We’ve been hearing for years about how the third-party solar model is giving way to loans and cash sales as the dominant business model for the residential solar market. But while this trend may be true for the larger market, it doesn’t apply to all companies equally.

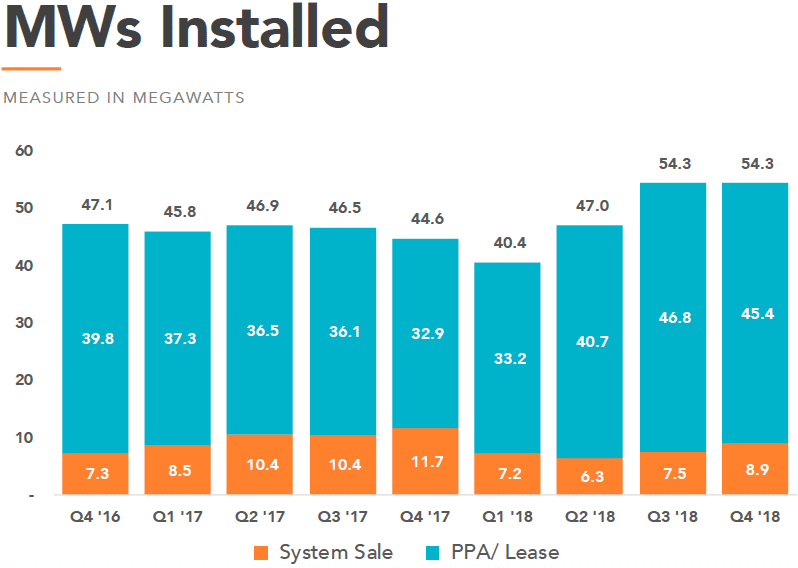

Notably, as revealed in the company’s Q4 2018 results, during 2018 Vivint Solar shifted back to the third party solar model. Direct sales represented only 15% of its 2018 installations, versus 22% in 2017.

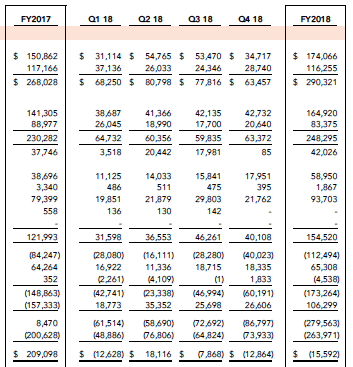

And while the company has emphasized profitability over growth in the years following its restructuring after the botched SunEdison acquisition, in 2018 Vivint grew as profitability fell. The company’s watts installed grew 7% during 2018, with revenues growing similarly, but Vivint also racked up a stunning $280 million net loss – higher even than in 2016. Fortunately for its shareholders, most of this was borne by non-controlling interests.

Along with this Vivint’s system costs increased from 2017 to 2018, driven by higher sales, general and administrative costs, despite lower installation costs.

Along with this Vivint’s system costs increased from 2017 to 2018, driven by higher sales, general and administrative costs, despite lower installation costs.

Quarterly losses sometimes don’t tell the full story, as both the third-party solar model and growth lead to future revenues, while representing net costs in the short term. Additionally, the company still reported $220 million in cash and equivalents, so Vivint can absorb losses for some time.

However, what is concerning is that Vivint Solar’s losses in 2018 were actually in excess of the value that it estimates that it created, as its net retained value increased only $246 million from the end of 2017 to the end of 2018.

Profitless growth

This phenomenon of losses exceeding net retained value was true for the fourth quarter as well, but the discrepancy in these numbers was not addressed on Vivint Solar’s Q4 results call. In fact, CEO David Bywater stated that he was pleased with the results, and noting that the company has “never had this kind of balance sheet and capital structure”.

It certainly is important for Vivint to have good terms, as its debt – both recourse and non-recourse – grew to $1.24 billion during 2018. And the reception of the company’s Q4 results from the stock market was not as positive, with Vivint’s stock falling sharply in after-hours trading.

Vivint still expects to grow, with Bywater repeatedly stating on the company’s results call that he expects the company will expand “above market rates”, based on a projected 10% growth rate for the overall residential sector in 2019. The company has several avenues to do this, noting its recent partnership with Home Depot, as well as what Bywater says is a “key investment in dealer network and inside sales”.

In concrete terms, Vivint expects to install 43-45 MW during the first quarter, which would be a 10% increase over the first quarter of last year. But while the company states that it is not growing for growth’s sake, like many companies in the highly competitive U.S. solar market, Vivint appears to be still trying to make the numbers work.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Third party now is so risky as any 15-20 yr contract is now for a solar business. So much can happen in that time.

The grid is going through a major change as behind the meter will dominate as solar installs go below $1/wt.

Since such is 50-75% less than utility rates/kwh at about $.04-.05/kwh it pays for itself in 2-3 yrs in electric bill savings in most places means loans are secure with low interest rates.

Many may just pay cash with 5kw costing only $5k.

So companies need to adapt to those lower costs with products like factory made Plug and Play, solar shed, carports, patio etc added value without all the costs of putting it on the roof.

And can be portable so can move with a renter, used at work to charge an EV, etc, broadening the market.