This morning TerraForm Power announced that it has completed the sale of a portfolio of 24 operational solar projects in the United Kingdom to the private equity arm of investment bank EFG Hermes, totaling 365 MW. This leaves TerraForm with only one 11 MW PV plant in the UK.

TerraForm gained $211 million from the sale, net of both transaction expenses, distribution and project-level debt. Such debt is reduced by £301 million ($388 million), meaning that the total value gained is $599 million.

This puts the sale at $1.64 per watt, which is very unlike the fire-sale prices when SunEdison solar a portfolio of projects in various stages of completion to NRG.

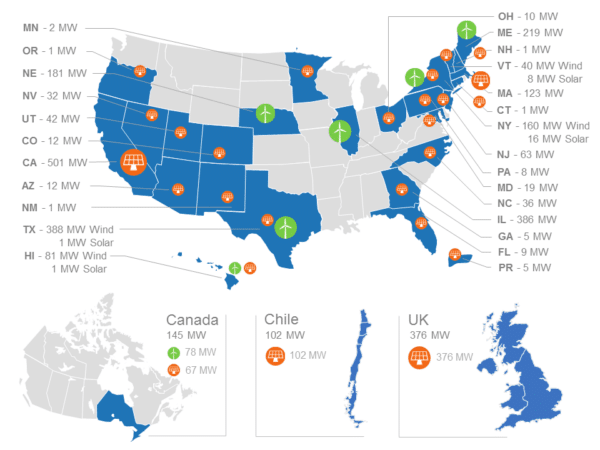

In addition to its sole remaining UK plant, TerraForm still holds solar and wind assets in Canada and solar projects in Chile, although the bulk of its assets at 2.36 GW are in the United States.

TerraForm says that it plans to use the proceeds from the sale to enhance its liquidity position and reduce its debt. This is doubtless a move welcomed by Brookfield, which is currently moving through the legal and regulatory processes associated with buying TerraForm Power and fellow former SunEdison yieldco TerraForm Global.

EFG Hermes acquired the projects through its Vortex renewable energy platform, which now holds 822 MW of wind and solar assets in Europe.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.