Part 1 of this blog looked at legislative and utility actions that address the potential grid and energy impacts of data centers, including the future downstream cost issues associated with a utility’s response to the massive amount of incoming load growth and the capital recovery that customers, especially those that are low-income, will have to deal with.

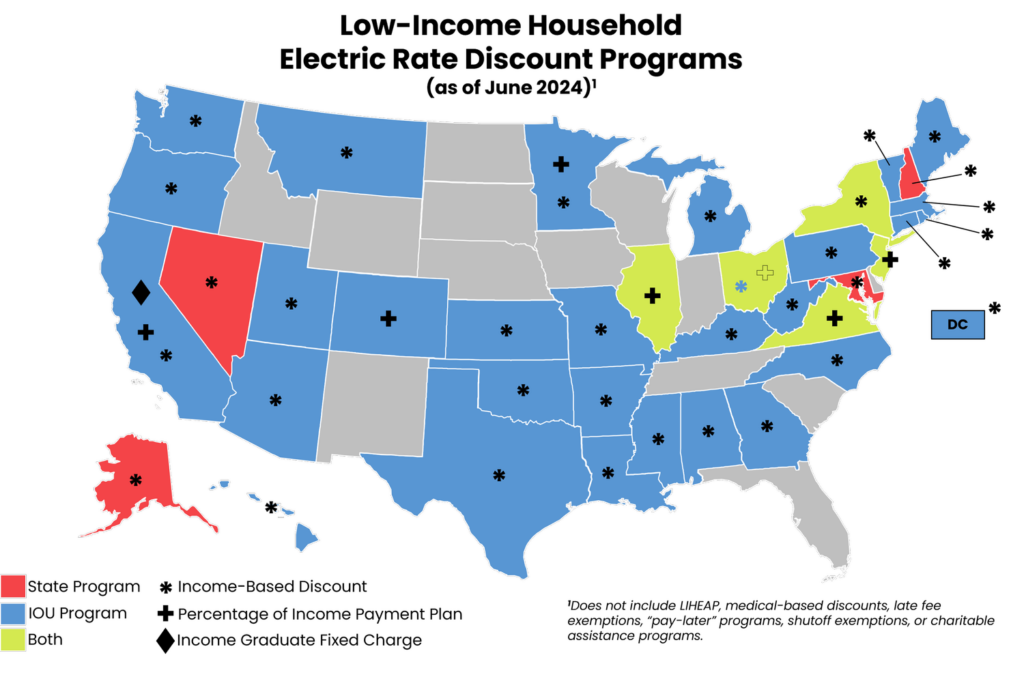

Many additional state and utility programs exist and vary in terms of approach and scope and can take the form of an income-based discount, a percentage of income payment plan (PIPP), and an income-graduated fixed charge, among other types of payment assistance, like late payment fee and utility shut-off exemptions.

To determine which approach best serves low-income communities and can garner the most support from utilities for future implementation, several state utility regulators have recently been on the case to do just that. Two such investigations began earlier this year in the competitive utility markets of Maine and Massachusetts.

The Public Utilities Commission in Maine finished its inquiry into affordable ratemaking opportunities towards the end of May this year, reporting that adopting a price cap on what utilities can charge to a low-income customer participating in an assistance program is problematic, as the compliance measures needed for such an approach could be administratively burdensome for utilities and could place them into a role of enforcement, a role the Commission did not feel would be appropriate. The Commission felt that a low-income price cap would incentivize utilities to no longer enter into contracts with low-income customers due to the hassle associated with their participation and the fluctuating income of certain customers, making eligibility determination challenging to keep up with. The Commission instead recommended that a competitive electric provider should obtain express, written authorization from customers before renewing a service contract and provide a price comparison between the provider price and the state’s standard offer.

Map depicting the various low-income household electric rate discount programs that state and/or electric investor-owned utilities offer as of June 2024. The map does not include LIHEAP, medical-based discounts, late fee exemptions, “pay-later” programs, shutoff exemptions, or charitable assistance programs. Source: Justin Lindemann, NC Clean Energy Technology Center.

In Massachusetts, state regulators have been investigating different low-income ratemaking options, and utilities provided their two cents on what they felt outweighed the implementation costs. Since utilities in the state are already required to provide a percentage discount to rates for certain low-income customers, National Grid, Eversource, and Unitil commented that a tiered discount rate would be the best option over PIPPs. They referenced Liberty, Eversource, and Until in New Hampshire as a model due to their existing five-tiered discount rates. Utilities supported the tiered discount approach because it allows for flexibility and lower compliance costs and removes “cliffs,” in which small income changes might result in a household losing assistance. Due to the broad income ranges and multiple tiers usually offered under a tiered discount program, the prevalence of “cliffs” would be minimized. As for PIPPs, the utilities mentioned that customers might have data privacy concerns due to the procedures required to determine one’s income eligibility. Compared to a tiered discount, the utility only needs to know the specific tier range the customer falls into. The investigation has been taking place as state regulators also examined Unitil’s proposal to increase its low-income discount rate to 40%, which was approved in late June.

Reflected by the Northeastern utilities, support for a discount-based approach is highly favored, and most investor-owned utilities in the country, albeit some with limited coverage, are already using this approach. PIPPs, on the other hand, garnered less support, which, if the utility perspective is any indication, may explain why they have only been administered in just five states and mostly through statewide regulations.

Circling back to the central issue, due to the influx and expansion of new data centers and the projected load to come with it, utility customers are expected to anticipate further electric rate increases, and approaches like those mentioned above would likely provide critical assistance. Examining the data center markets in the country with the largest growth and the kinds of low-income utility bill assistance that such states and their investor-owned utilities currently provide may grant an understanding of what still needs to be done to shield low-income customers in response to the projected market expansion.

The following states are projected to have the most data center growth in the country by 2030, according to EPRI, each providing bill assistance through different approaches:

-

Virginia

-

The state enacted a PIPP via legislation in 2020, directing only Dominion Energy and Appalachian Power to collect a universal service fee. The fee funds the PIPP and its eligible participants, who must apply for eligibility through the Department of Social Services, after which the utility enrolls a customer’s account. Under Dominion, customers who utilize electric heat will have their monthly bill capped at 10% of their income. At a minimum, customers will pay $10.

-

Virginia’s projected data center electricity consumption may grow to 46% of the state’s total by 2030, compared to about 25.6% in 2023.

-

-

Texas

-

Texas offers limited financial assistance outside the state’s LIHEAP program. El Paso Electric Company, situated in the eastern tip of the state, offers a low-income discount that exempts eligible customers from paying the customer charge.

-

Texas’ projected data center electricity consumption may grow to about 10.6% of the state’s total by 2030, compared to about 4.6% in 2023.

-

-

California

-

Utilities in the state must offer various income-based discounts under either the California Alternative Rates for Energy (CARE) or Family Electric Rate Assistance (FERA) programs. Customers eligible for the CARE program may receive a 30% to 35% electric bill discount through the utility. Families whose household income exceeds those allowed under the CARE program can receive an 18% discount on their electric bill through the FERA program.

-

Pacific Gas & Electric (PG&E) also operates a PIPP pilot program until 2027 for a limited number of customers, capping the monthly electric bill at $32 for certain income-eligible customers. Those who do not qualify under the program’s income guidelines may still qualify for a $97 cap.

-

California is also the only state in the country that has implemented an income-graduated fixed charge. State regulators approved a fixed $6 charge for CARE customers and $12.08 for FERA households. The new structure also decreases the residential energy usage rate by $0.05 to $0.07 per kWh. Though the rate structure has been approved, large investor-owned utilities have been given more than a year to transition, with the latest implementation date being March 2026 for Pacific Gas & Electric – the largest utility in the state. However, around the same time the fixed charges were approved, state legislators introduced a bill to repeal the original bill that authorized the income-graduated fixed charge. The bill replaces the equitable rate structure with a $10 cap.

-

California’s projected data center electricity consumption may grow to 8.7% of the state’s total by 2030, compared to 3.7% in 2023.

-

-

Illinois

-

Illinois’ Department of Commerce and Economic Opportunity administers a PIPP for customers with an income of up to 150% of the federal poverty guideline. The payment plan caps a customer’s bill at 6% of their income, as available to a limited number of utilities, including Ameren Illinois and ComEd. The program is funded by a meter charge for other low-income assistance programs and a one-time utility contribution. The availability of program funds has been an issue, as applications have been closed since October 2023 and continue into mid-August this year.

-

Illinois’ projected data center electricity consumption may grow to about 12.6% of the state’s total by 2030, compared to about 5.5% in 2023.

-

-

Oregon

-

Oregon’s electric investor-owned utilities offer varying low-income discounts. Pacific Power uses the state median income (SMI) to establish a tiered discount structure that gives customers up to 20% of SMI a 40% discount. In comparison, those with an SMI above 20% and up to 60% receive a 20% discount on their electricity bill. Certain customers living in a multifamily residential building may receive a 30% discount.

-

Portland General Electric offers a similar discount designed to follow the SMI and established five tiers for those with an SMI of up to 60%. The highest discount a customer may receive is 60% for having an income up to 5% of the SMI.

-

Oregon’s projected data center electricity consumption may grow to about 24.1% of the state’s total by 2030, compared to about 11.4% in 2023.

-

Looking forward

Knowing now what the fastest-rising data center markets already offer as assistance to low-income customers, it is apparent that there is a baseline of support that many customers can take advantage of. With each state offering LIHEAP payments and most utilities offering some discount to income-eligible customers, only a few provide customers with something other than a discount, going as far as capping residential rate payments altogether. Considering the significant shares of electricity consumption from data centers that each state is expected to be impacted by utilities in these states will surely propose significant capital investment reimbursements from their customers to combat the demand by the end of the decade. Millions of low-income utility customers are thus expected to be at an even greater risk of financial distress than today, and with LIHEAP facing current – and perhaps future – budgetary constraints, building out state and utility assistance has become all the more important.

In recent years, some states and utilities have implemented certain mechanisms that go beyond a simple discount, from California’s income-graduated fixed charge approach to Virginia’s PIPP program. Still, many have not equipped low-income customers with the certainty that they can withstand the weight of future bill increases, let alone the current rates. Customers may benefit from a definitive price cap or lower rates based on income, perhaps even instituting cost recovery exemptions that disallow certain customer classes from having to subsidize the cost of new resources needed to combat the energy demand from load sources that a specific class is not using or benefitting from, like data centers, among other alternatives. With the possible spike in energy burden rates across the country, building more equitable pathways to accessing rooftop or community solar may also be the key as low-income customers seek energy independence and savings. In addition, increased home energy efficiency, made possible by federal, state, and utility energy efficiency incentives explicitly designed for low-income communities, could be part of the solution as well.

All in all, as utilities plan to respond to the incoming flood of data center load by constructing additional generation resources, recovering a significant amount of capital from their customer base, one question to ask is: Will low-income customers be provided with enough protection?

Justin Lindemann is a policy analyst at NC Clean Energy Technology Center.

This is the second in a series originally published by NC Clean Energy Technology Center. Click here to learn about our DSIRE Insight subscriptions, custom research, and consulting offerings on various clean energy technologies for interested individuals or organizations. Read Part 1 here.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.