If there is one certainty about the trade actions that have been undertaken by the Trump Administration, it is that they are uncertain and hard to predict.

In June both U.S. solar developers and Asian cell & module makers celebrated when federal trade authorities announced that they would exclude bifacial solar cells & modules from the Section 201 tariffs imposed a year and a half prior.

The prospect of importing tariff-free bifacial modules, which are not significantly more expensive than their mono-facial counterparts and offer additional output, leads to potentially lower costs for PV systems. This affect is particularly acute for large ground-mounted projects where the price of solar panels makes up a more significant portion of total system costs.

And, in response, large Chinese PV makers with factories in Southeast Asia soon began converting a larger portion of their factories to produce bifacial products. However, this activity may slow down if the claim made by Roth Capital is true: that the Trump Administration has decided to reverse this policy.

In a research note issued yesterday, Roth Analyst Philip Shen stating that its investigations suggest that the Trump Administration has decided to reverse the exemption for bifacial products under Section 201. As of press time the office of the U.S. Trade Representative had not responded to the claim.

Manufacturing implications

Roth notes that whether or not the exemption goes away won’t matter too much for 2020, as most of the volume under order to be shipped into the United States is based on standard monocrystalline silicon cells with passivated emitter and rear cell (PERC) technology. This is supported by pv magazine’s discussions with PV makers who say that they have been sold out for more than a year in advance, meaning that contracts being filled for at least the next nine months were signed before the exemption.

The investment bank also states that this is not as good of news for bifacial going forward, although it can be argued that the technology is likely to mature on the advantages that bifacial offers.

However, there is one likely winner in this situation: First Solar. Roth describes this as an “incremental positive” for the thin film PV maker and its Series 6 technology, which competes against inexpensive Asian crystalline silicon solar for large solar projects. Roth has reiterated its “buy” advice.

However, it is important to note that First Solar is already in an enviable position. The company’s products are sold out years in advance, as it continues to build and ramp more factories in Ohio and Vietnam.

The bigger picture

As for the larger U.S. market, the removal of the exemption could make some projects with marginal economics no longer pencil, but it is likely to not be a big deal either way. The Section 201 tariffs fell to 25% in February of this year and will fall to 20% in February 2020, after which time most orders being made now will be filled.

These tariffs – and the uncertainty created by the Section 201 process – definitely hit the U.S. market in 2018. However the market is back on its growth path this year, with Wood Mackenzie reporting a record 8.7 GWdc of large-scale solar under construction at the end of July.

Wood Mackenzie estimates that the United States will install 12.6 GWdc of solar this year, and with total U.S. module manufacturing capacity at less than half of that, it is clear that module imports will continue, Section 201 or no, and tariff exemptions or no.

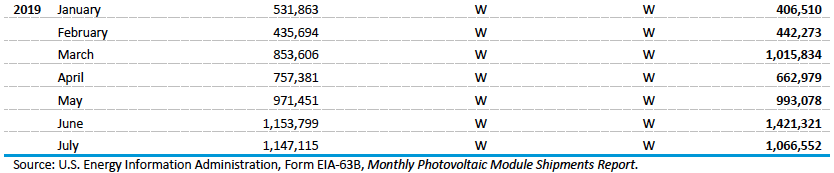

This is supported by module shipment data published by the U.S. Department of Energy. The agency’s latest report found more than 1 GW of module imports in both June and July, with imports making up the bulk of shipments.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.