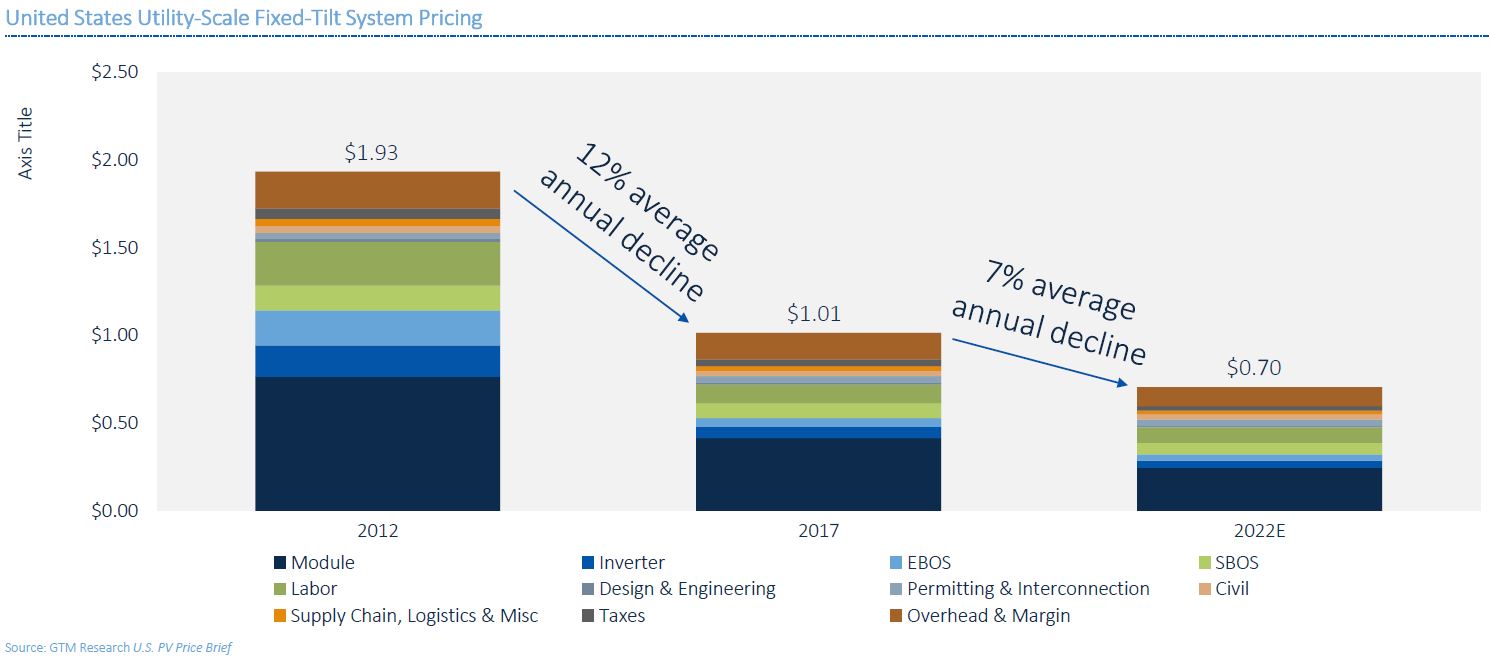

While we’ve seen prices for solar power installations globally fall well below one U.S. dollar per watt, it was only relatively recently (later in 2016, early 2017) that those prices were seen in the United States. And with the effects of tariffs on imported solar panels under Section 201, there are some projects that might have been under that number that won’t come to be – yet.

GTM Research did the math as part of a presentation by Research Manager Scott Moskowitz at GTM’s Solar Summit, Trends in Solar Technology and System Prices, which projects that utility scale fixed-tilt systems could reach 70 U.S. cents per watt by 2022.

It should be noted that the Section 201 tariff is scheduled to end in early 2022, and that to qualify for the 22% Solar Investment Tax Credit (the last year before it goes to 10% indefinitely) you must break ground in 2021 and complete the project before the end of 2023.

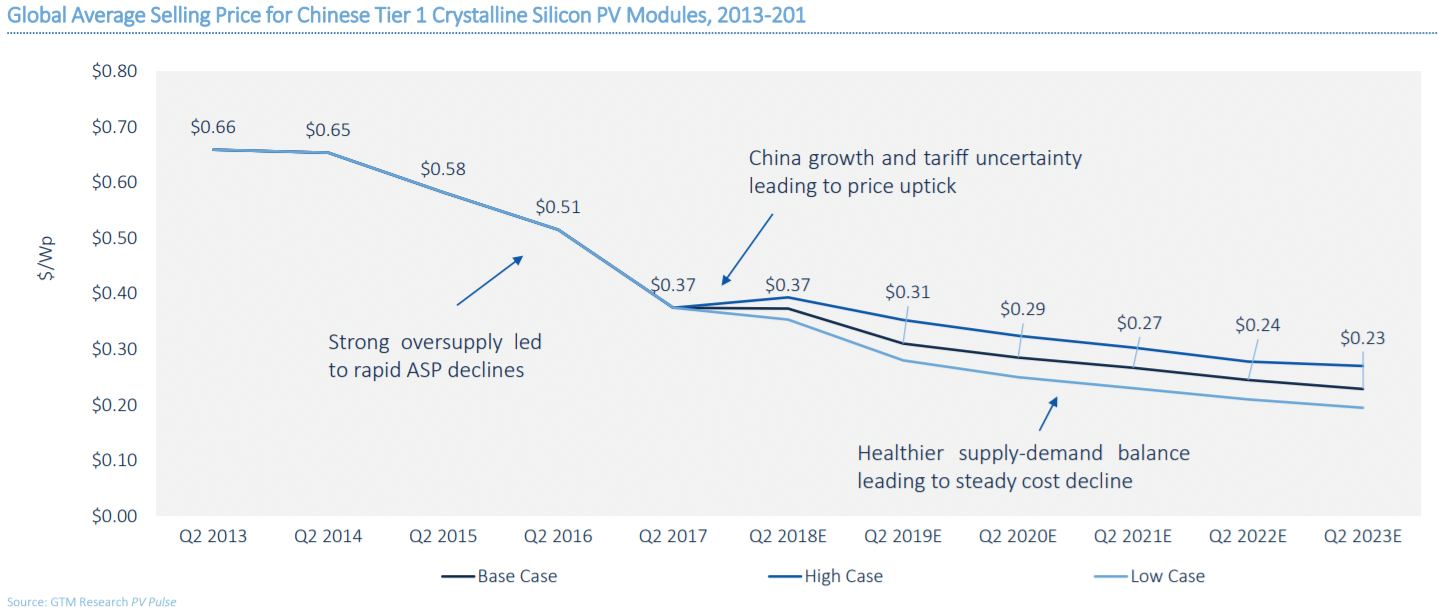

GTM Research projects savings from a range of areas. The largest savings come from the solar panels – expected to fall from from 37¢ per watt (W) today to 24¢/W by 2022, a 35% drop. Much of this price decrease could come from efficiency increases alone. pv magazine staff projects that by 2022, the average utility scale panel efficiency could be 20% – a 17-25% increase over the average 16-17% efficiencies used today.

GTM Research does caution that it will be harder to wring costs out of other parts of the system. For instance they showed inverter pricing slow from the historical 10-20% a year price declines to 5-10% price declines starting in 2019.

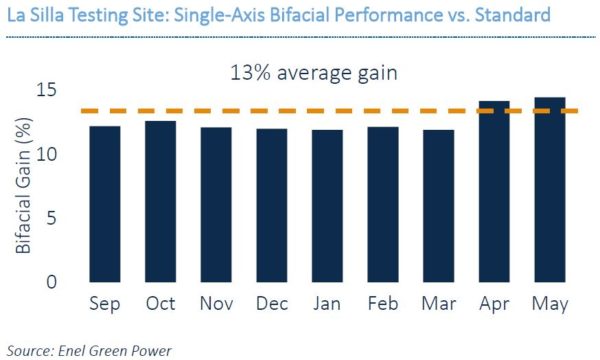

However they do sneak in a very optimistic slide – a bifacial solar module, single-axis tracker system whose performance gains versus regular modules mounted on single-axis trackers was 13%. This lines up with pv magazine seeing 12.5% gains earlier this year.

The effect of increased system economics from higher efficiency – not bifacial – panels has already been well documented, and single-axis solar systems are already reaching above 30% capacity factors in the US southwest.

The financial edge from the increased efficiency of bifacial solar panels on single-axis trackers creates compound benefits throughout the installation. If we put that bifacial panel on a single-axis tracker that is optimized to the land beneath it and the geographic location it is in – we get that aforementioned 12.5% bump to an almost 34% capacity factor. That’s 20% more electricity from the same piece of soil over a standard solar panel mounted on fixed-tilt racking.

All of these factors paint one clear picture. The price of utility scale electricity is coming down. Research suggests broad impacts across the power system as a whole, with solar and wind expected to bring wholesale prices down 50% by the end of the 2020s.

Getting to cents per kilowatt-hour

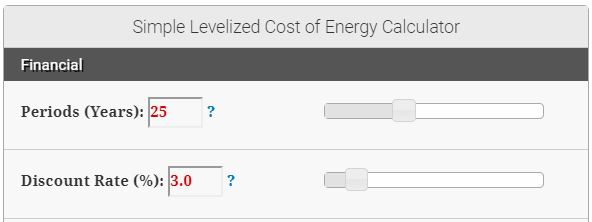

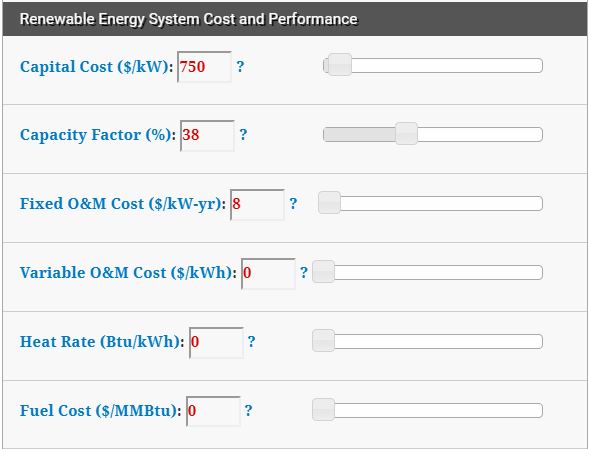

Making use of the National Renewable Energy Labs (NREL) Levelized Cost of Energy Calculator (LCOE) we start to get some insight into what the world’s largest solar developers are going to be producing electricity at.

We set the period at 25 years, as that aligns well with the current solar panel warranty. And by 2022, it might be set further as developers monetize future repowering of solar farms and longer lived solar modules.

For this analysis, pv magazine chose to increase the system cost above to 75¢/W to account for single-axis tracking. Our opinion is that this price is actually giving an extra penny or two, considering efficiency gains.

For capacity factor – we started with the 30.2% that we’re getting in California single-axis trackers last year and the year before, and we added 12.5% for the bifacial panel gain. That brought us to a capacity factor of 34%.

Next, we brought the capacity factor to 38%, an increase of about 11.8%. We did this because 20% bifacial solar panels mean an increase in panel efficiency of 17-25% from today’s product, and 38% seemed conservative.**

Next we adjusted O&M costs to $7.50/kW to align with increases expected here as well. Currently, there are contracts sneaking out at $8-10/W – some influenced by the tax credit, some by super dense installation areas.

Solar power plants have no variable O&M costs (PDF).

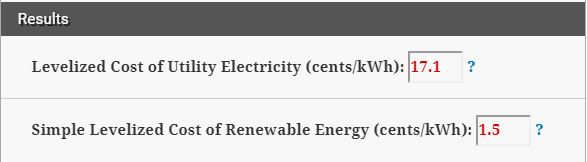

That leaves us with a simple, levelized cost of renewable energy at 1.5¢/kWh. This price does include profits for the utility scale developers.

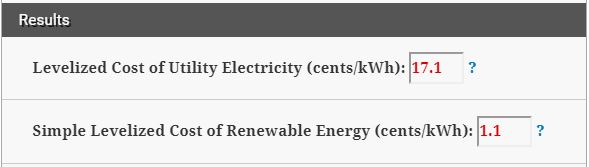

And, if the solar power developer were to partner with a strategic tax equity investor who discounted the tax credit and depreciation by 25% – lowering the effective capital cost to 52¢/W to install, we get a price of 1.1¢/kWh. The cheapest electricity on the planet, right here in the United States.

These numbers, while fantastic looking – are not that far from bids we’re already seeing float around in some global bids. Saudi Arabia saw 1.78¢/kWh that was declined possibly because they were using bifacial solar panels. Mexico, when accounting for clean energy certificates, saw a 1.97¢/kWh bid. Chile got a 2.15¢/kWh bid.

A reckoning is coming.

**It has been noted that increasing a solar panel efficiency, while it will lower broader system related costs – won’t in fact increase the power plant capacity factor, as the power plant’s rated capacity will scale with the efficiency gains. There’d need be kWh production gains from the same system size, to gain those benefits – say for instance from bifacial panels (if gains not noted in DC wattage) or single axis trackers.

Altering the LCOE calculation would mean a 1.7¢/kWh value at $750/kW and 1.3¢/kWh at $520/kW.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

At the end of your article you mentioned bids received for projects in Saudi, Mexico, and Chile. Shouldn’t those prices have been listed as cents per kWh as opposed to cents per Watt?

Thanks for alerting us to that. It has been corrected.

Q1: Are these levellized costs ?

Q2: Are there subsidies and/or forced purchase mandates involved ?

Thanks.

Q1 answer: “Making use of the National Renewable Energy Labs (NREL) Levelized Cost of Energy Calculator”

great

The 70 to 75 cent/watt cost is dc rated, while the 30% to 35% capacity factor is based on ac rating. The high capacity factor is achieved through tracking plus overloading the inverter with additional solar panels beyond its peak ac-rating. A typical inverter loading consistent with the high capacity factor would be around 1.3, meaning 1.3 times as many panels, trackers, wires, etc. So, this brings the capital cost to near $1 per watt-ac.

Also, the NREL calculator default discount rate of 3% represents financing costs, including profit. This is a very low; probably at least 5% would be more reasonable.

These adjustments bring the unsubsidized cost of energy to 3 to 4 cents/kWh in the NREL calculator. Of course, lower bids are possible in areas with very high sun, tax subsidies, and investors willing to accept lower profit and/or higher risk.