While certain solar production steps are measured in nanometers, atomic layers, and fractions of a percentage or cent, ingot and wafer production more closely resembles heavy industry. Gleaming crystalline silicon ingots emerge from towering pullers to be sliced by diamond wire saws into iridescent, black square, or rectangular, monocrystalline wafers.

The ingot and wafering production steps are power hungry and produce waste in the form of kerf slurry – the residue ingot material from between the sliced wafers. Those are the PV production steps most highly concentrated in China.

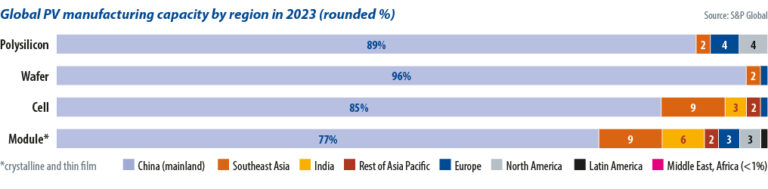

Jessica Jin is the principal research analyst for solar and clean energy technology at S&P Global Commodity Insights Shanghai. Jin reported that in 2023, China accounted for 96% of global ingot and wafer production. She added that the wholesale switch within PV manufacturing from multicrystalline to monocrystalline technology, in and around 2018, was decisive for China’s dominance of the production step. That dominance has extended upstream.

“This was led by Longi, as everyone knows,” she said. “Since then, Chinese equipment manufacturers working with Longi keep improving their technology and also add capacity and they all grow up with the market expansion in China.”

The development is one that is common throughout China’s solar success story. Through aggressive scaling and close cooperation with technology and material suppliers, Chinese manufacturers have been able to rapidly adapt new technology and production processes, outcompeting European and American rivals first on cost, and then on performance and efficiency.

“Nowadays, we see most of these equipment suppliers are also in China as well,” said Jin. The result being that in 2024 there are few credible pathways for non-Chinese manufacturers interested in developing ingot and wafer capacity.

European setbacks

PV manufacturing advisory Exawatt, now a part of CRU Group, finds that the only notable ingot and wafer production hub outside of China is in South East Asia. Exawatt tallied some 35 GW of wafer facilities in operation in South East Asia by the end of 2023, with that potentially expanding to 45 GW by the end of 2024.

While expansions are under way in South East Asia, the opposite is the case in Europe. The year 2023 saw both Norsun and Norwegian Crystal suspend or wind up their operations in Europe – effectively reducing wafer production in Europe to zero. Those decisions were followed shortly after by that of, presumably, a key supplier. Polysilicon producer REC Solar Norway began winding up its operations in Kristiansand, Norway – which had an annual output of 8,000 tons – and in Heroya, Norway – with 5,500 tons – in November 2023.

Norwegian Crystal had closed its 500 MW ingot facility in Glomfjord, Norway, a month earlier. As recently as 2022, it had been pursuing plans to develop a 6 GW ingot and wafer facility but had been unable to secure funding, forcing it to begin liquidation of the company.

In September, compatriot Norsun announced layoffs and a production halt at its 1 GW facility in Årdal, Norway. Tellingly, Norsun is now trying to establish a 5 GW ingot and wafer production facility in the United States. In August 2023, it announced it had raised NOK90 million ($8.5 million) in capital in pursuit of the plan, alongside the €53.6 million ($58 million) it was awarded by the European Union Innovation Fund.

Potential in United States

Subsidies are available for solar manufacturers in Europe but they pale in comparison to what is on offer in the United States. In the first 12 months after the US Inflation Reduction Act (IRA) was signed into law, announcements were made totaling 155 GW of annual solar manufacturing capacity, right across the value chain, according to trade body the Solar Energy Industries Association. However, few were for ingot and wafer production.

“According to our model, the incentive is actually very good for production in the United States,” said S&P Global’s Jin. “But it’s not simply about the production cost but also other costs, like the recycling, construction cost, and so on.”

Jin said that securing environmental approvals for wafer operations may prove difficult outside of China. Although she did note that in the past five years, many of the waste and recycling issues from wafer production have been addressed.

South Korean module maker Qcells stands out as an exception. In January 2024, Qcells announced a $2.5 billion investment decision which included 3.3 GW of annual ingot, wafer, and cell production capacity, to be executed in stages. The manufacturing will involve the establishment of a new production base, in Cartersville, Georgia – outside of the city of Atlanta in the United States. It follows the expansion of Qcells’ module assembly operations, to 5.1 GW capacity, in Dalton, Georgia, in the United States, completed in October 2023.

Supply deal

In January 2024, Qcells announced it had expanded an existing 2.5 GW module supply and engineering, procurement, and construction services deal with Microsoft to 12 GW of supply over eight years. The companies say the projects covered by the deal will be supplied by Qcells’ “fully integrated solar supply chain factory in Cartersville,” to the tune of 1.5 GW per year through 2032.

The deal provides offtake certainty to Qcells, with one-third of its ingot and wafer output accounted for in cooperation with a bankable counterparty. For its part, by working with Qcells in this way, Microsoft hopes to accelerate its renewable energy deployment by locking in supply and driving large-scale domestic production of solar modules in the process.

“There is always something that makes supply to the US uncertain,” said Alex Barrows, head of PV at Exawatt. “I can see an appeal to locking in something that gives you some certainty – even if you’re paying a premium.” PV module prices are higher in the United States and there remains a complex web of tariffs, exemptions, border seizures, moratoria, and legal challenges, all of which can delay final project realization or blow out costs.

European manufacturers issue 'plea’

Barrows noted that Qcells’ parent company, Hanwha, is South Korean rather than Chinese. It has access to American polysilicon from REC Silicon and is on the way to becoming a vertically integrated United States producer – making it well placed to offer stability in the face of potential policy turmoil or geopolitical shocks. “I feel like it is a pretty good way to lock in some security,” said Barrows.

Yet despite the IRA, higher prices, and advantages for locally produced products, Barrows remains skeptical of the prospects of many announced ingot and wafer facilities in the United States. Alongside Qcells and Norsun; Convalt Energy, CubicPV, and India’s Vikram Solar have announced American manufacturing plans that extend up the supply chain to ingots and wafers.

“I think we’ll get a bit [of ingot and wafer capacity] in the US but nowhere near what has been announced,” said Barrows. “Thirty-five GW of capacity by the end of 2026 has been announced but I would actually suspect it is more likely that 15 GW to 20 GW will be installed.”

Kerfless promise

On the list of aspiring manufacturers, CubicPV stands out. Not only has it announced its intention to develop 10 GW of traditional ingot and wafer technology, it is also a proponent of “direct wafer” usage. The company’s chief executive officer (CEO), Frank van Mierlo, formerly led 1366 Technologies. That business had attempted to commercialize “direct wafer” technology by producing multicrystalline solar wafers from a liquid, rather than cleft from a monocrystalline ingot.

Qcells worked in partnership with 1366 Technologies and achieved notable conversion efficiency achievements with the latter’s technology, including cells with more than 20% efficiency. However, when the PV industry switched to monocrystalline technology, 1366’s wafers were left stranded on the wrong side of development.

Germany’s NexWafe is pursuing a wafer technology not dissimilar to that used by 1366. The NexWafe approach is described as epitaxial and involves gases being deposited onto a seed substrate from which it can be separated and fashioned into a cell. Both approaches can be described as “kerfless” wafer production as they do away with wafer cutting and the waste kerf it produces.

In October 2023, NexWafe broke ground at a 250 MW factory in Germany where it will invest at least €70 million. Interestingly, NexWafe CEO Davor Sutija was the former president and CEO of SiNor, which eventually became Norwegian Crystals.

Production alternatives to the mature Czochralski process for monocrystalline ingot pulling and diamond wire sawing must overcome capital expenditure, throughput and efficiency challenges to become commercially viable. High cell efficiencies on epitaxial or direct wafer technology have not yet been reached, nor has competitive throughput from a factory at scale.

Production alternatives to the mature Czochralski process for monocrystalline ingot pulling and diamond wire sawing must overcome capital expenditure, throughput and efficiency challenges to become commercially viable. High cell efficiencies on epitaxial or direct wafer technology have not yet been reached, nor has competitive throughput from a factory at scale.

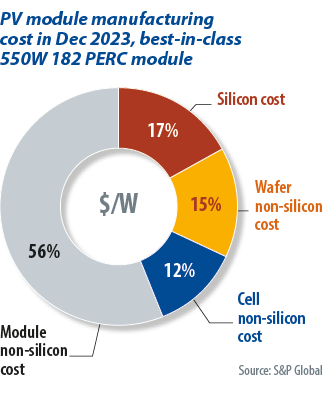

The establishment of any new ingot and wafer capacity with any technology will also take place under intense cost competition. The year 2023 saw module prices decline by more than 30% on global markets and there is a glut of product on the market. “We’re definitely expecting a wash in the industry next year,” said S&P Global’s Jin.

Yet, in times of bankruptcies and consolidation, there are opportunities for “step change” or next-generation technologies. European or United States companies may prosper while oversupply grips their Chinese rivals. NexWafe and CubicPV are pursuing new approaches to wafer production despite manufacturing-segment adversity.

In November 2023, NexWafe appointed Rick Schwerdtfeger as chief technology officer and André Seemaier as chief financial officer as the company moves into the commercialization phase of its gas-to-wafer technology.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.