To date, wind has been the big game in new renewable energy. The capacity of wind installed is nearing 100 GW, and wind generated 6.5% of all electricity in the United States last year – more than double the share from solar.

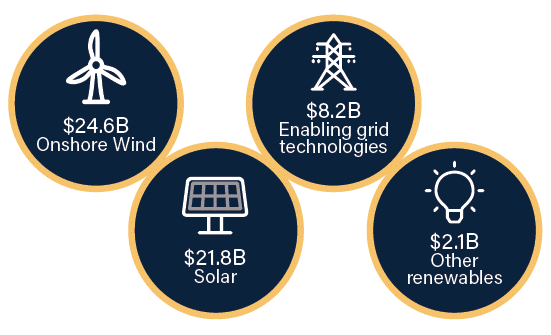

According to the latest report by the American Council on Renewable Energy, land-based wind also attracted more investment in the United States last year at $24.6 billion, compared to solar’s $21.8 billion, as part of $56.7 billion invested in renewable energy and enabling technologies in 2018.

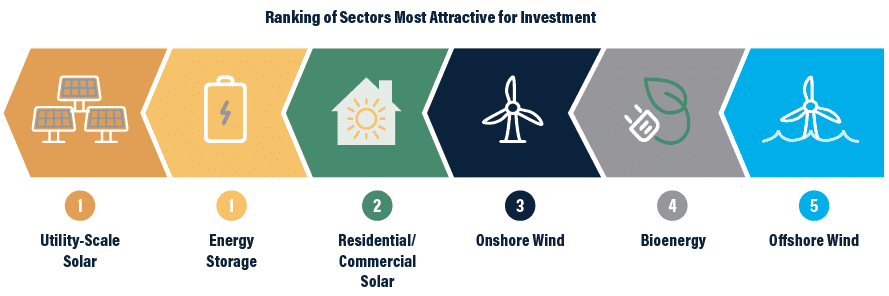

But while wind is still bigger by these metrics, this may not last. While the growth of wind generation in the United States has followed a roughly linear progression over the last decade, the growth of solar has been exponential. And when ACORE polled investors on the sectors they consider most attractive for investment, utility-scale solar came in first, followed by energy storage and then residential & commercial solar.

Tax credits expiring

At the end of the day renewable energy markets remain strongly influenced by tax policies, particularly the Investment Tax Credit (ITC) for solar and the Production Tax Credit (PTC) for wind. Both are scheduled to expire, and the expiration schedules influence both the markets for solar and wind and investor interest.

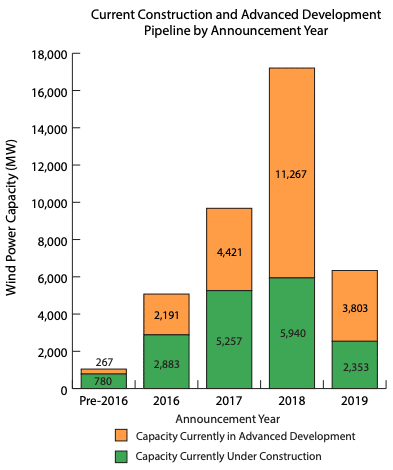

The PTC is in the third year of its drop-down, and for wind plants built in 2019, the PTC has been reduced by 60% from its original 2016 value. Despite this step-down, the wind market has been relatively steady for the last two years, hovering at from 6-7 GW, and 2019 is also expected to be a strong year for new capacity, with the U.S. Department of Energy expecting a massive 12.7 GW. However much of what is being built was planned and/or began construction years ago, and it is not clear how much new capacity is coming once this ends.

The PTC is in the third year of its drop-down, and for wind plants built in 2019, the PTC has been reduced by 60% from its original 2016 value. Despite this step-down, the wind market has been relatively steady for the last two years, hovering at from 6-7 GW, and 2019 is also expected to be a strong year for new capacity, with the U.S. Department of Energy expecting a massive 12.7 GW. However much of what is being built was planned and/or began construction years ago, and it is not clear how much new capacity is coming once this ends.

Solar is in a very different situation, with a major boom expected over the next five years as the ITC phases out. This is supported by a tsunami of utility-scale solar applications to interconnection queues in the Midwest and Texas, and voluntary deployment by Florida utilities led by Florida Power & Light.

For the ITC to be claimed developers need access to sufficient tax equity financing, and ACORE had previously expressed concern that lower corporate tax rates and the new Base Erosion Anti Abuse Tax (BEAT) implemented by the Republican tax reform in late 2017 would limit the availability of such financing. However, despite both factors ACORE says that there is “no evidence” that tax equity investment was constrained in 2018.

New capital, strong optimism

One of the details noted by ACORE in its report is the entrant of new sources of capital. ACORE lists corporations investing directly in renewable energy projects, infrastructure funds acquiring pipelines of U.S. renewable energy assets, and other institutional investors.

We at pv magazine have also been covering this trend, and could note any one of dozens of discrete examples, including Facebook moving beyond merely buying power from renewables to actively investing in solar, Danish pension funds buying up U.S. solar plants or asset manager HPS Investments buying Spruce Finance.

There will be much more detailed information provided on renewable energy investment this week at ACORE’s Renewable energy Finance Forum – Wall Street in New York City from June 18-19. pv magazine staff will be reporting from the conference, with our own insights on the dynamic and growing world of renewable energy finance.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

There is a huge market, replacing FFs of which RE has just begun.

Solar will rule because it is so wide spread and reliable in most places resource.

And PPAs will rule in putting solar, wind, geo, battery around the world for free and a very low cost when produced is a compelling app that means most anywhere in the world new FF generation will stop as just costs

too much.

Now add the huge mounts of money with no where to invest, the 2 together will switch the world to RE much faster.

The eastern Pacific coast and most islands will be 100% RE very fast as PPAs, home, building, etc RE takes over because it costs much less.

Have Solar, have wind, have storage- where can you help? It’s patented!!!