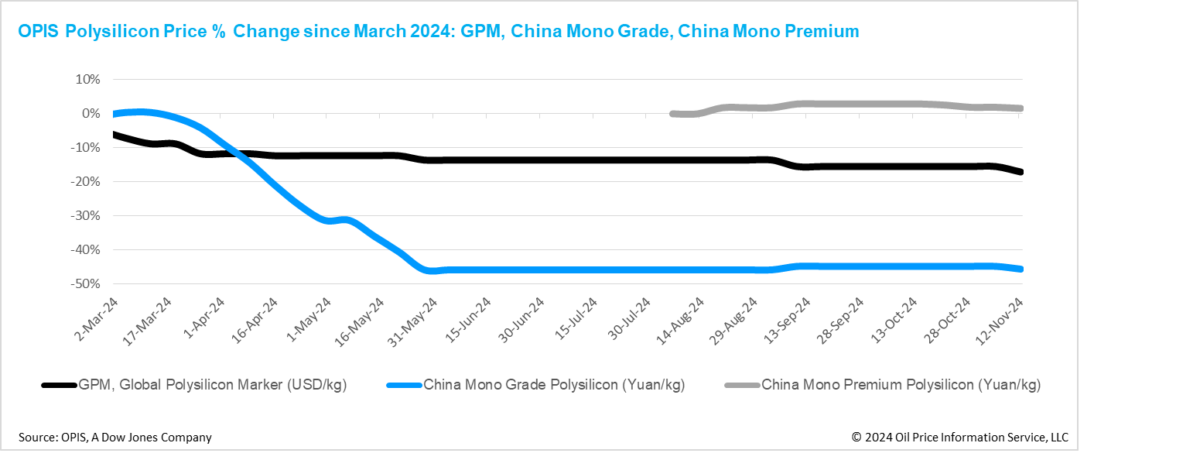

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $21.652/kg, or $0.049/W this week, down by 1.89% from the previous week.

The prolonged lack of strong demand caused by trade barriers has pressured prices to decline. Sources indicate the stagnation in global polysilicon spot trading over the past few months, coupled with the non-renewal of expired long-term procurement agreements, has driven global polysilicon inventories up to nearly 10,000 MT.

This buildup has led to lower prices in recent monthly orders under long-term contracts, falling below the formula-based rates outlined in these agreements, with some orders priced $2–$3/kg lower than last month.

Wafer production in the four Southeast Asian countries, which currently serve as the primary sales market for global polysilicon but may face U.S. anti-dumping (AD) and countervailing duty (CVD) measures on solar cells and modules, shows limited activity. The largest active ingot plant in these regions operates at just 4 GW capacity, while the remaining plants either have capacities under 2 GW or have suspended operations altogether. Earlier this year, the region was said to reach a wafering capacity of about 35 GW by the end of 2024.

In terms of new capacity, a Chinese polysilicon manufacturer recently announced a partnership with a local petroleum company to build a 150,000 MT polysilicon production facility in Angola, which surpasses the 100,000 MT and 120,000 MT capacities announced earlier by two other Chinese polysilicon producers for projects in the Middle East.

Insiders acknowledge this project may face lengthy timelines due to significant funding and technology demands but highlight the company’s rapid growth—it achieved 150,000 mt capacity in China by late 2023 despite being founded in 2021. The company’s stalled 100,000 MT polysilicon expansion project in China, initially slated for August 2024 completion, has sparked industry speculation that resources are being redirected toward overseas expansion, potentially boosting the feasibility of the Angola project.

China Mono Grade, OPIS’ assessment for mono-grade polysilicon prices in the country, decreased slightly by 1.49% week-over-week to CNY 33.125 ($4.58)/kg, or CNY 0.075/W this week. Similarly, China Mono Premium, OPIS’s price assessment for mono-grade polysilicon used in n-type ingot production, saw a slight drop of 0.31% from the previous week, reaching CNY 39.625/kg, or CNY 0.089/W.

Industry consensus points to rising polysilicon inventories and a deteriorating supply-demand balance. While China’s polysilicon output is projected to decline to around 120,000 MT to 130,000 MT in November, wafer companies’ substantial production cuts mean their polysilicon needs will be less than 90,000 mt for the month. Insiders note that, excluding additional monthly production, existing inventory alone could sustain wafer production for more than a quarter.

An OPIS survey indicates that the average operating rate in China’s polysilicon market has fallen below 50%, with notable differences in production levels across manufacturers. Leading producers of Siemens polysilicon and FBR granular polysilicon are reportedly operating at over 70% capacity, while two other major Siemens polysilicon producers are running at around 30%. Meanwhile, some smaller factories and those with lower n-type polysilicon yields have largely halted production.

Insiders suggest that Chinese polysilicon manufacturers are unlikely to reach 100% operating rates within the next year due to severe overcapacity. Consequently, some large polysilicon companies are reportedly considering layoffs as a cost-saving measure to better align with their actual operating rates.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.