Throughout the Section 201 investigation, the argument raged as to whether a combination of tariffs, import quotas and/or a minimum price would or would not support U.S. manufacturing.

Suniva, SolarWorld and their allies in the steel industry and ‘made in America’ groups insisted that strong trade sanctions were the only way to bring back U.S. cell and module production, whereas their opponents led by Solar Energy Industries Association (SEIA) insisted that there would be no substantial new manufacturing with tariffs.

This week that discussion continued, with two current and former GTM Research executives publishing a paper for the Columbia Center on Global Energy Policy (CGEP) arguing that while some plants may be built, the tariffs will not bring about a “renaissance” in U.S. cell and module production.

“Too short lived and too small”

CGEP Non-Resident Fellow Shayle Kann and Wood Mackenzie Global Lead on renewables and emerging technology MJ Shiao, who also serves as head of Americas research at GTM Research, not only note the brief window to receive any benefit from the tariffs, but also argue that economic advantages may never actually pencil.

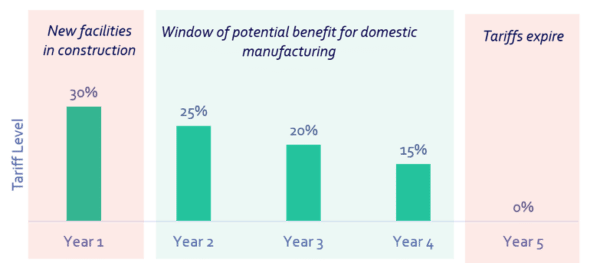

The first and most obvious challenge is timing. Kann and Shiao estimate that a new cell and module manufacturing facility typically takes at least 9-18 months to build and ramp, meaning that even if foreign PV makers are ready to start now, new facilities will only get three years’ worth of advantage from the tariffs – and a rapidly shrinking advantage at that.

And this is a conservative estimate, as many remedies imposed under the Section 201 process have been successfully challenged at the World Trade Organization, and most have not lasted four years.

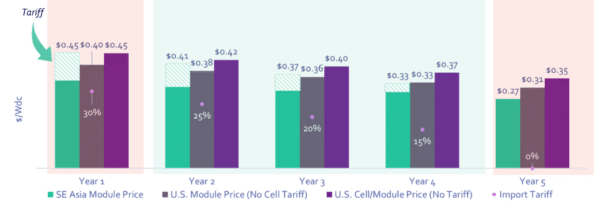

More centrally, the analysis compares prices from Southeast Asian manufacturing versus U.S. manufacturing, and finds that even with tariffs, modules made in Southeast Asia will be cheaper than those made in the U.S. from domestic cells next year, and will be cheaper than U.S. module manufacturing with foreign cells two years later.

“The tariffs are simply too short lived and too small, and if manufacturing does not return to the country, the impact of the tariffs will largely just be higher prices and fewer installations over the next four years,” concludes the article.

Kann and Shiao’s analysis – and even their wording to describe it – echo the conclusions that pv magazine has printed, and similar assessments have been made by IHS Markit’s Edurne Zoco.

The case for U.S. module expansions

However, there is one significant angle that appears missing in Kann and Shaio’s writing. The paper addresses the issue of whether or not foreign companies will come to the United States, but does not discuss the expansion of U.S. module manufacturing to take advantage of the exemption of 2.5 GW of tariff-free cell imports.

In the last three months, pv magazine has reported expansion plans at no less than three U.S. manufacturers, including Mission Solar’s plan to double their annual module capacity to 400 MW this year – news which a source revealed a day before Kann and Shiao’s paper was published.

pv magazine has concluded that there will likely be an expansion of U.S. module production to take advantage of the strange circumstance of the 2.5 GW exemption for imported cells, which is far more than the current demand for merchant cells in the U.S. market. This also conforms to the more favorable of Kann and Shiao’s two scenarios for U.S. manufacturing.

No “renaissance”

It is important to note that this is still not a “renaissance”, and the final part of the CGEP paper is perhaps the most interesting. Kann and Shiao – both of whom are associated with GTM Research, which took a stand against the Section 201 remedies – argue that while the tariffs alone may not be enough to spur substantial new manufacturing, that they could be augmented by other actions which might.

The two authors refer to six tariff alternatives which they outlined in a post on Greentech Media, as well as Jigar Shah’s proposal that the United States should direct the money collected from previous solar tariffs to subsidize domestic production. They also note that what they are suggesting would be far larger than the “paltry” $3 million American-Made Solar Prize recently announced by DOE.

This is also the conclusion that pv magazine has reached in our writing on the subject – that if you want to rebuild U.S. manufacturing, that a much more comprehensive, robust and forward-thinking approach than simply slapping tariffs on foreign products will be needed.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.