Last night the Massachusetts House and Senate nearly unanimously passed the energy bill produced by the conference committee. The bill now goes to Governor Charlie Baker (R), who is expected to sign it.

H.4857 was allegedly a compromise between both chambers, but mostly represents the House forcing its version of energy legislation and killing the more ambitious measures passed in the Senate.

The bill will increase Massachusetts’ renewable portfolio standard (RPS) by 2% each year to 2030 and 1% each year thereafter, resulting in an effective 40% by 2030 and 100% by 2090 – making for a rather absurd version of a 100% renewable energy mandate. H.4857 will also create a target to deploy 1,000 megawatt-hours of energy storage by 2025, as well as requiring an investigation into whether or not the state should procure an additional 1.6 GW of offshore wind.

Additionally, the bill sets in motion the creation of a “clean peak standard” including the creation of certificates to award generation which meets peak demand.

Big concerns for C&I solar

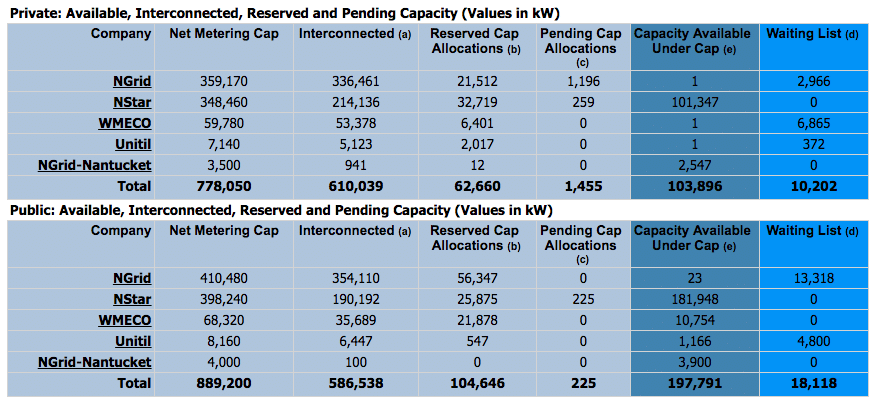

But what is most notable is what the bill does not do. H.4857 does not lift the caps on the state’s net metering policy, which the Senate energy bill did. These caps have already been reached in three utility service areas for either private installations, and two for public installations, which covers large parts of the state.

The good news is that solar projects under 10 kW on a single-phase circuit or 25 kW on a three-phase circuit are not affected by the caps, meaning that the large majority of the residential market is exempt. This also explains why Sunrun, which only works in the residential segment, cheered the passage of the bill.

But for the commercial and industrial, government and non-profit installations this is a major problem, at least until the new Alternative On-Bill Credit (AOBC) is instituted through the state’s SMART program. However, not everyone is convinced.

“Unfortunately, while the AOBC value (= basic service rate) is acceptable, the utilities appear to have successfully limited ones ability to allocate those credits to an off-taker account,” Russ Aney, the CEO of Avid Solar, told pv magazine. “Those restrictions (yet to be finalized by the DPU) make for a weak substitute for a net metering credit.”

MMRC issues

There are also concerns regarding the language around demand charges. While everyone pv magazine spoke to about this bill agrees that H.4857 will force Eversource to re-file its demand charge – the first ever allowed for residential customers by a state regulatory body – the language does enable other kinds of demand charges.

And while Sunrun issued a statement applauding legislators for their work to “stop mandatory punitive demand charges”, Avid Solar’s Aney has a different take. He notes that the bill allows demand charge based on system peak, and says that this creates an exemption in the rules big enough for utilities to “drive a truck through”.

“A charge based on ‘system peak demand’ is not the same as determining the charge based on a ‘customer’s peak demand’ during the period of system peak demand,” explaines Aney.

There is an upside in that the solar industry is expected to be better organized to combat Eversource in regulatory hearings, however Aney has expressed little confidence in Governor Charlie Baker’s (R) appointees to the Department of Public Utilities. “The (utilities) will have fun with this one, and this trio of DPU Commissioners will allow them to get away with it,” predicts Aney.

A unreachable target?

A number of organizations including Northeast Clean Energy Council (NECEC) issued statements in support of the bill. But at the end of the day, there are still serious policy challenges for solar in Massachusetts.

Additionally, while the bill has set a relatively ambitious RPS through 2030, it is unclear where all the renewable energy to meet this target will come from, given the slow permitting of offshore wind, NIMBY resistance to onshore wind, and now the barriers to larger solar installations. And while the RPS can be met with out-of-state resources, Maine has put a moratorium on new wind development, and Vermont and New Hampshire are also resistant to developing their scenic countrysides to feed power demand from southern New England.

This is not the first time in New England that an RPS increase has come in the context of barriers to deploying solar. Like Connecticut, Massachusetts is in danger of setting a renewable energy target that it cannot reach.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.