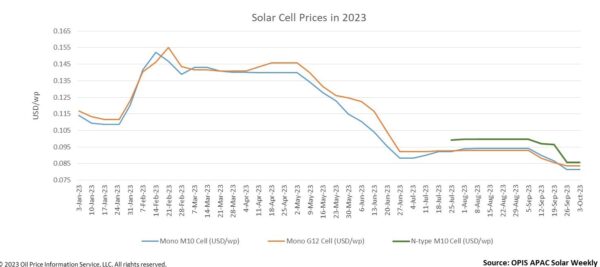

Solar cell prices stopped declining this week – arresting three straight weeks of prior decline – due to limited activities during China’s Golden Week holiday. According to OPIS data, prices have momentarily stabilized at their lowest levels ever this week – Mono M10 and G12 cell prices stayed unchanged at $0.0814 per W and $0.0836/W, respectively; TOPcon M10 cell price this week likewise remained at $0.0856/W.

The majority of industry sources concurred that following the holiday, new record lows for cell prices can be expected. A seller source predicts that the price of P-type M10 cells will decline to around CNY 0.61 ($0.085)/W after the holiday, while the price of TOPCon M10 cells will continue to carry a CNY0.05 ($0.0069)/W premium over p-type M10 cells.

The pricing differential between p-type and n-type M10 cells is confirmed by a second seller source, who predicts that after the holiday, p-type M10 cells may drop to around CNY0.63 ($0.088)/W while TOPCon M10 cells would drop to CNY0.68 ($0.094)/W

According to a market observer, cell producers are currently maintaining a profit margin of about 10-15%. This source therefore expected that there is still room for cell prices to decrease after the holiday.

Insiders anticipate a fall in cell prices, mostly as a result of a decline in demand for cells from downstream module producers due to certain module makers curtailing production. Additionally, module prices are also in the bearish sentiments due to the severe oversupply, as a result, cell prices will inescapably be influenced by downstream pessimism.

A source from an integrated player, on the other hand, expressed skepticism over the prediction that cell prices will continue decreasing following the holiday. “After all, the price of cells has already decreased by about 14% over the last three weeks, which is a significant amount,” the source explained.

The price of polysilicon has a significant role in determining how much cell price will drop after the holiday, a source from a specialized cell manufacturer concluded. There isn’t much room for wafer and cell prices to decrease at present. More significant price cuts must wait until polysilicon’s price drop frees up price reduction space for wafers and cells, the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.