Rising retail electricity rates are emerging as the primary catalyst for commercial solar investment as federal tax incentives begin to transition out.

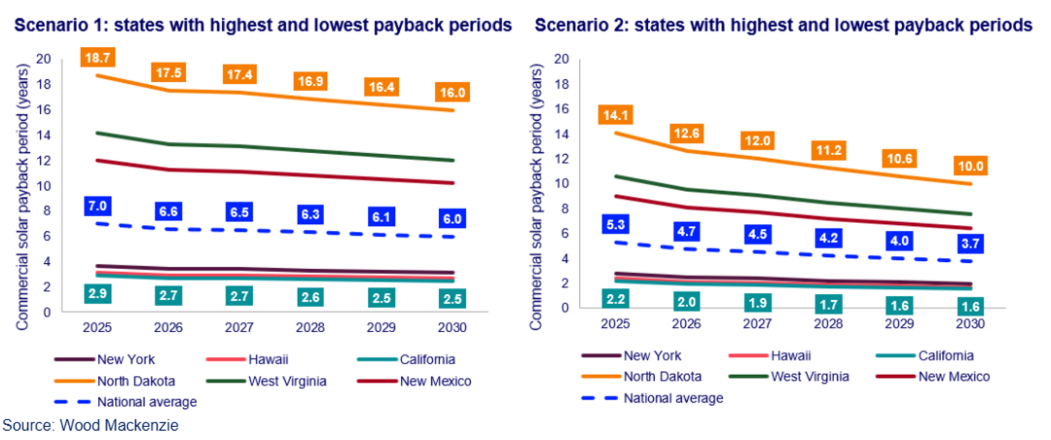

According to a Wood Mackenzie analysis, increasing average annual retail rate growth from 2% to 6% between 2026 and 2050 reduces the national average payback period for a commercial solar project from 6.3 years to 4.2 years. This represents a 33% decrease in the time required for a business to recoup its capital investment, driven by the escalating cost of grid power.

The commercial solar segment installed 2,118 MW in 2024, representing an 8% year-over-year increase and setting an annual record for the sector. While other distributed solar segments faced contractions in early 2025, commercial solar grew 4% in the first quarter of 2025 and 27% in the second quarter of 2025. The growth occurred even as commercial system pricing saw a 9% year-over-year increase by the third quarter of 2025, following a 7% decline in 2024.

State-level data reveals a 12-year spread between the most and least favorable markets for project returns, said the report. California consistently shows the shortest payback periods due to high commercial electricity prices, while North Dakota records the longest.

The top markets for cumulative commercial solar installations through 2025 include Hawaii, California, New York, Massachusetts, and Connecticut. These states correlate with regions experiencing the highest commercial electricity price inflation and grid constraints.

Demand for onsite generation is being fueled by data center expansion and broader electrification trends. Wood Mackenzie said that while federal policy under the One Big Beautiful Bill Act creates a new landscape for tax credits, the fundamental value of offsetting utility energy remains a strong driver of deployment.

Commercial projects sized between 2 MW and 20 MW are positioned for growth as corporate offtakers seek to hedge against volatile retail power markets, said the report.

The report indicates that as federal incentives decline, the widening gap between the cost of solar and the cost of grid power maintains project viability. In high-cost regions, some commercial solar projects now reach a payback in under five years.

Analysts project that if retail rates continue a 6% growth trajectory, the economic attractiveness of commercial solar will intensify across a broader range of states previously considered marginal markets.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Imagining ‘markets’ are the only driver of solarization leaves out the real threat facing all of us on the planet. I would imagine California gets that threat, or is getting it, as summer fires continue to ravage the region.

We can be stupid and call a hoax on everything that frightens us….or we can imagine a less wasteful and polluting environment for our children. We solarized in 2009 and again in 2017….that has allowed us to run our Kona EV for the last 5 years, and put in a heat pump more recently.

Fossil gas is a poison….heavy oil is a poison and uneconomic to boot……..and nuclear??? Too capital intensive, and it emits a poison that lasts for thousands of years.

What is it about living clean that so many of us find so hard???

Anyone in California under NEM 3, and most everyone in Texas where there is scant (if any) net metering would disagree. Rising electric rates are often not correlated, and may even be inversely correlated, with changes in electric rates. Including fees in electric bills makes this even more so.