The PV module supply chain is undergoing transformation in 2024, marked by oversupply, policy uncertainty, and low prices affecting manufacturing capacity expansion and factory utilization rates.

Oversupply has been central to the solar supply chain since the second quarter of 2023 but there are signs the trend is shifting. In 2024, the supply chain has experienced a slowdown. Rationalization efforts in China aim to control the expansion of companies and increase industry barriers to entry. Since June 2024, expansion plans have been delayed or terminated. China’s Ministry of Industry and Information Technology submitted a revision of the Photovoltaic Manufacturing Industry Normative Conditions policy for public consultation in early July 2024. The revision encourages companies to reduce capacity expansion and focus on innovation and cost reduction, promoting sustainable development.

In the current market, predicting Chinese bankruptcies or industry exits at the module level is challenging. Financial challenges restrict capacity expansion plans but will not automatically translate into market exits and consolidation. The industry has grown more than tenfold since the last oversupply cycle, more than 10 years prior to 2024. The solar industry is highly concentrated, making consolidation increasingly complex. Since the first quarter of 2024, however, there has been a noticeable decrease in the utilization rates of global PV manufacturing capacity. Lower utilization is attributed to limited demand growth and high inventory levels, leading to a market surplus.

The weakening domestic economy in China means it is challenging to sustain an oversized domestic supply chain. Since 2014, a 20-fold increase in solar installations in China has supported manufacturers’ aggressive expansion plans. The exponential growth of demand in China seems to have curved, however.

In this context, leading suppliers are being forced to adjust their strategy and halt production capacity expansion plans in response to tougher economic conditions. Moreover, China’s solar installation growth is slowing down, posing a threat to the annual module shipment guidance issued by leading suppliers under the current demand scenarios managed by S&P Global Commodity Insights.

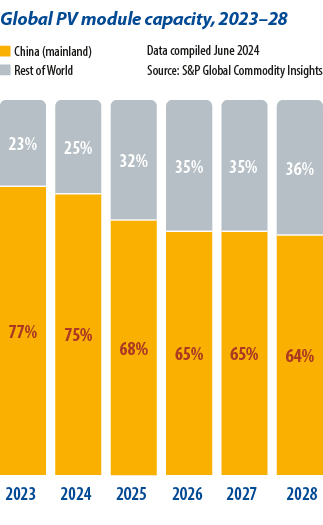

China’s dominance in PV manufacturing is likely facing its most severe downturn to date. The second half of 2024 is expected to see a decline in China’s PV manufacturing capacity due to oversupply and ongoing losses. Manufacturing cancellations and idle capacity in China are not immediately translating into new capacity in other regions, however – quite the contrary.

Future plans

The future of solar cell and module manufacturing in Southeast Asia depends on the upcoming antidumping and countervailing duty preliminary determination from the US Department of Commerce. Most Chinese solar suppliers with production capacity in the four Southeast Asian countries under investigation (Cambodia, Malaysia, Thailand, and Vietnam) have stopped shipping to the United States due to the elevated risk of retroactive tariffs being applied to their products. PV factories in those countries have significantly reduced utilization rates and even shut down prior to the preliminary determination, which had been expected in July 2024 but had not been publicized at the time of going to press. If the imposed tariffs turn out to be financially unfeasible for continuing exports of cells or modules to the United States, that would leave the most significant manufacturing capacity outside China underused in the second half of the year: up to 100 GW of idle cell and module annual production capacity.

The future of solar cell and module manufacturing in Southeast Asia depends on the upcoming antidumping and countervailing duty preliminary determination from the US Department of Commerce. Most Chinese solar suppliers with production capacity in the four Southeast Asian countries under investigation (Cambodia, Malaysia, Thailand, and Vietnam) have stopped shipping to the United States due to the elevated risk of retroactive tariffs being applied to their products. PV factories in those countries have significantly reduced utilization rates and even shut down prior to the preliminary determination, which had been expected in July 2024 but had not been publicized at the time of going to press. If the imposed tariffs turn out to be financially unfeasible for continuing exports of cells or modules to the United States, that would leave the most significant manufacturing capacity outside China underused in the second half of the year: up to 100 GW of idle cell and module annual production capacity.

The effects on China of ongoing onshoring in the United States and India are also increasingly uncertain. A forecast increase in module production capacity in India and the United States is driven by government initiatives and incentives that encourage domestic production in the solar industry, such as India’s production-linked incentive scheme and the US Inflation Reduction Act (IRA). In the case of the United States, investors and manufacturers face unprecedented uncertainty due to the upcoming presidential election, in November 2024, as well as recent developments in courts, most notably the undoing of the US Supreme Court’s long-standing doctrine known as “the Chevron deference.” Such decisions open new avenues for challenging any federal regulatory actions that might enable capital deployment linked to projects that benefit from the law and could extend to challenge different aspects of the IRA, generating severe uncertainty for investors.

Beyond policy uncertainty, doubts also remain about the factual dependence of the US and Indian solar markets on Chinese products, technology, and the equipment needed to launch a domestic supply chain as there are significant gaps between module production capacity and local capacity for other nodes and materials in the PV supply chain.

The current oversupply scenario presents challenges to increasing module prices. With low or negative margins expected from the third quarter of 2024 onwards, and limited room for more cuts in production costs, manufacturers are in a tight spot. The industry anticipates a balanced supply-and-demand cycle only after 2025, which could provide relief to manufacturers still active in the market at that stage. Until then, manufacturers, policymakers, and industry stakeholders must navigate these challenges carefully to ensure the sustainable growth of the global PV industry and prepare for the next cycle.

About the author: Edurne Zoco is an executive director in the Clean Energy Technology group at S&P Commodity Insights. She leads research across solar, supply chains, and carbon sequestration. She has been involved in the PV industry for more than a decade and has written cost-breakdown models, company benchmarking reports, price forecasts, supply chain analysis, and technology outlooks.

About the author: Edurne Zoco is an executive director in the Clean Energy Technology group at S&P Commodity Insights. She leads research across solar, supply chains, and carbon sequestration. She has been involved in the PV industry for more than a decade and has written cost-breakdown models, company benchmarking reports, price forecasts, supply chain analysis, and technology outlooks.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.