Of all the states that have terminated their original net metering programs, California appears to have gotten off the lightest. Unlike Nevada and Hawaii, California has kept the essence of retail-rate net metering, while incorporating additional charges and moving owners of PV systems to mandatory time-of-use pricing.

But while the policy changes are not as dramatic as those in other states, there is strong evidence of a negative effect on the market. In March, we reported a fall in the residential solar market in the service area of San Diego Gas and Electric Company (SDG&E) during the second half of 2016 after the utility moved to “Net Metering 2.0”.

This week, pv magazine received further information which suggests that the residential solar market in the service area of Pacific Gas & Electric Company (PG&E) is experiencing similar difficulties after the Northern California utility became the second of the state’s big three to move to net metering 2.0 in late December.

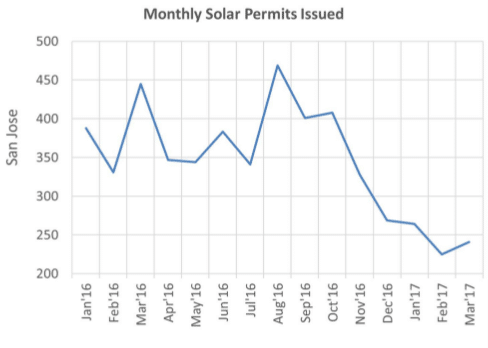

While full Q1 residential market data for PG&E’s service area has not yet been published either by the state or GTM Research, OhmHome has published solar permit data for the quarter for several areas in the state. This includes San Jose, the largest city in PG&E’s service area, which saw a dramatic decline in permits beginning in late 2016.

And while the trend is clear, causation is more complicated. Many parts of California experienced torrential rains during January and February.

And while the trend is clear, causation is more complicated. Many parts of California experienced torrential rains during January and February.

However, OhmHome’s data shows a 46% year-over-year fall in solar permits issued in San Jose in March – after the period of intense rainfall.

PG&E has an enormous service area that covers most of Northern California, from Santa Barbara to Humboldt Counties, however San Jose with more than one million inhabitants is the largest city. The city issued only 241 permits for residential PV systems in March 2017 and has not issued more than 300 in any month since last November.

This is a similar pattern to what has happened in SDG&E’s service area, where installations declined 35% from the first to the second half of 2016, which coincides with the utility’s switch to Net Metering 2.0. OhmHome’s analysis shows a similar fall in solar permits in both the city and county of San Diego during this period and a further decline in Q1.

And while OhmHome’s data shows no such fall in Sacramento, which is under a municipal utility, the overall impact many mean a slowdown in California’s residential solar market.

GTM Research describes this scenario of a statewide decline in the segment during Q1 as “likely”. “This is due to a combination of factors: significant rainfall that extended build times across the state, to operational pull-back from national installers that limited installations, in addition to some confusion regarding net metering 2.0 transition – particularly in SDG&E territory where time-of-use rates have not been established,” GTM Research Solar Market Analyst Austin Perea told pv magazine.

Perea says that he sees confusion from the move to net metering 2.0 as less of a factor. “I’d say that’s a less important factor than what’s happening in the competitive landscape,” states Perea. In addition to rains, he cites “pull-back/closure from national installers for reasons related to both profitability and an increasingly challenging customer acquisition landscape”.

However, California Solar Energy Industries Association (CALSEIA) says that policy changes are part of the market slowdown. “Business has slowed down overall,” CALSEIA Executive Director Bernadette Del Chiaro told pv magazine. “Some consumers are feeling uncertain and less urgency. Some contractors are getting used to the new rate structures as well. We must remember that going solar is rarely a need for the consumer, like buying a car or a phone. Because of that, the market is more vulnerable to policy changes.”

Given that California is the largest solar market in the United States, the net effect of a slower residential market may be a factor in trouble at several national companies. This includes Sungevity, which went bankrupt in March, and Spruce Finance, which laid off an undisclosed number of employees in February and may be seeking a buyer.

However, CALSEIA’s Del Chiaro also says that she thinks that like the rains, policy-related impacts will pass. “As sunny weather returns, solar businesses gain more experience, and concerns over federal policies mount, there is reason to be optimistic,” she says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.