The enactment of the Inflation Reduction Act (IRA) marks a significant turning point for solar energy in the United States, ushering in a new era of possibilities. Projections indicate that the IRA will fuel a remarkable 69% surge in solar deployment over the next decade compared to what would have been achieved without the transformative legislation. Within the next five years alone, the solar sector is poised to install a staggering 200 GW of solar capacity, surpassing the cumulative capacity installed to date.

In order to realize the IRA’s full potential, the solar industry needs well-defined and prompt guidance regarding the IRA’s implementation. Delays by federal agencies interpreting new concepts introduced by the IRA and the lack of clear guidance have hindered development. Additionally, federal permitting reform is needed to address issues of congestion, interconnection and transmission (at all levels). Federal and state policies should focus on addressing these challenges and facilitating the adoption of solar across all market segments — particularly commercial-scale distributed solar.

The solar industry can be categorized into three distinct segments: residential, commercial and utility-scale. Each segment operates within its own unique set of development and business dynamics. Residential and Commercial solar projects connect to the distribution system at the local utility level. Utility-scale projects typically connect to the high-voltage transmission system, regulated by the Federal Energy Regulatory Commission (FERC) and operated by various Regional Transmission Organizations or Independent System Operations (RTOs/ISOs). The differences in interconnection requirements between these segments create varied regulatory and operational environments within the solar industry.

All solar is not alike

At first glance, focusing on utility-scale solar makes sense. Large projects benefit from economies of scale, making them cheaper to build per megawatt (MW). But they come with the significant hidden costs of delivering the energy they produce over long, expensive transmission lines, resulting in energy losses and degrading their impact in offsetting emissions.

The transmission system plays a vital role in the efficient and reliable delivery of energy, supporting both renewable and fossil fuel sources. The expansion and modernization of this infrastructure can be a complex and time-consuming process, requiring significant investment and navigating numerous regulatory hurdles.

However, it is essential to sustaining a reliable electric grid. Utility-scale projects, which have the technical capability to connect to the transmission system, are among the primary beneficiaries of its expansion. In other words, the scale needed to connect to the transmission system is limited to larger projects that present significant challenges, including substantial land requirements and ecological disruptions, further exacerbating delays and creating a backlog of interconnection requests.

Commercial solar generation, in contrast, connects to the distribution system. These solar systems are frequently located in densely populated areas supporting the energy needs of surrounding communities. Commercial solar is more efficient to build in terms of project timelines. Building out commercial solar lowers the overall grid system peak, ultimately reducing peaking capacity requirements and the need for greater energy capacity to be delivered through the transmission system from distant generators.

Commercial solar provides a host of infrastructural and economic benefits for the public good. The process of connecting new sources of generation and/or battery storage to the distribution system is experiencing prolonged timelines and increased costs. When grid infrastructure needs to be upgraded to accommodate distributed generation projects, the developer of the commercial solar projects pays for such upgrades. Such developer-funded upgrades may defer or eliminate upgrades that ratepayers would have otherwise funded.

The addition of generation in the distribution system also reduces the demand for further upgrades to the transmission system. This further results in lower congestion costs arising when less power is generated locally than is demanded. This goes to illustrate that commercial solar has a very different path to completion compared to utility-scale solar. Both are equally important, but we must insist that decision-makers understand the difference between the two market segments.

Commercial solar provides unique benefits

Even dense urban areas can accommodate surprisingly large amounts of solar on rooftops, parking lots and parking structures. Commercial-scale projects can also be deployed on closed landfills and other brownfields, on farmland in a practice known as agrivoltaics, and on undeveloped or underutilized land.

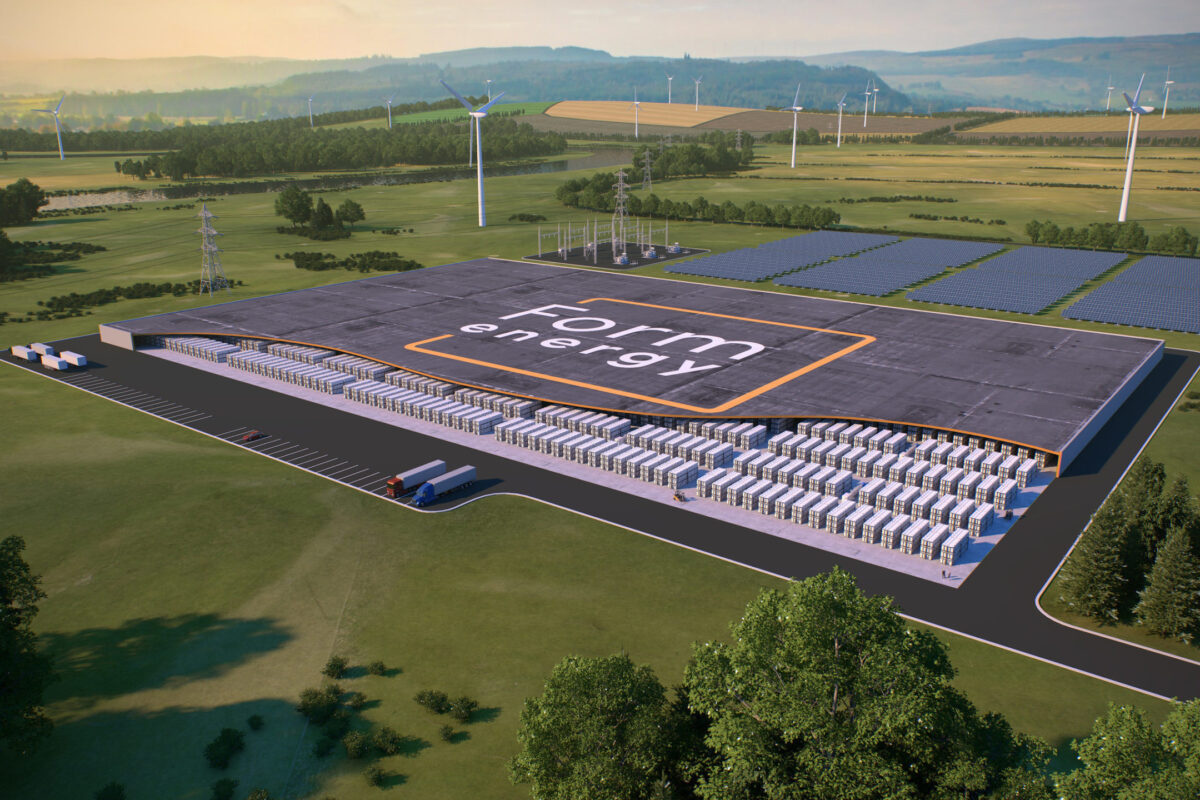

What all of these deployments have in common is that they’re sited near where energy is consumed, directly benefiting communities with jobs that can’t be outsourced and local economic benefits – often lowering energy bills for homes and businesses. When paired with energy storage, they can store excess energy for use during periods of high demand or grid outages, improving grid reliability and reducing the need for peaker plants powered by fossil fuels.

Additionally, distributed solar provides the ability to economically quantify the savings it provides to ratepayers, particularly in terms of avoiding costly upgrades that utilities typically rate base. Traditional centralized power plants require expensive infrastructure to deliver power across long distances. Distributed solar is uniquely scalable and flexible, efficiently catering to diverse energy needs and empowering communities through a localized approach.

Ensuring stable growth

The solar industry is experiencing a big boost from recent legislation from the Biden Administration. The IRA, CHIPs, and Infrastructure Investment and Jobs Act (IIJA) are transformative for our industry and nation.

Despite the recent legislative successes, the industry is currently experiencing two challenges. First, a sluggish transition period, particularly with the rollout of IRA guidance. Second, a disconnect between policy and industry needs, particularly with recent legislation not addressing the core issues to solar growth: congestion, interconnection, inefficient permitting and delayed transmission projects.

The solar industry would benefit significantly from clear, timely and concise guidance that is both actionable and capable of unlocking our potential growth. Thus far, the Treasury has released guidance that has left the industry with more questions than answers or has set unattainable targets given the lack of U.S.-made solar products. Nonetheless, timelines for future guidance remain unknown, causing unintended consequences resulting in stalled decisions on investments and project decisions.

Up to this point, implementing IRA guidance has placed developers in a challenging position. To achieve certain ITC bonuses, developers are developing projects to source specific materials and locate projects in particular areas, all while lacking a comprehensive understanding of the rules governing these bonuses. The result is a reluctance to invest in shovel-ready projects. Unfortunately, the industry is seeing projects stalled given the incomplete set of guidance.

Domestic content

In the long run, the industry seeks to establish a domestic manufacturing base of critical solar components such as PV modules, batteries and inverters. Unfortunately, there is significant concern within the industry that it will take years before domestic manufacturers can meet the highly restrictive and complex requirements and produce at a capacity to support the domestic industry. So, in the short term of 2-5 years, this incentive may not be a meaningful section of the IRA bill.

Low to moderate income

The newly established application process for the low-income bonus of the ITC is hindered by restrictive statutory requirements. The imposed cap of 1.8 Gigawatt (GW) fails to acknowledge the actual market demand. Furthermore, segmenting the 1.8 GW allotment into four categories significantly limits the bonus to a disproportionately small fraction of the industry. To provide some context, earlier this year, the New Mexico Public Regulation Commission released a community solar request for proposal (RFP) that allowed up to 200 MW.

The RFP followed a similar application process as the IRA’s application queue for low-income economic benefit projects, rewarding projects based on specific geographic areas, ownership models and other criteria. Remarkably, the RFP received close to 450 applications, totaling approximately 1.7 GW of solar projects for consideration. In other words, there were nearly 1.8 GW worth of applications in just one state, while the IRA only allows 1.8 GW of ITC bonuses nationwide.

This stark contrast highlights the significant size of the community solar marketplace and the disconnect between policymakers and industry.

Interconnection process

While not explicitly covered in the IRA bill, the interconnection process for commercial solar projects is a significant bottleneck. The lack of adequate distribution-level interconnection processing resources combined with onerous local level permitting continues to plague the pace of commercial solar deployment. The complexity of interconnection studies regarding how each project influences the distribution circuit and substation operations drives the lengthy interconnection review periods. Many utilities lack the resources to properly process interconnection applications expeditiously.

Additionally, the public would be well served if the utilities adopted fewer conservative processes in order to utilize the benefits of smart inverters and wireless communication technologies. This is only possible with the support of state regulatory commissions who oversee the utilities and their state’s solar programs.

Policy certainty and support for all solar market segments are crucial for the growth of our industry. Achieving this requires a sharper focus on rules, regulations and implementation from a policy and rulemaking standpoint. Despite industry support of existing laws, there is a significant shortfall in implementation and a clear disconnect between the different segments of solar development. Moving forward, legislators, governing agencies and the solar industry must cohesively work together to understand the barriers to exponential growth.

Directives and reforms needed

For the U.S. to truly meet its climate goals for reducing greenhouse gas emissions and cultivating a robust domestic solar industry, it is essential for policymakers to have a comprehensive understanding of the intricacies within the solar sectors. This understanding should begin by recognizing the interplay between different market segments and the quasi-governmental entities responsible for managing interconnection and permitting processes necessary to facilitate the energy transition.

Recent legislation has provided a major foundational structure for the expansion of renewable energy; however, it is crucial for policymakers and governing agencies to reduce ambiguous regulations and establish clear deadlines for future guidance. To mitigate uncertainty for businesses, the solar industry requires concrete and achievable directives from the Treasury. Moreover, urgent policy reforms are needed to streamline the interconnection process and address deficiencies in transmission and distribution-level infrastructure.

Unlocking the full potential of the solar industry relies on close collaboration between policymakers, governing agencies and a nuanced understanding of the three distinct solar markets comprising the utility-scale, residential and commercial participants. It is vital for our leadership to grasp the sector-specific obstacles that hinder growth and work together to implement effective rules and regulations that will foster a flourishing solar industry throughout the US.

Trevor Laughlin is policy and regulatory affairs analyst and Eric Partyka is director of business development at Standard Solar.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Once again this IRENA Report, as per pvmagazine, is once again a myopic view of The Potential of Solar Energy (Commercial & Residential & Utility) .. barely 25%, if that at all..

The REAL POTENTIAL is in REPLACING ALL POLLUTING FUEL USE by ZERO POLLUTION Pollution-Free Solar 4,000Energy.. as follows..

• Industry .. 25%

•Transportation .. 25%

• Commercial. … 25%

• Residential .. 25%

Utilities provide Electricity to just parts of a of the above Sectors with its 1.3TW of Generating Capacity and 4,000TWh/yr of Electricity Production.

In a ZERO POLLUTION USA.. it will require a 15TW, 18,000TWh/yr System requiring an Investment of $20 Trillion (including 25%. 4,000TWh/yr S2S.. Sunset-To-Sunrise.. Energy Storage, using UHES, to provide 24h/day Pollution-Free Solar Energy.

THIS IS THE SOLAR POTENTIAL IN THE USA..!!!

Will pvmagazine stop publishing all these erroneous abd misleading mickey-mouse Reports & Projections by many many “self-appointed Experts”… and raise its “JOURNALISM STANDARDS”.. from C- to A… ???

As far as the T&D “Chokehold” on Rapid Deployment of Solar Energy, to Eliminate the PreMature Deaths and Suffering caused by it, FERC and The Biden Administration MUST ESTABLISH.. THE RIGHT TO CONNECT PRINCIPLE….. in the USA.. asap … for Solar Installations, to ensure and enable rapid expansion of The US Electric Grid from 1.3TW/ 4,000TWh/yr to 15TW/18,000TWh/yr.. by 2050 or asap..

This will support The State Regulatory Commissions to enable the Utilities to expand, as fast as possible, and ensure rapid deployment of Pollution-Free Solar Electricity, rather than choke its growth.. like already being experienced by several parts of thd USA .. TODAY..!!!