the advance rates available on the bonds sold, rising from 62% in 2013 to 80% in 2018. Advance rates represent the ratio of the capital raised by the bond to the present value of projected cash flows from the underlying collateral. In essence, the issuers are structuring the deals –and the bonds are being rated and bought — with less cushion if something goes wrong. Rising advance rates indicate increasing confidence in the asset class and, other things equal, lower cost of capital for the issuers.

Perhaps more relevant are the advance rates available on the bonds sold, rising from 62% in 2013 to 80% in 2018. Advance rates represent the ratio of the capital raised by the bond to the present value of projected cash flows from the underlying collateral. In essence, the issuers are structuring the deals –and the bonds are being rated and bought — with less cushion if something goes wrong. Rising advance rates indicate increasing confidence in the asset class and, other things equal, lower cost of capital for the issuers.

Industry data indicate that technical performance (i.e., system production) and credit performance (i.e., payment reliability) are reasonably high and consistent with projections. Of course more data, particularly long-term, is needed, but the asset class has a valuable story to tell. And buyers of ABS – pensions and other large money managers) are increasingly comfortable with that story.

PACE and Private Securitizations

Property Assessed Clean Energy (PACE) assets, including residential, commercial, and mixed portfolios have been securitized by a variety of issuers. Most of the underlying cash flows have been associated with efficiency or other non-solar investments. Several pure commercial PACE, or C-PACE, portfolios have been securitized. In July this year, CleanFund issued the first 144A securitization of C-PACE assets, comprising primarily non-solar cash flows.

Separately, the cash flows from a number of solar portfolios have been securitized via “private placements” although, by definition, this sector is opaque. Private placements are unregistered securities sold to a small pool of investors, and generally incur lower expenses to issue but offer reduced liquidity for the buyer. In 2017, Mosaic secured a forward flow purchase commitment from Goldman Sachs for approximately $300 million, with those loans subsequently securitized in a co-branded transaction in 2018. In 2016, SolarCity raised $227 million in a private placement to monetize the cash equity portion of residential lease and PPA portfolios.

*Solar Finance Council is a member-led organization designed to open capital for the solar and storage industries. To learn more or participate, please visit https://www.solarfinancecouncil.org/

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is interesting 🙂

Thanks for this. I’m trying to fit my understanding of the funding of the largest solar pv farm project east of the Mississippi, by sPower, in Spotsylvania, VA for 500 MW, into the pattern above. Seems it is a different animal altogether. $650 million raised not by the corporate parents of sPower, but via bank funding, the major banks being unnamed, and the funding held up until Virtual PPA’s were signed with the major corporate players – Microsoft, Apple, Etsy, Swiss Re…and a small slice to the Univ. of Richmond.

If what I was told is the correct funding level $650 million it fits into the upper reaches of the deals described above. For me, also, it was a glimpse into the world of “The Cloud,” all the servers and Internet storage systems built in the Loudon County area over the past 20 years.