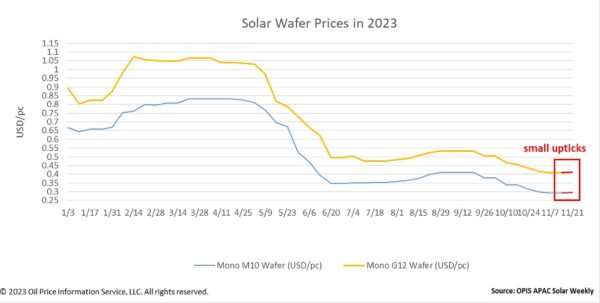

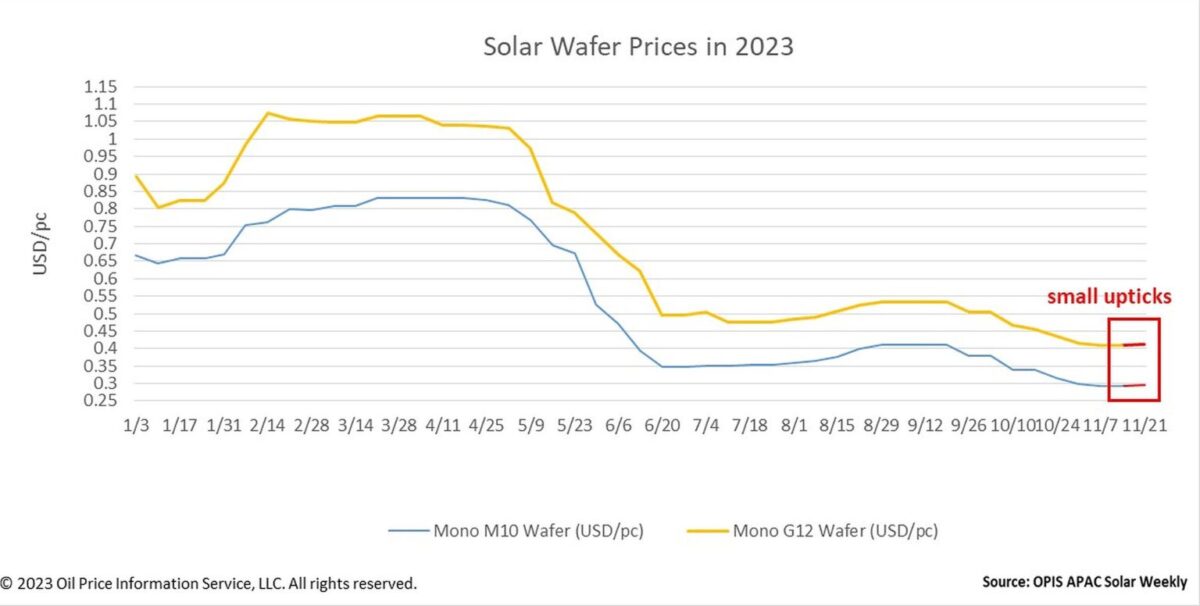

The price of wafers this week notched upward slightly as a result of the US dollar’s weakening relative to the Chinese yuan.

FOB China prices of Mono PERC M10 wafer increased by 0.68%, or $0.002 per piece (pc), to $0.295/pc this week, while Mono PERC G12 prices increased by 0.49%, or $0.002/pc, to $0.412/pc.

Currency fluctuations aside, the dynamics underlying China’s domestic market remained the same, leading to a continuation of the flat trend in the EXW wafer prices in the China domestic market for the second week running. The prices of Mono PERC M10 and G12 wafers remained stable at about CNY2.38 ($0.33)/pc and CNY3.32/pc, respectively.

Recently, low operating rates resulted in greater manufacturing costs for wafer producers, according to an integrated manufacturer. Now that wafer inventories have somewhat dropped, wafer makers are keen to increase their operating rates, the source continued.

There have been recent talks about wafer producers raising their operating rates and buying polysilicon at a faster rate due to the industry-wide sentiment that the price of polysilicon is about to bottom out. However, OPIS learnt from its market survey that the operating rates at wafer companies did not significantly grow, as production costs would decrease but losses would accumulate with unsold wafers.

According to a cell supplier, the consumption of inventories of good-quality wafers has slowed as some cell producers have been buying wafers of reduced quality. This may resonate with a few downstream users who have been worried about the impact that this cost war may have on module quality for 2024.

There are no profitable wafer companies currently, and some small-size wafer factories in China have closed, according to a market observer. Some wafer businesses are looking for chances to establish manufacturing facilities overseas in order to survive, the source continued.

Another source from upstream concurred, stating that wafer manufacturers would find it challenging to turn a profit in the near future. As a result, this source does not anticipate a notable increase in the operating rates of wafer companies, since more production entails higher losses.

Looking ahead, the industry expectation points to stable wafer prices, in equilibrium between weak demand and steady polysilicon and crucible cost.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.