We’ve been expecting this for some time. At the beginning of the year, pv magazine reported an unprecedented volume of solar projects in the interconnection queues of six grid operators, totaling 139 GWac. We’d missed one (Southwest Power Pool), which would have brought this total to 154 GWac.

And now, it appears that these projects and others in the South and Mountain West – areas which do not have independent grid operators – are beginning to move forward with power contracts and even steel in the ground.

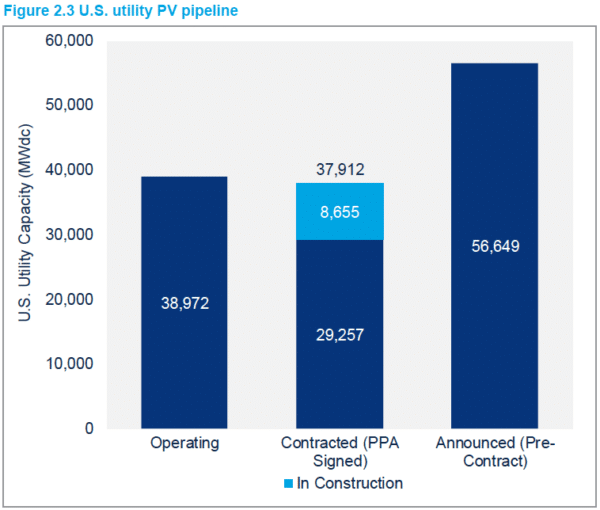

According to the latest U.S. Solar Market Insight report from Wood Mackenzie and Solar Energy Industries Association (SEIA), at the end of the second quarter the volume of large-scale solar projects under contract across the United States had ballooned to 37.9 GWdc, with 8.7 GWdc of these currently under construction. This is in part the result of 11.2 GWdc of new projects that have won contracts in the first half of this year.

According to the latest U.S. Solar Market Insight report from Wood Mackenzie and Solar Energy Industries Association (SEIA), at the end of the second quarter the volume of large-scale solar projects under contract across the United States had ballooned to 37.9 GWdc, with 8.7 GWdc of these currently under construction. This is in part the result of 11.2 GWdc of new projects that have won contracts in the first half of this year.

These numbers are also supported by data from the U.S. Department of Energy’s Energy Information Administration (EIA). EIA is reporting 1.4 GW of PV module shipments in June and 1.1 GW in July – the highest monthly volumes since November 2018, when developers were frantically importing modules to avoid the pending tariffs under Section 201.

A slow Q2

But just as the sea before a large wave can be calm, Q2 2019 installation numbers were unimpressive. The United States only installed 2.1 GWdc of solar during the quarter, a 7% year-over-year contraction.

This was highly uneven from sector to sector. The non-residential sector – where Wood Mackenzie lumps together commercial and industrial, non-profit, government and even community solar arrays – looks to fall for the second straight year. Only 426 MWdc was installed during Q2, less than Q1. Wood Mackenzie blames policy changes in California, Massachusetts and Minnesota for this decline.

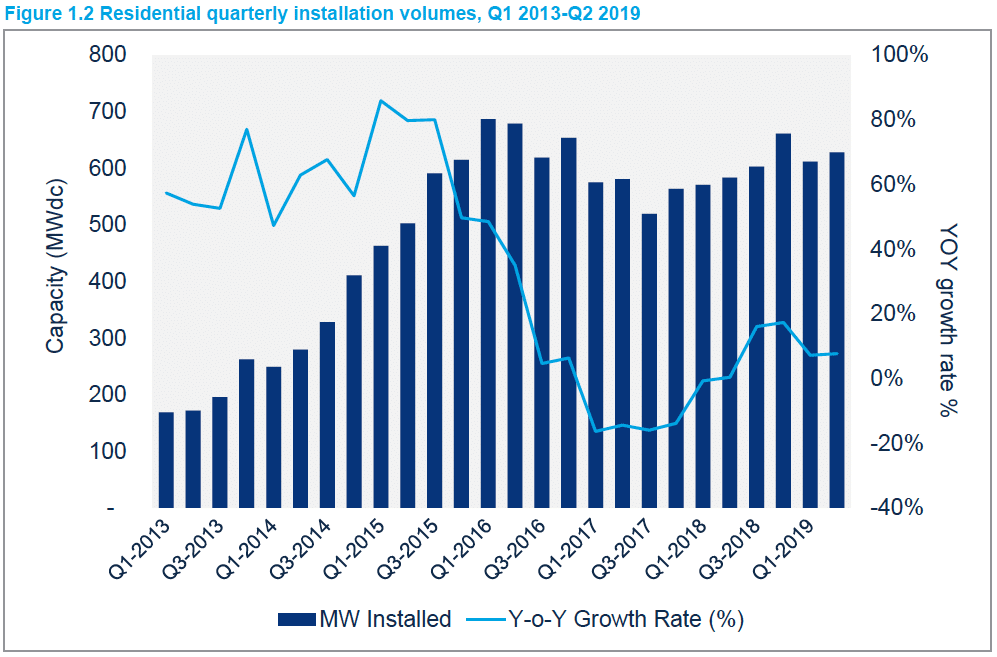

However, the utility-scale sector is relatively strong, with more than 1 GW installed during the second quarter. And residential solar installations are showing the continuing rebound of that sector after the crash in 2016 and 2017. Overall, residential solar installations were up a cheerful 8% year-over-year, despite continued contraction at Tesla/SolarCity, which was at its height responsible for 1/3 of the total residential market.

Geographically, there were no big surprises. California led again, with Florida coming in second (by a wide margin) and North Carolina third. However, later in the year we can expect higher installation volumes in Florida and perhaps Texas, where project development is booming.

Looking forward

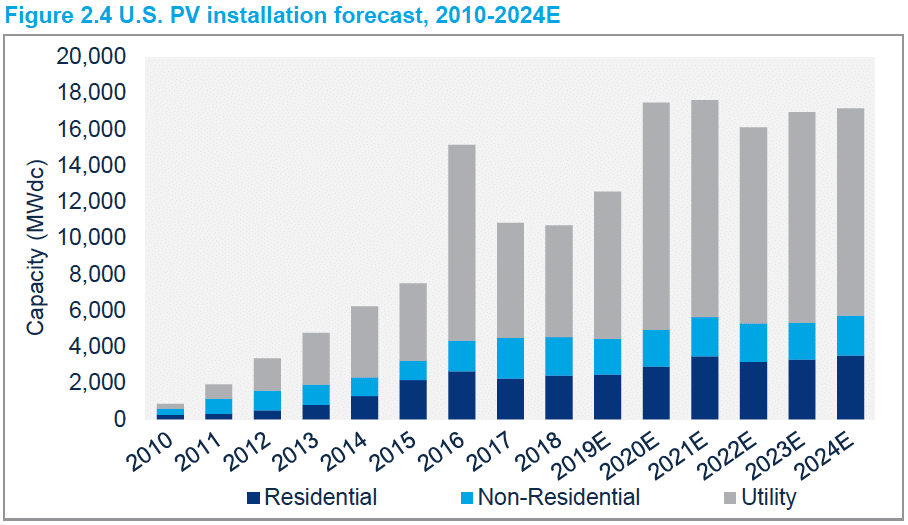

Of the massive wave of utility-scale solar, many of these solar projects are not expected to be completed this year. The federal Investment Tax Credit (ITC) steps down from 30% to 26% from 2019 to 2020, however if contractors have begun construction by the end of 2019 they can still claim the full 30% credit. Wood Mackenzie is forecasting that a total 12.6 GWdc of solar will be installed this year, and has reduced its utility-scale forecast due to completion of many projects being pushed out to 2020 or later.

However, Wood Mackenzie is increasing its 2020 and 2021 forecasts, with 17.6 GW expected in 2021 and nearly that volume in 2020, as projects come online for the final hurrah of the 30% ITC.

Wood Mackenzie is expecting a slight dip again in 2022, but it is important to note that the further out that projections get, the more uncertain they are. And if one thing is true of the forecasts of market analysts, it is that they tend to go up over time more than they go down.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

In FERC’s current monthly report solar proposals jumped from 87.4GW to 113GW in one month. A 29% increase. According to their “In Construction” column it looks like about 20% of those projects make it to construction phase which would put it around 22GW.