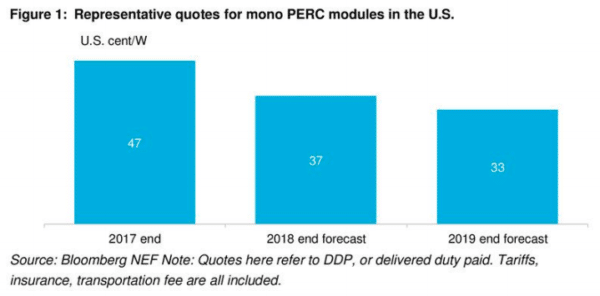

Those who spelled doom and gloom for the U.S. solar market in the wake of 30% Section 201 tariffs appear to have missed the track record of cost reduction in global solar manufacturing. As further evidence of this, Bloomberg New Energy Finance (BNEF) has released a note indicating that the cost of mono-PERC PV modules is expected to fall 20% to $0.37 per watt by the end of this year, despite the impact of the 30% tariff.

BNEF says that large module makers are already quoting prices of $0.35 to $0.40 per watt for product to be delivered during the fourth quarter of this year, across modules comprised of both multi-PERC and mono-PERC cells.

The march of U.S. manufacturing

These cost reductions are coming as many global manufacturers have already announced plans and in many cases begun work on factories. Since the end of 2017, pv magazine has reported on plans by Hanwha Q Cells, First Solar, LG, JinkoSolar, Seraphim USA, Mission Solar, Solartech Universal and Heliene to build or expand U.S. manufacturing capacities, totaling around 4.5 GW of new module capacity, 3.3 GW of which is crystalline silicon.

BNEF and Greentech Media have additionally reported plans by Sunpreme to start up a cell and module factory in Texas in early 2019, although veteran solar analyst Paula Mints has questioned the plant’s expected timeframe.

#solar Sunpreme's timeline for the start up of commercial production is not only speedy, it is ridiculous and an example of an announcement not supported by the realities of cell technology development – ALL plants go thru pilot scale https://t.co/PClU221GN3

— Paula Mints (@PaulaMints1) October 2, 2018

With existing PV module manufacturing is factored in, by pv magazine’s calculations in mid-2019 there could be as much as 5 GW of crystalline silicon PV module assembly fighting over the 2.5 GW of annual cell imports that are exempted from the Section 201 tariffs.

This will drive up costs, and cell imports have risen sharply in recent months, indicating that manufacturers are hoarding cells, just as modules were warehoused in advance of the Section 201 tariffs.

U.S. cost advantage to disappear in 2021

For the time being, U.S. manufacturing appears to pencil. BNEF has found and all-in cost of $0.30 per watt to make mono-PERC modules in the United States, which at prices of $0.37 per watt leaves $0.07 per watt of gross margin. This compares favorably to an estimated $0.345 per watt cost in Southeast Asia, which includes shipping and a $0.075 cost of the Section 201 tariff, leaving a very slim gross margin.

Costs will be higher for U.S. manufacturers that miss the 2.5 GW exemption and have to pay tariffs on PV cells, however these will not be $0.075 per watt given that tariffs are calculated based on the cost of the product imported, and cells are cheaper on a per-watt basis than modules.

However, in future years tariffs will decline and BNEF expects the cost of manufacturing in Southeast Asia and China to also decline more rapidly than U.S. costs, meaning that the cost advantage of manufacturing in the United States will be wiped out some time in 2021.

While it is possible that Section 201 tariffs could be extended for another four years, that will depend on who is in the White House. If they are not, this could mean a difficult future for up to 8 GW of module factories, including the Tesla/Panasonic Gigafactory in upstate New York and First Solar’s U.S. thin film manufacturing.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

When have prices gone down in a cliff year? With the ITC step down those buying in Q3 forward are exposed to margin grabs from cell and module suppliers. The .33 p/w is not a real price in my opinion unless it is from a tariff free country. ( for PERC Mono)

By “those who missed the mark”, you mean SEIA.