Pacificorp, in its 2017 Integrated Resource Plan (IRP) Update – sent out on May 1, has for the first time not included new fossil fuels as a ‘least cost, least risk’ resource. This IRP looks out over the next 20 years.

Instead of building any new fossil generation, the company projects a procurement of 2.7 GW of wind, 1.86 GW of solar, 1.877 MW of incremental energy efficiency, and 268 MW of direct-load control resources (demand response). The company also expects to repower 999 MW of wind power.

Pacificorp also plans to retire 3.65 GW of coal within the same period. In total, the power company has about 8.3 GW of coal, oil and gas-fired resources currently available, so this would mean a 44% reduction in its fossil capacity, and a fleet where wind and solar represent a majority of capacity, if not necessarily generation.

A large volume of renewables was originally announced in April of 2017, however, in this update to that plan we saw the utility’s model change to exclude future fossil fuel growth in addition to adding 1,564 MW of wind and solar.

Pacificorp already has a portfolio of solar power PPAs totaling 1,197 MW spread across 53 projects (page 25), and 975 MW of wind PPAs. The solar projects are heavily located in Utah and Oregon, with a few in Wyoming.

The portfolio of solar projects includes a large number of 10 MW, 50 MW and 80 MW systems.

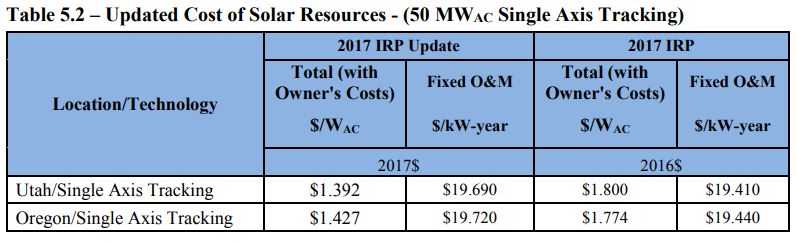

The company’s IRP includes a projection of three 50 MW-AC solar projects to potentially be built in both 2021 and 2024, and has documented a sharp fall in prices for systems including trackers. The Utah prices fell by 22% and Oregon by 19% from 2016 to 2017.

The price, if the DC-AC ratio is 1.3:1, would be $1.07/watt-DC for the Utah single axis.

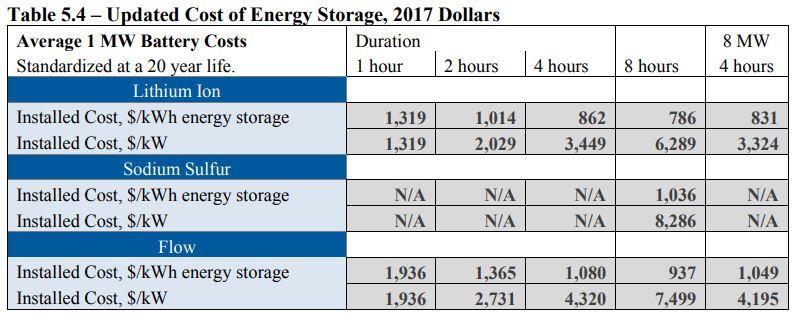

The utility also modeled costs of energy storage, and spoke of exploring ways to integrate the resource, however, no hard plans were laid out to include battery storage in its broader portfolio.

Pacificorp is owned by Berkshire Hathaway, a Warren Buffett company. Another of Buffett’s electricity utilities – MidAmerican Energy of Iowa – is aiming for 100% renewable energy. MidAmerican Iowa recently announced a wind power buildout that will bring them from 55% renewables currently, to greater than 95% – mostly from wind power – by 2020. And despite the public fued with Elon Musk, Buffett’s Nevada utility holding company, NV Energy, hopes to procure more than 40% of its power from renewable energy by 2023.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.