Vivint Solar has struggled over the past few years, as it switched gears and priorities following the botched acquisition of the company by SunEdison. However, for the second quarter of 2018 Vivint reported remarkably strong results, as reflected in both quantitative and qualitative assessments.

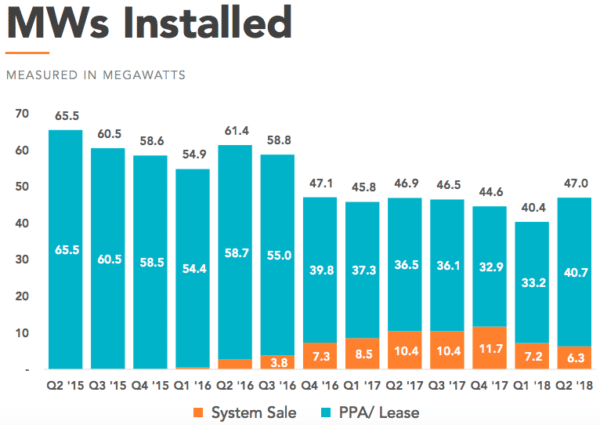

The company is still much smaller than it was in 2015 and 2016, however the 47 MW that Vivint installed is the highest volume in the last six quarters. This is likely to increase in future quarters, as the company booked 64 MW of systems, and notes that it is hiring additional installation teams.

Of the many changes Vivint has undergone in recent years, an emphasis on more profitable markets and systems has been a major focus. This includes California, and the company recently announced that it has signed a deal with a un-named “major homebuilder” to provide PV systems for new homes under the state’s mandate.

Breaking new ground with finance

But the biggest news was on the financing front. Vivint reports that it has closed on a $327 project financing deal which includes project-level debt, a levered tax equity partnership and a cash equity investments. The company describes this as a “forward flow” funding arrangement, and says that this will allow it to deploy 95 MW of solar energy systems without using any cash on its balance sheet.

“This transaction is the first of its kind in the residential solar industry that incorporates a multi-party forward purchase commitment anchored by a levered tax equity partnership,” noted Vivint in a press release.

This was not the company’s only financing success, as Vivint also reported a $50 million tax equity partnership after the end of the quarter. The company appears to have ample funding for more deployments, as it ended the second quarter with $375 million in undrawn capacity in an aggregation facility.

Return to third-party solar

Vivint’s second quarter results also showed that the company is moving against the current to return to a greater emphasis on solar leases and power purchase agreements. Cash sales and loans represented only 13% of the solar the company deployed during the quarter, its lowest portion since 2016.

This comes as its rival Tesla has joined the industry trend in moving away from third party solar towards cash sales and loans, which provide more cash on a quarter-to-quarter basis.

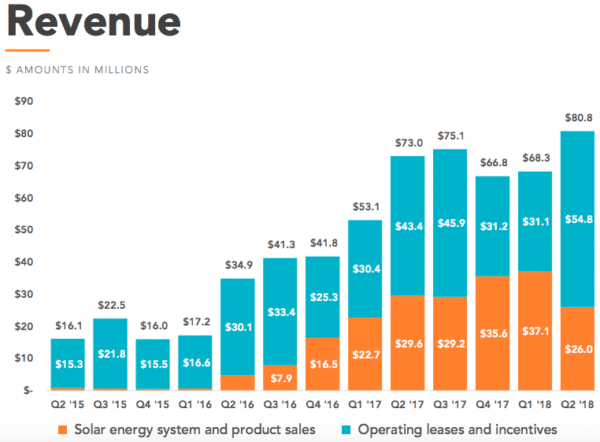

But despite the lower quarter-to-quarter profitability of third-party solar, Vivint brought in the most revenue it has to date at $80.8 million during the second quarter, which suggest that the company’s emphasis on more profitable projects is more than hype. Vivint still reported a negative operating margin, but $18.1 million in net income.

High costs remain

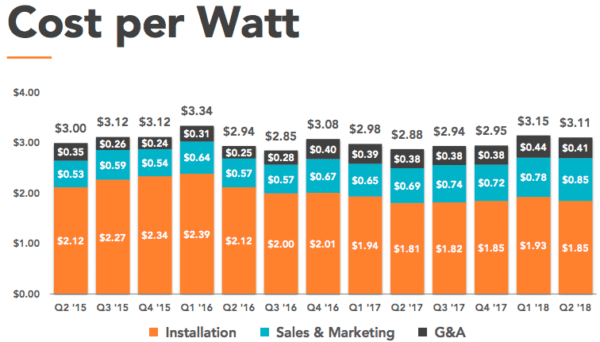

If there is one place that Vivint appears to be struggling, it is in reducing system costs. The company reported the cost of the PV systems it is deploying at $3.11 per watt, which is the second-highest cost over the last two years.

This includes stubbornly high sales and marketing and general and administrative costs, with both at their highest levels to date in the first two quarters of 2018.

In the third quarter Vivint expects to increase installations to 51-54 MW, but for system costs to rise again to $3.15 – $3.23 per watt.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.