Markets are fickle, and nowhere is this more true of the solar industry. In the seven years Mercom Capital has been issuing reports on funding, and mergers and acquisitions in the solar industry, it has covered a flood of capital leaving upstream technology companies in advance of an industry-wide shakeout, market readjustment as the German feed-in tariff was slashed, the fallout caused by the collapse of SunEdison, and many other twists and turns.

Sometimes investors react to phenomenon that have no impact on solar market fundamentals, such as solar stock prices collapsing as oil prices fell last year. And other times they are reacting to changes that will have very real market consequences.

It remains to be unseen whether the effects of the Section 201 case end up being more smoke than fire, or whether the dire market impacts that have been warned about will come to pass. However, what is clear is that capital is already reacting to the uncertainty that the case has engendered, as has been verified by Mercom Capital’s latest report on funding and mergers and acquisitions in the solar sector.

Global stability, U.S. trouble

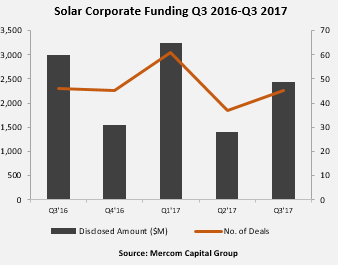

These changes come during a relatively strong time for solar globally. In its Q3 2017 report, Mercom finds that with stable Q3 numbers, total corporate funding reached $7.1 billion in the first nine months of 2017, down only 5% from a year ago. But the company reports that this is largely due to gains in other nations, as debt financing for U.S. companies collapsed from $2.4 billion to only $500 million during Q3.

These changes come during a relatively strong time for solar globally. In its Q3 2017 report, Mercom finds that with stable Q3 numbers, total corporate funding reached $7.1 billion in the first nine months of 2017, down only 5% from a year ago. But the company reports that this is largely due to gains in other nations, as debt financing for U.S. companies collapsed from $2.4 billion to only $500 million during Q3.

“Most of the effects you see (in the United States) are in public market financing and debt financing,” Mercom Capital CEO Raj Prabhu told pv magazine. He also notes that while public market financing has been low for several quarters, that the collapse in debt financing is new.

This is a particularly notable turn given that the stock prices of many solar companies have been rising for the last six months, giving U.S. companies enviable market capitalizations. While this typically puts companies in a good position to borrow more money at better rates, this is not happening. “This is when they should be out raising money,” notes Prabhu.

VC dollars flow from America to Asia

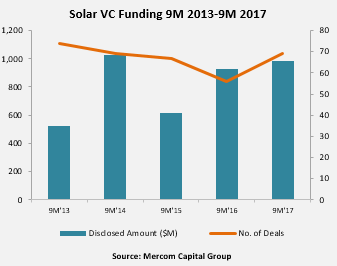

Venture capital (VC) funding for solar companies is stronger than a year ago, recovering in Q3 after a slow Q2, and rising 7% year-over-year to $985 million during the first nine months of 2017.

Venture capital (VC) funding for solar companies is stronger than a year ago, recovering in Q3 after a slow Q2, and rising 7% year-over-year to $985 million during the first nine months of 2017.

This is particularly notable as VC funding historically has come largely from U.S. investors; however the top recipients are increasingly based outside the United States. India’s CleanMax Solar raised $100 million, followed by $56 million raised by Singapore’s Sunseap Group as the two largest deals during Q3.

Prabhu notes that this trend was established before the Section 201 case and suggests that it may have to do with a decline in the U.S. residential solar sector, coupled with opportunities in India and elsewhere in Asia.

Uncertainty around third-party solar funds

Residential and commercial solar funds are also down, reaching only $2.2 billion in the first nine months of the year, compared with $3.5 billion a year ago. This is reflective of U.S. market conditions, as these funds cover third-party owned solar in the United States. But while the share of third-party solar has been declining for years, the 35% decline is steeper than the market, which shows declining investor interest.

There is an irony here in that the residential, as well as the commercial and industrial (C&I), markets are expected not to be hit as severely as the utility-scale market by any coming trade action imposed by the Trump Administration.

However, Prabhu notes that these figures are only announced funds and could conceal a more complex set of circumstances. Concurrent with the decline in installations and market share at SolarCity and Vivint Solar, smaller companies are getting in on the action.

“Now all the smaller installers have access to finance, and these guys don’t go out to announce a fund,” explains Prabhu. “The financing has become really commoditized.”

Large scale project funding booms

A bright spot in Mercom’s quarterly report was announced large-scale project funding crossing the $10 billion mark in the first nine months of the year, with $2.8 billion in Q3 alone. Mercom also reports 161 large-scale project acquisitions in the first nine months of the year, with 14.6 GW aggregated.

This included U.S. projects, such as Tenaska’s Imperial Solar West securing $400 million in funding during Q3. However, trouble is on the horizon. This summer Bloomberg New Energy Finance reported that new contracts for large-scale solar projects are not being signed as U.S. developers and offtakers seek clarity on the 201 case. And while Prabhu says that this is not showing in funding yet he also notes that there is typically a lag between signing power contracts and securing funding.

All of this does not bode well for Q4. “The 201 case has touched everything,” warns Prabhu.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.