The Trump Administration and the Republican-controlled Congress are giving a lot of headaches to the solar and wind industries. Between trying to ram a blanket coal and nuclear bailout through federal regulators to tax provisions that would neuter federal tax credits to a pending decision to limit access of foreign solar components, there is a lot to keep all of us up at night.

But despite all of this, one of the nation’s top ratings companies says that the outlook remains strong for renewable energy. And Fitch Ratings’ latest outlook report notes that both the BEAT provision and the reduction in corporate tax rate may reduce the desire for banks and corporations to provide tax equity financing, it gave both a Rating Outlook and a Sector Outlook of “stable” for renewable energy.

The agency’s comments on projects reflect the larger level of comfort with wind and solar that has developed among the investment community in recent years. The company notes that both solar and wind projects tend to have high availability and stable operating costs within their base expectations, and further notes that solar assets have been performing slightly above forecast.

But perhaps the biggest factor is wind and solar’s insulation from wholesale market dynamics. “Rated renewable projects largely benefit from fixed-price, contracted energy sales agreements that mitigate cash flow volatility and underpin the stable outlook for the sector”, notes the report.

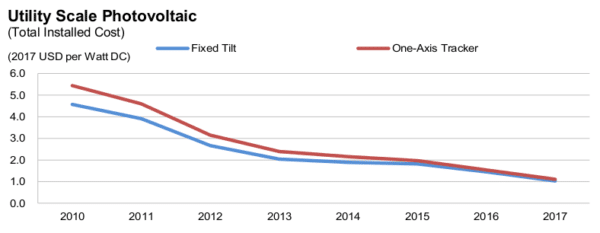

For the larger wind and solar sectors, Fitch notes that low prices are spurring the “rapid growth” in the sector. The company points to several reasons for this, including improved technology, capital cost reductions and economies of scale. And while it notes that the solar trade case has already pushed up prices for PV modules, when set against an 80% decline in prices for utility-scale solar projects over the last seven years this seems a minor factor.

Fitch expects that as federal support for renewable energy weakens, state-level policies including renewable portfolio standards will drive demand. However, this statement is in contrast to trends in recent years. Both Lawrence Berkeley National Lab and GTM Research have documented that an increasing volume of utility-scale solar contracting is due to other drivers, including PURPA and voluntary utility procurement.

Fitch does acknowledge the rising importance of “alternative models” including corporate power contracts and community solar, as well as the potential for battery storage to enhance the peak shaving abilities of solar.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.