The U.S. residential solar market has seen many twist and turns in the past few years, with two of the three largest installers scaling back their ambitions and losing market share in the wake of their own internal struggles.

As this happens, the market is also experiencing a seismic shift, with third-party owned solar – residential leases and power purchase agreements – falling away as the dominant business model. However, as shown in a new report by GTM Research, while third-party solar loses the central position that it once had, it is being increasingly replaced by a new business model: solar loans.

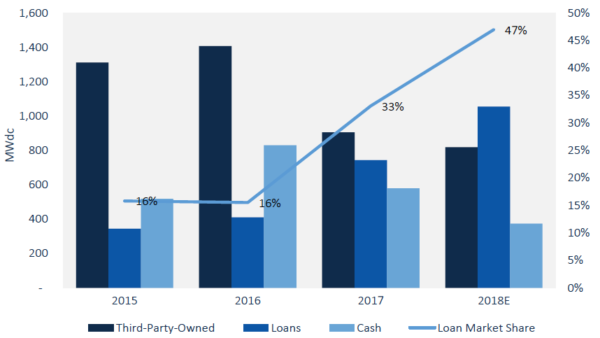

Solar loans already represented 33% of the U.S. residential last year, and GTM Research is predicting that this year they will support 47% of all sales, replacing not only third-party solar but also cash sales.

Shifting terrain

As it turns out, these two trends – the rise in loans and the fall in third-party solar – are related. Tesla/SolarCity, Sunrun and Vivint, which have been the three largest residential installers for the past five years, all rose to their positions on third-party sales.

However, third party solar is a complicated business model for investors. By installing ever-growing pools of rooftop solar assets that bring in monthly revenue, third-party solar companies tend to show quarterly losses and rack up debt. SolarCity in particular was struggling with its rapid growth when bought up by Tesla, and both Tesla and Vivint have moved away from the third-party solar model.

This pull-back was one of the factors in an overall residential market decline in 2017, but it also provided more room for both the “long-tail” of installers as well as loan providers. GTM Research notes that the national residential loan market grew 81% last year.

Ongoing growth

The company notes that part of this is that loans offer some of the benefits of both leasing and direct ownership. As with leases, many solar loans offer zero-down financing options, and can provide monthly savings for homeowners. However, they also allow PV system owners to take advantage of the 30% federal Investment Tax Credit.

As such, it expects the solar loan market to grow through 2023, however, it notes upcoming challenges for the solar loan market. These include rising interest rates, which it says will may result in lenders moving to fewer, more profitable loans.

Crowded landscape

It is less clear who the largest loan providers are. GTM Research names Mosaic and Sunlight Financial as two of the loan companies leading the charge, but did not provide a breakdown by market share in a press statement. And while it does not represent the entire residential market, EnergySage reported Dividend Solar, Sungage Financial and Service Finance Company as the top three loan providers on its online marketplace in its latest report.

GTM Research notes in particular Dividend Finance’s “explosive growth” through partnerships with the “long tail” of smaller installers, who are more represented on online solar marketplaces.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.