Have some empathy for the nearly 10 million people served by TVA. The utility’s draft integrated resource plan (IRP) is supposed to identify the least-cost option for supplying electricity in the future.

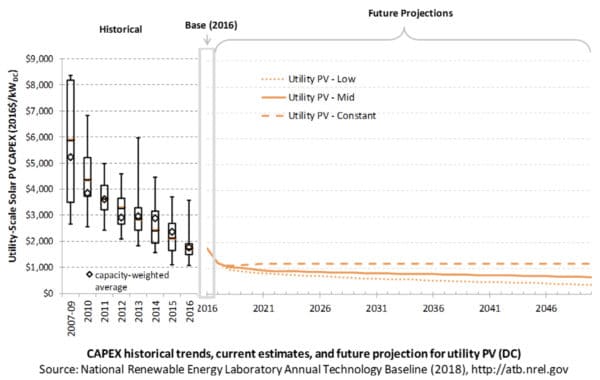

Yet the highly logical math behind an IRP model can only work with good input data. TVA started with projected solar capital costs of about $1,400 to $1,500 per kWdc (draft IRP Appendix A). See if you can find those costs in the graph below from the National Renewable Energy Laboratory, which synthesizes nine separate studies (hint: they are floating above the highest dashed cost curve, “constant”).

And a utility planning model can only work if it’s allowed to do its job. Imagine a computer programmed to add 600 + 400, but to give an answer not exceeding 500. That’s a hard problem! The closest it could get is 500.

That’s what happened in 22 of 30 model runs of TVA’s model, according to an analysis by the Southern Alliance for Clean Energy (SACE). TVA placed an artificial cap on solar of 500 MW per year in its draft IRP—a cap that SACE discovered only through a Freedom of Information Act request, as SACE outlined in its formal comments. Even using high capital costs for solar, TVA’s model hit that limit of 500 MW of solar per year—every year for 16 years—in 22 model runs. That suggests “the model would select additional cost-effective solar if allowed,” noted Maggie Shober, SACE’s director of power market analytics, in a post. Overall, she wrote, TVA “did not optimize for what is best for Tennessee Valley residents.”

For comparison, Florida Power & Light, which SACE notes is comparable to TVA in terms of sales and customers, plans to add “an average of 750 MW of solar per year in the next 10 years, with additions growing to over 1 GW in a year in the later 2020s,” wrote SACE and nine other citizens groups, in separate comments that referenced an FPL regulatory filing. With this added solar, pv magazine has calculated that FPL will generate more than 40% of its electricity from zero-emission solar and nuclear by 2030.

SACE found “apparent bias” in TVA’s draft IRP “by utilizing high cost estimates for solar, wind, storage, and energy efficiency, but low cost estimates for gas and nuclear resources.” The draft IRP “appears to drive results away from renewables and energy efficiency in preference to building new gas generation.”

Noting that “a successful IRP should be overseen by an engaged regulatory body,” SACE called on the TVA board of directors to reject TVA’s final IRP “unless TVA makes serious strides” to address that apparent bias, in its final IRP filing. Nine other citizens groups joined SACE in that call.

TVA’s draft IRP reflects planned generation additions from 2023 onward. Currently, TVA has only 84 watts of solar per customer, per a recent SACE report, well below the Southeast average of 269 watts, and well outpaced by the 1,625 watts for Duke Energy Progress. By 2022, Duke Energy Progress is set to reach 2,618 watts per customer, or 10 times the projected 251 watts for TVA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

If you look at the NREL Solar Radiation maps it is clear why FPL would target higher solar construction than TVA. Florida gets 25% more sun than TVA’s service territory. TVA doesn’t need more energy. It needs dispatchable peak generation. Unfortunately, solar doesn’t meet that requirement. Energy is cheap, reliability is expensive.

TVA’s customers deserve a resource plan that will give them the lowest electric bills. The “apparent bias” found by SACE indicates that TVA’s draft resource plan won’t do that, particularly with respect to solar. Florida Power & Light’s solar plans indicate that adding higher levels of solar each year is technically feasible. And the cost for solar has fallen so sharply that aggressive solar installations will save customers money in many areas; even TVA’s model runs, using high cost projections and an arbitrary cap, selected solar as a cost-saving option.

As for reliability, utility resource planning models solve for the lowest-cost resource mix that meets projected demand at all times with an adequate margin of reserve capacity—or “reliability” as the term is commonly used. These models would be pointless if they did not.

I’m glad that organizations are starting to call BS on the utility models.

Hopefully the customers of TVA will get more RE after this.

Right now it is obvious to a lot of us that solar/wind/storage are the future. Unfortunately, there are a lot of regulatory bodies like the TVA one that are willing to stick their heads in the sand and stick their ratepayers with an expensive future.