There are a number of utilities in the United States that have been reluctant to deploy solar, even within the paradigm of large, centralized generation that they are most comfortable with. However, pv magazine has not seen any that are as openly hostile to renewable energy as the Tennessee Valley Authority (TVA), the federally owned corporation created in the Great Depression to serve Southern Appalachia.

In 2018 TVA was arguing against plans to incorporate distributed solar in the service area of the utilities it serves on the basis that more rooftop solar would reduce the need for large-scale generation. It is hard to reconcile such statements with TVA’s mandate to find the lowest-cost solutions for its customers.

As can be expected, the process of crafting TVA’s latest long-term plan has been contentious, to say the least. The power company’s earlier Integrated Resource Plan (IRP) draft was sharply criticized by Southern Alliance for Clean Energy (SACE) for both capping solar deployment at 500 MW per year, and using suspiciously high cost estimates for solar wind, and energy efficiency, but low costs for gas and nuclear power.

It is not clear if the final IRP delivered on Friday addresses these issues. Both SACE and Sierra Club criticized the new plan, with SACE stating that TVA ignored its recommendations for greater efficiency and transparency and renewable energy. In SACE’s words:

While the final IRP shows an overall reduction in greenhouse gas and air pollution emissions from TVA’s current trajectory, TVA could and should do more to reduce emissions and save customers money. This IRP might have been groundbreaking 20 years ago, but today it is the plan of a regional laggard on both energy efficiency and renewables.

A wide range

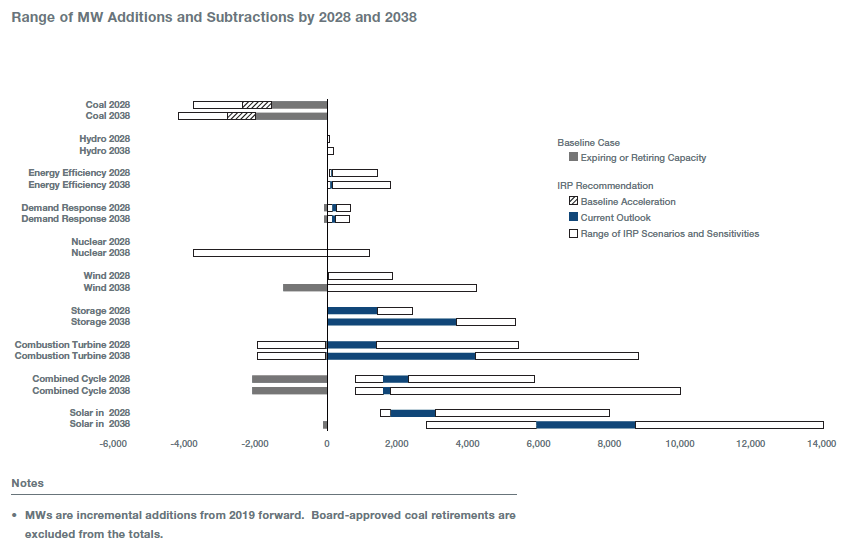

But what is most notable about TVA’s plans for solar is just how vague they are. The power company took the unusual step of providing a range of solar deployments in its IRP, suggesting that it could between 1.5 and 8 GW of solar by 2028, with an expected range of 2-3 GW. It also plans for 0 – 2.4 GW of energy storage, with an expected range of 0 – 1.5 GW.

Nor does TVA provide much of an explanation as to why it took this route, instead merely stating that it “elected to establish guideline ranges for key resource types (owned or contracted) that make up the target power supply mix.”

What this also does is to leave the door open for more gas. While its “current outlook” projects net capacity additions of 0-1.5 GW of combustion turbines and around 2 GW of combined cycle plants, TVA has left a range that includes adding more than 10 GW of gas plants.

This incredibly vague approach was lambasted by policy analyst Ben Inskeep of EQ Research:

TVA’s final resource plan (IRP) calls for between 1,500 MW and 8,000 MW of solar by 2028– a range so broad as to be essentially meaningless. More concerning is the hand-waving about building anywhere up to 10,900 MW of new natural gas by 2028.

In the case of both solar and gas, TVA is leaving the door open to add greater capacities if demand increases, and has stated that future solar needs will be driven by “pricing, customer demand and demand for electricity.”

And if TVA builds any solar at all, it may be because it is forced to by its customers – in specific those customers who are global corporations. Last fall TVA announced that it was moving forward with 377 MW of solar projects in Alabama and Tennessee to support a Facebook data center, which will dramatically increase capacities in both states.

But the reference to pricing is more questionable. Given TVA’s track record for over-estimating prices for solar, this could be a rationale to put less online.

Investment in nuclear power

Similar to every utility in the United States, TVA would prefer centralized generation that allows it to build transmission lines. And like every owner of power plants, TVA would like to keep its centralized generation online as long as possible.

But for TVA, there appears to be a third motivation. The federally owned corporation has shown a particular affinity for nuclear power, and has stated that it will be pursuing a second license renewal for its 44-year old, 3.4 GW Browns Ferry nuclear power plant.

TVA also repeatedly mentions the potential to deploy small modular reactors (SMR), and its graphics indicate that it could add in the neighborhood of 1 GW of nuclear power over the next 10 years. Such technology is still under development, and none have been licensed to date.

Overall, it appears that TVA plans to do what it wants – cost be damned. And there is a great irony that the one power company owned by the federal government and not a private entity appears to be the least responsive to its customers or the public.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

They’ll just get stuck with massive stranded assets as homes, buildings, factories, etc just make their own power for less taking demand as they go from being loads to being generators.

Since it’ll cost them 50-75% less to make their own power by solar, wind, chp, csp with heat, cold, battery EV storage and generation, those that don’t lead the parade, will get run over by it.

And a lot of nuke in the region that is going to have problems finding a load, especially at nuke prices.