Following the passage of the Inflation Reduction Act fifteen months ago, the U.S. is expecting solar module manufacturing to ramp up rapidly. At the pv magazine Roundtables US 2023, experts discussed what to expect in terms of manufacturing capacity, what technologies will be manufactured, and how manufacturers will maintain quality, reliability and durability while growing the domestic industry.

In this session, moderated by pv magazine editor-in-chief Jonathan Gifford, panelists include Theresa Barnes, manager of PV reliability and system performance group at the National Renewable Energy Laboratory (NREL); Mark Culpepper, general manager of solar at Zeitview; Terry Jester, managing director of PI Berlin in North America; and Nicole Thompson, head of data science property insurance with kWh Analytics.

Big floppy modules

One of the notable developments in the PV industry over the last few years has been the adoption of larger modules, which Theresa Barnes said are popular due to high energy yield. These modules offer lower overall cost and higher energy yield. However, she said they tend to be “big floppy modules,” because to make a module that large, some of the components have to be very thin in order to keep the weight down.

As a result, Barnes said that they can be less mechanically durable than smaller modules. “In some cases, that’s okay. But we have to understand that these modules have less room for error, they don’t have this big design safety factor for mechanical loads, that some of the smaller, more stouter, thicker modules used to have” Barnes said.

Unfortunately, NREL is seeing early failures in the field at fairly high rates, which Barnes said is attributed to the glass because with a thinner frame, the glass becomes part of the load structure. Now there’s 2-millimeter glass on the front, compared to 3.2 millimeters in smaller designs. And that glass is heat strengthened, but not fully tempered, because glass can’t be tempered below a certain thickness, Barnes said.

Hail testing and more

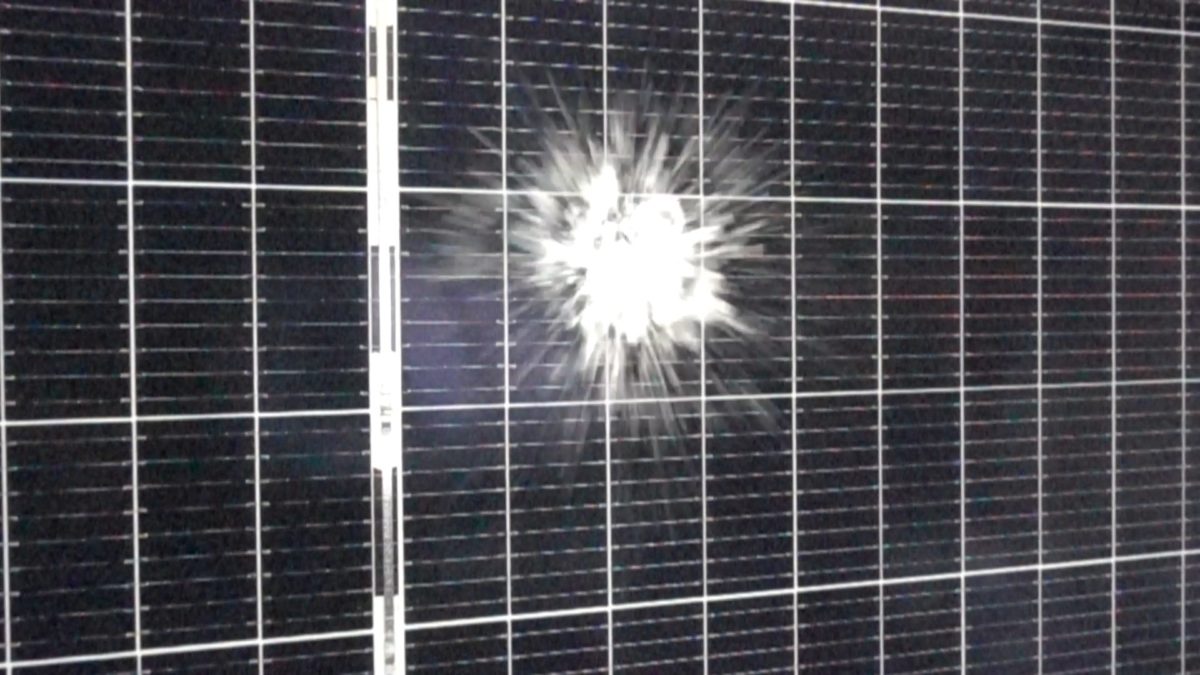

In terms of testing of these large-format modules, Terry Jester said PI Berlin’s sister company PVEL is seeing quite a bit of deflection with the center glass modules and that perhaps hailstone testing needs to be stepped up hail-prone regions. Jester said this would move us to a regional series of tests, and that it behooves module manufacturers to look at statistics on hailstones in particular regions and possibly step up internal testing as a result. Once in the field, damage is not always obvious as it does not always end up in the glass, but EL inspection may spot damaged cells.

In addition, large-scale solar plants are being built not just in the sunny south, but also in the central U.S., which experiences more hailstorms than other regions. Nicole Thompson of kWh Analytics pointed to the need for testing and the need to further standards to test for more than 1.8 joules, which she said is equivalent to less than one inch of hail. In addition it’s important for labs to test these modules and quantify the differences between 3.2 millimeter tempered glass and the two millimeter non-tempered glass, Thompson said.

Zeitview conducts aerial inspection of solar installations, completing assessments of about 6,200 assets this year in the U.S. Mark Culpepper said glass crack analysis has become one of Zeitview’s fastest growing services. Cracks can cause both performance and safety issues, and the safety issue could be ground faults. This can occur if a module has a deep crack and then gets rained on. Ground faults can be serious safety issues for crews on site, he said.

While the industry has trained itself to try to cut costs, Culpepper said “I do think there is a point of diminishing returns there,” noting that he thinks the industry is discovering that 3.2-millimeter glass is probably more appropriate than the thinner glass in hail-prone regions.

Gathering data

One of the challenges in figuring out failure rates is lack of data. Thompson said that companies are addressing standardization of data, which will make distinctions between costs of projects, maintenance, resilience and more. She said insurance premiums should reflect that reduction of risks that you have by having a more resilient site.

The data being gathered in the field and in internal testing is extremely important to manufacturers who are putting 25- or 30-year warranties on modules. Jester said that at PI Berlin they spend a lot of time ensuring for clients that modules are built to the standard that’s promised, and gathering data from what’s happening in the field is an essential piece of information.

“Obviously anything you can get from the data that can help feed your decision making both on design and factory operations, I think will only help us as an industry,” she said.

Most of the module manufacturers coming to the U.S. are planning highly automated factories, but as Jester pointed out, automation doesn’t substitute for good practice and good data analysis within four walls of a factory. In addition to automating, they should look at lab reports, field reports, as well as at what the insurance companies are finding, and then then refine the design as appropriate.

“If that design loop can continually feed itself, I think, well, we’ll get stronger as an industry,” she said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.