Carbon taxes have been in the news a lot lately. First Solar has joined Exelon in supporting a campaign to establish a carbon dividend, and during the last week E&E News reported that Congressional Republicans are crafting a proposal to price carbon.

We at pv magazine USA support a carbon tax in principle. It makes sense to dis-incentivize pollutants, and it may be useful as one in a suite of policies for decarbonization. However, it is a mistake to present carbon taxes as a silver bullet. And carbon taxes should certainly not be a substitute for more reliable, proven policies to decarbonize our electricity supply – such as renewable portfolio standards, federal tax credits, and state and local incentives.

At the end of the day, our decarbonization policies must be effective, efficient and reliable. There is no clear indication that carbon taxes fit the first criteria, and they most certainly are not reliable.

The track record of putting a price on carbon has not necessarily resulted in meaningful decarbonization of electricity or any other sector. This isn’t necessarily because pricing carbon, in and of itself, is the issue, but instead that politicians have not shown an ability to craft a viable program.

One issue is that these taxes have been passed in affluent societies, and energy is mostly an inelastic demand. Another issue is that certificate systems can be gamed, as was shown with the crisis in the EU-Emissions Trading System (ETS).

Some will point to an increased shift from coal to gas, as in the UK, to demonstrate the effectiveness of these programs. However, given the advanced rate of Climate Change we need to not just move from coal to gas, but off of fossil fuels entirely.

We simply do not know what price per ton on carbon is needed to result in any particular level of decarbonization. Prior policies have mostly had low prices (some research suggests they should be as high as $220 per ton) and been ineffective, there is little to no track record to go on. This is in contrast to renewable portfolio standards, which mandate a certain level of zero-carbon (renewable) electricity, and thereby achieve decarbonization.

When you are in an emergency situation, you don’t experiment. You do what you know will work. Climate Change is an emergency.

Taxes, dividends, and passive action

We at pv magazine USA also have specific recommendations regarding the varieties of proposals to price carbon. Any carbon tax that is fashioned as a dividend is a political no-go. Washington State showed this clearly when it down-voted such legislation in 2016.

Research should have prepared these politicians, as it has over and over shown America’s real position on this topic. Polls show that Americans are willing to pay a carbon tax; but if they’re going to pay it, they want it to go for something.

A study by the Yale Program on Climate Change Communication suggested that Americans would be willing to spend up to $177/year in the form of a carbon tax, a 14% increase in energy costs per per household.

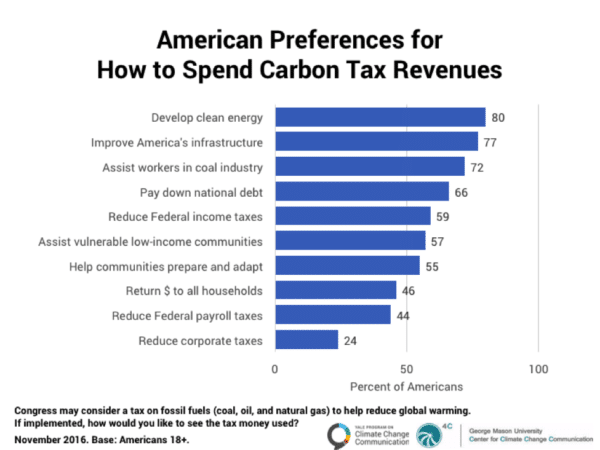

But the key nuance to the study was what respondents preferred to do with the carbon tax revenues, and here is where we find a carbon dividend dies in the rising oceans.

A full 80% of Americans preferred that the money go specifically to not just infrastructure, but clean energy infrastructure. And this makes sense. We Americans know in our guts that if we just sit back and let the “invisible hand” move us forward, we very well could fail at our clean energy aspirations. And failure is not an option.

Another concern is that a carbon dividend could be yet another implementation of “political ju-jitsu” performed by electric utilities to take advantage of popular legislation and slip in their own changes.

For instance, the $23 per ton carbon tax that is reported to be introduced in the U.S. House is planned as a means to get rid of the gas tax. Using a carbon tax to undercut other taxes with broader societal benefits could be the move du jour by politicians in the pay of the fossil fuel industries.

Furthermore, if we’re going to take money from citizens but then give it right back to them in a check, we’re putting too little pressure on industry and individuals to drive change. We’re simply forcing Americans to float 1% of their total income – the tax – between the time of their spending and when the administration pays them back.

We’ve been building the scientific foundation for Climate Change for almost 200 years – with Joseph Fourier starting in 1824. We learned that CO2 was a greenhouse gas in 1856. The first predictions that CO2 would be the danger it is came in the late 1890s. We had experimental evidence supporting these predictions as early as the 1932, and a public warning before the U.S. Senate by Dr. James Hansen in 1988.

The fossil fuel industries and electricity utilities had already began their march. We know that as far back as 1968 the utilities and oil industry were being told by their own engineers of the coming challenges of rising CO2 levels.

This is why passive market action alone is not viable. There are active participants paying politicians and false experts to strategically muddy the political waters and delay action.

We are beyond the time of passive action.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.