Bank of America is the most recent entity to join Duke’s Green Source Advantage program, which was established by the utility as a way to allow large-scale customers to offset power purchases by securing renewable energy from projects connected to the Duke Energy grid.

Under the power contract (PPA) that the two parties have agreed upon, Bank of America will purchase the entire annual generation of a 25 MW project set to be located in the Piedmont region of North Carolina. The project is expected to hit commercial operation in 2022, at which point the 10-year agreement for electricity and Green-e certified renewable energy certificates will begin. Silver Pine Energy, a joint venture between Silver Creek Energy and Pine Gate Renewables, will oversee the development of the project and will support the engineering, procurement and construction services.

Bank of America is now the second high-level partner to come to terms with Duke on a Green Source Advantage contract, after the city of Charlotte signed a PPA for a 35 MW installation within the city back in March.

This is the second major renewable move that Bank of America has made in the past week, signing a PPA with NRG Energy for enough renewable generation to power 345 of the bank’s Texas facilities, which include office sites, financial centers and ATMs. The PPA with Duke is expected to provide enough electricity to power 45% of Bank of America’s North Carolina operations. Like the North Carolina facility, the West Texas facility that Bank of America is contracted with is expected to come on-line in 2022.

BofA’s tricky renewable history

The two purchases were made in pursuit of Bank of America’s climate goals, which include achieving carbon neutrality and procuring 100% renewable electricity. The company claims to have achieved both landmarks in 2019, but these recent purchases would put those claims into question.

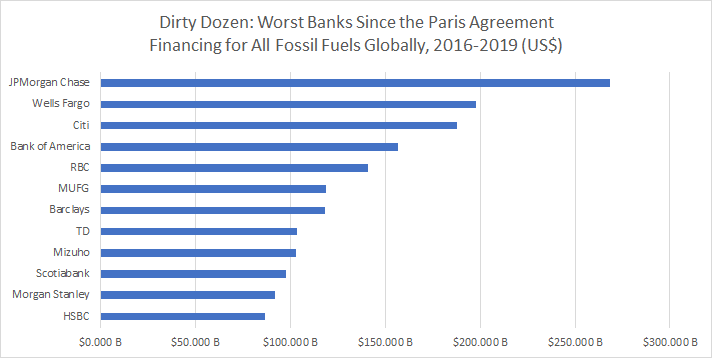

Additionally, a report released by BankTrack, Oil Change International, Sierra Club listed Bank of America as one of the financial institutions most actively financing fossil fuels. Between 2016 and 2019, the bank put more than $150 billion into the financing of fossil fuels, which seems to contradict Bank of America’s expressed goal of “helping our customers and clients navigate the transition to a low-carbon, sustainable economy.”

This is not to say that Bank of America has made no strides towards committing to renewable energy, it just appears that the company has extraordinarily cold feet when it comes to abandoning fossil fuel investment. To the company’s favor, Bank of America did announce in 2019 that it would be adding more than 60 solar installations across its operations, including projects at 15 financial centers and on ten ATMs.

Bank of America was also one of the eight banks included in DTE Electric’s 2018 green bond offering, which was a series of a 20-year bonds created to cover investments in renewable energy and energy efficiency investments.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.