Georgia has been a leader in the Southeast in terms of deployment of solar. And while Southern Company subsidiary Georgia Power can claim some credit for voluntarily deploying solar following an initial push by Georgia regulators, the latest plan to add another 1000 MW of renewable energy – which will likely be solar – in last week’s Integrated Resource Plan (IRP) filing may well owe more to tech giants including Facebook.

950 MW of this 1 GW will be through the “Customer Renewable Supply Procurement” (CRSP) program, under which Georgia Power will issue competitive solicitations for renewable energy facilities at least 3 MWac in capacity, to come online in two tranches by 2022 and 2024 As past auctions have indicated, utility-scale solar will generally beat all other resources, so it’s safe to say that most or all of this will be solar.

The company is also launching a 50 MW program for distributed generation (DG) – less of a role for DG than even its previous programs.

Moving to a winter peak?

Buried in the weeds of the plan – whose main document alone is 161 pages – are a number of significant details that point to possible factors for the additional 1 GW. First, the new solar is not to meet peak demand. While Georgia Power notes that it is still a summer-peaking utility, it notes also notes that “recent operational experiences and forecasted conditions reflect a significant shift in reliability risk from the summer season to the winter season.”

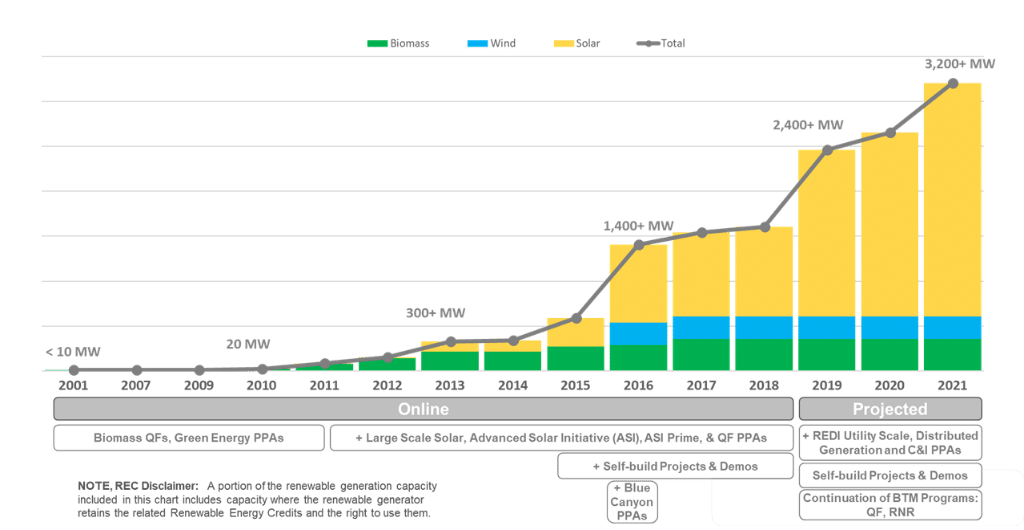

This could be the result of the solar that Georgia Power has already deployed and is deploying. The company has around 1.6 GW of renewable energy online at present, most of which is solar, and expects to put another 1.5 GW online by the end of 2021 – all of which will be solar.

As we’ve seen with the arrival of the “duck curve” in New England, even relatively small amounts of solar can alter net demand patterns. And while there was no such mention of the duck flying to Georgia, it is possible that the company’s new and planned solar is effectively mitigating its summer peak.

Corporate sustainability and jobs

So if Georgia Power expects to shave its summer peaks with new and planned solar, there is less of an economic reason for it to want to deploy renewables, and Georgia Power certainly isn’t pursuing the energy transition for its own sake.

Instead, the reasons for this new procurement can be gleaned from the description of the program on page 52 of the company’s IRP filing. Georgia Power notes that the program will be available for subscription by both new and existing customers, and the next two lines explains further:

By offering existing large customers the opportunity to subscribe to a portfolio of up to 500 MW of new renewable resources, the Company seeks to satisfy the increasing demand from customers with specific goals to support renewable energy. Additionally, up to 450 MW of new renewable resources will be available for subscription from customer load additions greater than 25 MW, providing Georgia Power with an additional economic development incentive to attract large companies who desire to support renewable energy when locating to Georgia.

It is likely not accidental that Facebook is building a data center in the state.

Mixed reactions from advocates

Renewable energy advocates offered a range of responses to the new IRP. Sierra Club issued a statement congratulating Georgia Power for scheduling the retirement of another 1 GW of coal-fired generation, and stated that it “looks forward to being part of the process to keep moving” in the direction of 100% renewable energy.

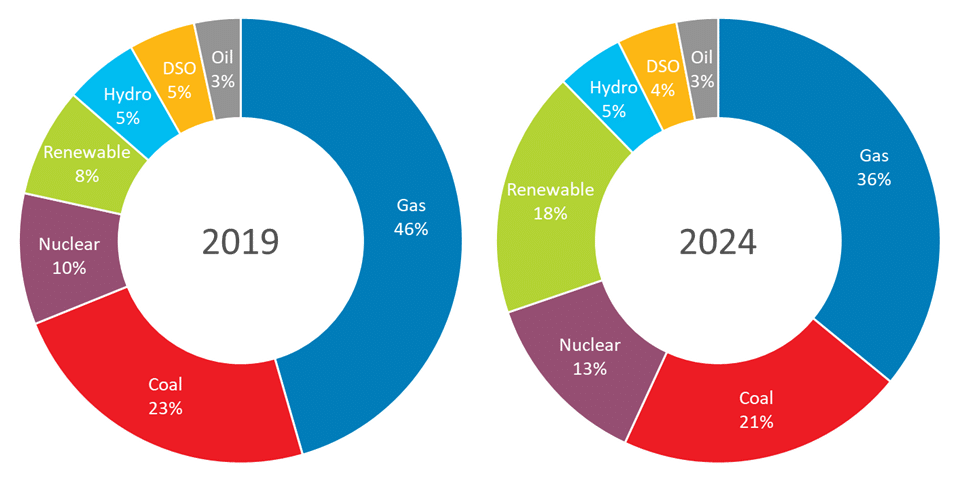

However, like other Southern utilities Georgia Power shows no inclination to move to 100% renewables. Under the IRP it would move to a modest 18% renewables by 2024. While that is ahead of other utilities in the region, that is a low bar for progress and this rate of change well behind the level of deep decarbonization that the Intergovernmental Panel on Climate Change (IPCC) says is necessary by 2030.

This may be in part due to Southern’s preference for nuclear power. Georgia Power is one of the only investor-owned utilities in the United States to continue to push for the construction of new nuclear reactors, despite the scandals, delays and dismal economics that have characterized the construction of these projects.

In its statement responding to the IRP, Southern Alliance for Clean Energy (SACE) blasted Georgia Power for its lack of ambition. “Georgia Power’s new resource plan would have been considered bold nine years ago, but this plan is behind the times,” notes a statement by SACE.

“While we commend Georgia Power for retiring approximately 1,000 megawatts of coal-fired capacity at Plants Hammond and McIntosh, the utility is only acknowledging the inevitable with the retirement of these two minimally-operating coal plants.”

Both of these organizations should get a chance to weigh in further, as the process of finalizing Georgia Power’s 2019 IRP is expected to last months.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Georgia Power. Isn’t that the Company that wants the ratepayer to subsidize the private investor for the promise of reliant power as their bills go up to ensure ROI for the passive income interest.

How are those mafia style contracts with the nuclear plant overhaul working out for Georgia ratepayers?