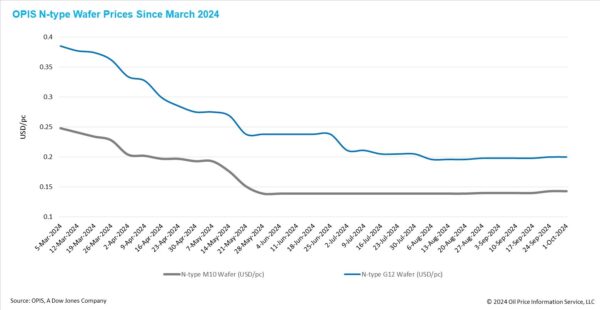

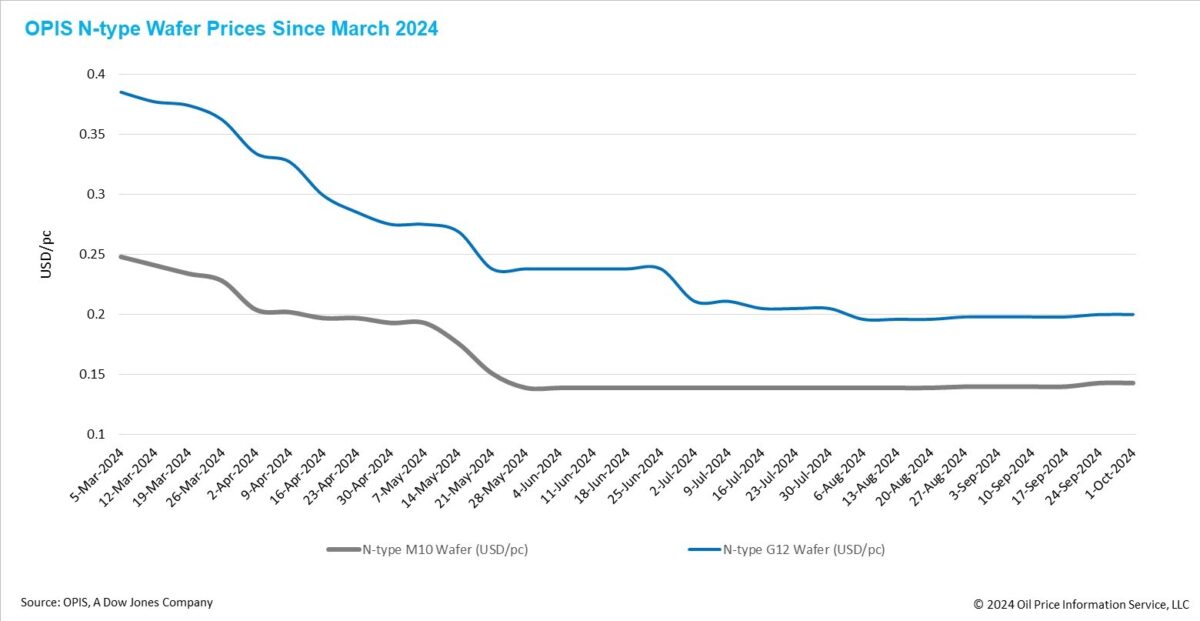

FOB China prices for wafers have remained stable across the board this week. Mono PERC M10 and n-type M10 wafer prices held steady at $0.145/pc and $0.143/pc, respectively. Likewise, Mono PERC G12 and n-type G12 wafer prices remained unchanged at $0.211/pc and $0.200/pc, respectively, compared to the previous week.

The supply-demand balance in the wafer market is improving as manufacturers have significantly lowered their operating rates in the past month. According to the Silicon Industry of China Nonferrous Metals Industry Association, China wafer production was 44.31 GW in September, a month-on-month decrease of 15.76%.

The low operating rate of wafer producers is likely to persist. During the China Golden Week holiday in early October, some wafer manufacturers reportedly scaled back production, reducing from the usual three shifts of production personnel per day to just one shift.

While the industry agrees that wafer prices have likely bottomed out and started intermittent rebounds, the challenge of raising prices is matched by the difficulty of clearing excess capacity. If prices increase, integrated manufacturers may boost their own wafer production and reduce external purchases, weakening demand for externally supplied wafers. Additionally, smaller factories might take this opportunity to restart operations.

Another uncontrollable factor in clearing excess wafer capacity is the weak downstream demand. China’s 14th Five-Year Plan aimed to reach 1,200 GW of combined solar and wind capacity by 2030, but this target was achieved by July this year, six years early. Insiders believe future solar installation growth may flatten, with an expected annual growth rate of around 10% under optimistic scenarios.

In the global market, a recent hurricane in North Carolina affected a mining area producing high-purity quartz (HPQ). An insider reported that a major HPQ supplier temporarily halted operations last week due to power outages and infrastructure damage. While the full impact is still uncertain and considered manageable by some sources, concerns have already emerged. The disruption in HPQ supply could drive up wafer costs or reduce wafer quality if lower-grade quartz substitutes are used.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Would very much like your views on development with Qcells And REC silicon. Whats going on?