In the year 2018, the solar technology of previous years is not good enough. Just as First Solar has undergone a massive retooling to move to its larger-format Series 6, SunPower is also preparing for a major shift in technology to its new NGT technology, as revealed in today’s second quarter 2018 results call.

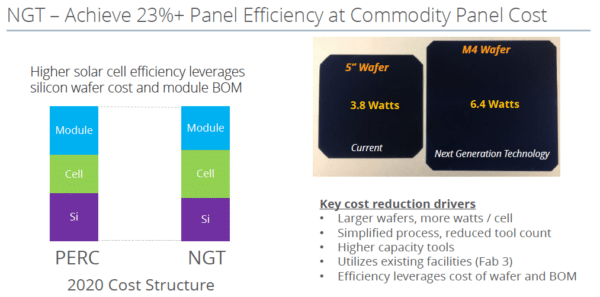

The call also saw some of the only details that SunPower has released on its NGT technology to date. Like its current Maxeon solar cells, NGT will be based on interdigitated back contact (IBC) technology, but using larger-format 6” wafers.

SunPower will also make NGT at existing factories, instead of new fabs, and announced that it plans to entirely convert its current 800 MW of E-Series cell and module production to NGT. SunPower CEO Tom Werner says that NGT is “ahead of plan” and that the company has already produced the first silicon on a new line at its Fab 3 in the Malaysia.

The company expects to begin volume production of NGT in the fourth quarter of this year, and states that the new product will substantially reduce the cost of its products, noting a simplified process with fewer tools and higher capacity.

“When fully ramped, we believe that NGT cost per watt will be on par with mono-PERC technology,” stated Werner on the company’s results call.

At the same time SunPower reports very high efficiencies similar to its Maxeon products, projecting that modules using its NGT cells will offer greater than 23% efficiency. Any wattage gains will be mostly due to larger wafers, however Tom Werner told pv magazine that there are “some subtle changes to get the efficiency up due to the geometry on the back side of the cell.”

SunPower has not yet released information on the format of the modules that will be made with NGT cells, but Tom Werner says that there may be a slightly larger format, in line with existing trends.

Werner also stated that the company has not yet made a decision as to whether or when it will switch over its 400 MW of X Series production to NGT, given that its Fab 4 in the Philippines is only two years old.

Cash ins and outs

The decision to phase out its E-Series was not kind to SunPower’s Q2 results. The company wrote down $369 million of its legacy manufacturing equipment, the largest factor in the company’s stunning second quarter loss of $447 million, which nearly equalled its revenue of $449 million for the quarter. Additionally, SunPower reported a sizable $68 million in impairment of impairment of its lease assets, and when these two are taken out the company pretty much broke even.

However SunPower has also been paying off its debt. The result that its balance sheet shows less than $300 million in cash, and the company is furiously selling off the parts of its business deemed non-essential. This has included the sale of its partial ownership stake in yieldco 8point3 Energy Partners and its microinverter technology, and now SunPower expects to monetize the first phase of its lease portfolio, and by the end of the year the company expects to sell 400 MW of residential lease assets.

Even with this, it is not clear how SunPower is going to pay for a massive retooling and the acquisition of a factory.

The good news is that the company expects much lower retooling cost thanks to reusing its existing factories as opposed to making NGT in greenfield factories. This does not mean that the cost will not be significant; and CEO Werner estimates a cost of $0.30 per watt to retool its Fab 3 to make NGT, meaning a total cost of around $400 million given the higher capacity after the switch to NGT. The company plans to fund this at least in part through customer advances and partnerships, and reports that it has several in the works.

Additionally, there is the substantial matter of the pending acquisition of SolarWorld’s Oregon factory, which SunPower also plans to fund without new capital raises, and here the sale of assets could prove critical. Retooling at the SolarWorld factory is expected to be much less costly, as the company plans to use SolarWorld’s cell production, and the biggest change will be moving module production to P-Series.

But in the larger picture is that SunPower may not have much of a choice. Like all other PV makers it is in danger from the falling prices for solar due to global oversupply stemming from Chinese policy changes, and it is additionally staring down an estimated $51 million in tariffs on its products during the second half of this year alone.

SunPower has a choice to go big or go home, and it is choosing the former.

Correction: This article was corrected on November 14, 2018 at 11:00 AM EST. An earlier version of this article stated that the cost to retool Fab 3 would be over $1 billion, but the figure is actually around $400 million. We have changed the figure in question, and regret the error.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

As much as I like SunPowers modules and efficiency ratings, I think that Panasonic provides more value per dollar spent.

Yeah, up front you spend a healthy amount for that panel. However, SunPower offers a 40 year solar panel. That’s pretty damn awesome.

Any idea when we can purchase the NGT panels as residential home owners here in California? I was just about to sign with them for the X22 series. Now it looks like we should wait? Their announcement sure will kill some of the potential sales for the current X series?

I don’t know when NGT will be available. I would recommend asking SunPower. I expect there will be a delay, as it has only been produced on pilot lines so far and I’m not sure they are selling that product to end-consumers.