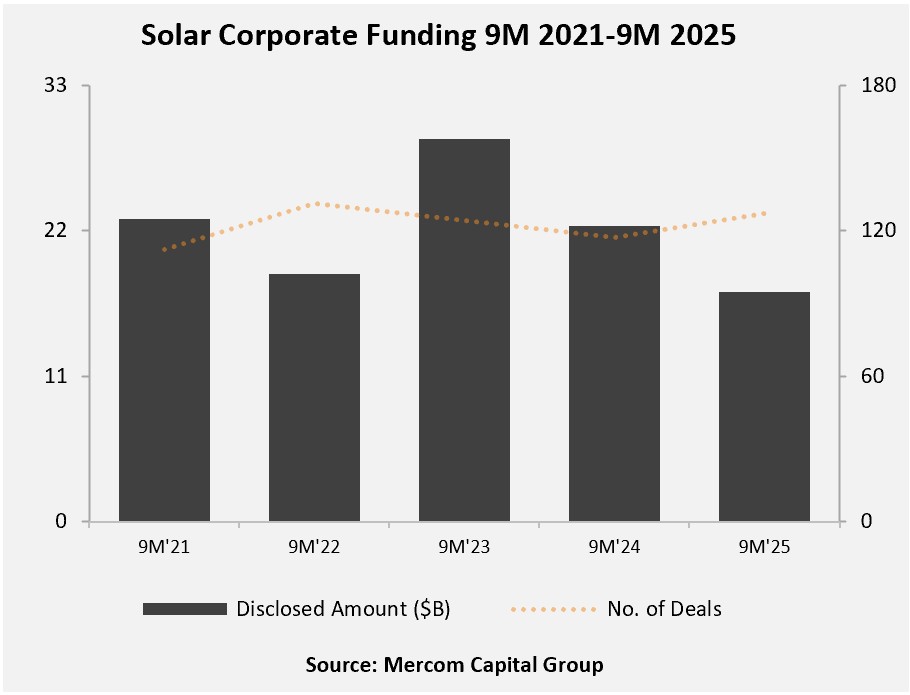

Total corporate funding, including venture capital (VC) funding, public market, and debt financing decreased 22% year-over-year through the first three quarters in 2025, said a report from Mercom Capital Group. Through the first nine months of 2025, total corporate funding reached $17.3 billion, down from $22.3 billion raised through the first nine months of 2024.

VC funding reached $2.9 billion across 55 deals over the period, down from $3.9 billion raised over 39 deals in the year-ago period. The largest VC deals were $1 billion raised by Origis Energy, $500 million raised by Silicon Ranch and $130 million raised by Terabase Energy.

Solar debt financing totaled $12.7 billion across 60 deals, 24% lower than the $16.7 billion raised through the first nine months of 2024.

In the first three quarters of 2025, corporations acquired 165 solar projects totaling 29 GW. This is a slight increase from 28.3 GW in transactions a year ago.

Mergers and acquisitions activity increased year-over-year, with 76 deals in the first nine months of 2025 compared to 62 last year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.